- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self employed

Hi maguire95 and welcome to the TurboTax Community,

I will cover each section as best as I can and then do a summary.

Graphic Design: This is your first business/form of self-employment/schedule C (the form on your taxes) and if you have not created a separate EIN(Employer Identification Number) or DBA (Doing Business As) then this goes on your normal tax return. You are definitely self-employed and it sounds like last year either you did not owe enough to warrant quarterly taxes or have a penalty for underpayment.

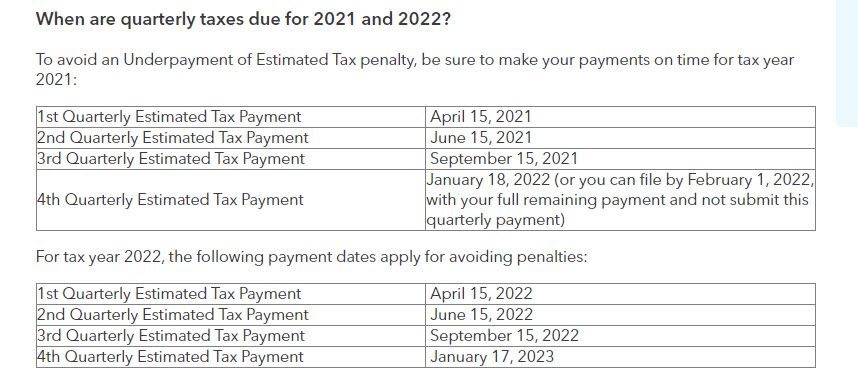

Quarterly taxes can be tricky at first if you are not used to keeping track of your income or your income is inconsistent through the year. A Guide to Paying Quarterly Taxes This may help clear up some confusion on the estimates.

If you are not self employed this might apply for other years. Estimated Taxes: How to Determine What to Pay and When

Art Business: That is really exciting to be able to be selling your art as well. As soon as you are able to make estimated payments and have a rough idea what they might be it is a good idea to send them in. You can still make estimated payments for tax year 2021.

Comedy Club: This sounds like you would be getting a W-2 from this job. Keeping track of tips for reporting purposes is a good idea too.

Summary answer:

At this time you have multiple businesses which all are reported on your personal 1040 tax return. If your overall tax responsibility is more than $1000 at the end of the year you will need to pay some quarterly taxes to keep from penalties.

The LLC questions are more of a legal question and you can do some research here at the IRS. I always suggest someone learn a bit before delving into starting a business, but usually this research is after someone has a wonderful idea.

If you have more questions after looking these over we'll be here!

**Mark the post that answers your question by clicking on "Mark as Best Answer"