- Community

- Topics

- Community

- :

- Discussions

- :

- Groups

- :

- Self employed

- :

- Freelance artist / designer / multiple forms of income

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Freelance artist / designer / multiple forms of income

Hi! So many questions I'd love to hear from an expert about...thank you in advance!!

Graphic Design: I work as a graphic designer for multiple companies, and I did last year as well. I am a contracted worker at those companies and pay taxes accordingly. I thought I did everything right for that last year, but I'm looking back at my documents and they say Self-Employed. But I did not pay quarterly taxes. Does this mean I did that incorrectly?

Art Business: Starting this year, I also now have my own business selling artwork, products with my artwork on them, and art commissions. I have not yet made a quarterly payment this year so I know I'm already doing that incorrectly... How do I made up for that at this point? Do I send in my estimated taxes for q1 - q3 by Jan 15, 2022?

Comedy Club: One last form of income, I work as a server at a comedy club. Taxes are taken out of my paychecks though so I think that should be treated more normally / not as self-employed. Is that correct?

So major question - what do I pay the quarterly self employment taxes on? Just my art business? Or my graphic design contractor jobs as well?

More art business questions: I don't have an LLC or anything at all set up like that. Do I need to before I pay taxes? Is it financially smarter if I set up an LLC?

If I do set up an LLC, should I include my graphic design work within that business or get paid as an individual for that, but get paid as an LLC for my art?

Thank you so much for your help!!! So sorry for the long list of q's

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Freelance artist / designer / multiple forms of income

As a contractor, you receive From 1099NEC or 1099 MISC instead of W2. Taxes are not withheld from that income.

The general rule is that you must pay taxes as you earn income and hence the quarterly estimated tax payments. Meaning that when you file your tax return, if you haven't paid enough taxes through withholdings or estimated tax payments then you might owe an underpayment penalty.

To determine whether you need to make quarterly estimates, answer these questions:

- Do you expect to owe less than $1,000 in taxes for the tax year after subtracting your federal income tax withholding from the total amount of tax you expect to owe this year? If so, you're safe—you don't need to make estimated tax payments.

- Do you expect your federal income tax withholding (plus any estimated taxes paid on time) to amount to at least 90 percent of the total tax that you will owe for this tax year? If so, then you're in the clear, and you don't need to make estimated tax payments.

- Do you expect that your income tax withholding will be at least 100 percent of the total tax on your previous year's return? Or, if your adjusted gross income (Form 1040, line 8b) on your tax return was over $150,000 ($75,000 if you're married and file separately), do you expect that your income tax withholding will be at least 110 percent of the total tax you owed for the previous year? If so, then you're not required to make estimated tax payments.

If you answered "no" to all of these questions, you must make estimated tax payments using Form 1040-ES. To avoid a penalty, your total tax payments (estimated taxes plus withholding) during the year must satisfy one of the requirements above.

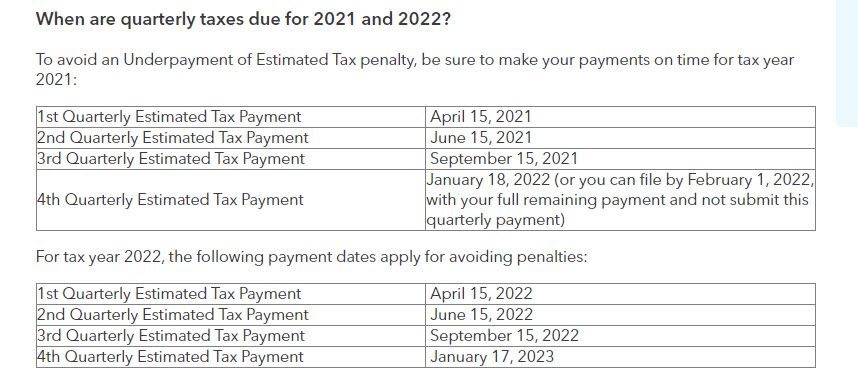

You still have time to make estimated tax payment by January 18 , 2022.

The same applies for your art business, you can send in the estimated tax payment by January 18, 2022.

The comedy club is where you earn wages and they withhold taxes from your wages. Therefore, no need to make any other payments on behalf of that income.

There is no requirement to set up an LLC or another form of entity for a business. You can continue as a sole proprietor. The art business and graphic design business are very similar in nature and you can put them together under one business. You may create an LLC and put income and expenses from both the art work and graphic design business under the LLC. The LLC is treated as a sole proprietorship on the tax return unless you make a different election. In short, you can file the income and expenses on Schedule C just as you would for a sole proprietorship.

One advantage of setting up an LLC is the Liability Protection that comes with it. LLCs are responsible for their own debts and obligations, and although you can lose the money you have invested in the company, personal assets such as your home and bank account can't be used to collect on business debts. Your personal assets are also protected if an employee, business partner or the business itself is sued for negligence. Again, setting up an LLC is not required.

I hope I have answered all your questions.

Estimated Taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Freelance artist / designer / multiple forms of income

Hi maguire95 and welcome to the TurboTax Community,

I will cover each section as best as I can and then do a summary.

Graphic Design: This is your first business/form of self-employment/schedule C (the form on your taxes) and if you have not created a separate EIN(Employer Identification Number) or DBA (Doing Business As) then this goes on your normal tax return. You are definitely self-employed and it sounds like last year either you did not owe enough to warrant quarterly taxes or have a penalty for underpayment.

Quarterly taxes can be tricky at first if you are not used to keeping track of your income or your income is inconsistent through the year. A Guide to Paying Quarterly Taxes This may help clear up some confusion on the estimates.

If you are not self employed this might apply for other years. Estimated Taxes: How to Determine What to Pay and When

Art Business: That is really exciting to be able to be selling your art as well. As soon as you are able to make estimated payments and have a rough idea what they might be it is a good idea to send them in. You can still make estimated payments for tax year 2021.

Comedy Club: This sounds like you would be getting a W-2 from this job. Keeping track of tips for reporting purposes is a good idea too.

Summary answer:

At this time you have multiple businesses which all are reported on your personal 1040 tax return. If your overall tax responsibility is more than $1000 at the end of the year you will need to pay some quarterly taxes to keep from penalties.

The LLC questions are more of a legal question and you can do some research here at the IRS. I always suggest someone learn a bit before delving into starting a business, but usually this research is after someone has a wonderful idea.

If you have more questions after looking these over we'll be here!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Freelance artist / designer / multiple forms of income

Thank you so so much for your thoughtful answer. Can't tell you how much I appreciate it. Really love that you all held this forum. Thank you!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mscottwhitson

New Member

cat1221

Level 1

ajungg28

New Member

freelancebre

Level 1

maguire95

Returning Member