Try deleting the form and then re-enter the form.

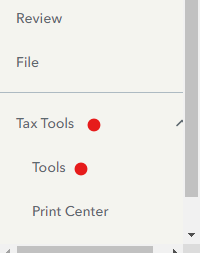

- On the menu bar on the left that shows.

- Select Tax Tools

- On the drop-down select Tools

- On the Pop-Up menu select Delete a Form

- This will give you all of the forms in your return

- Scroll down to the form you want to delete

- Select the Form

- Click on Delete.

Always use extreme caution when deleting information from your tax return. There could be unintended consequences.

If you are using the desktop version, you can switch to forms mode and look at the form to start to see if something is missing. If it is missing fix it and this will remove the error. If nothing is missing, click on the form and then click delete in the lower left hand corner.

Then to re-enter the 1099 Misc as non-self-employment income take the following steps:

- Income

- 1099-MIsc under Other Common Income

- Enter the information from the 1099-MIsc

- Continue through and say the work does NOT involve work that is like your main job

- Select the years you received it

- Say no, to did this involve an intent to earn money

If this is a 1099-G instead of a 1099-Misc click the following:

- Federal

- Income and Expenses

- Show More next to Unemployment

- Start Next to 1099-G Unemployment or Paid Family Leave

- Walk through the steps to enter your 1099-G

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"