- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Groups

- :

- Self employed

- :

- Estimated Tax Payments using 1040ES

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimated Tax Payments using 1040ES

Here is my situation:

1. Worked on W2 in Jan and mid-Feb (taxes deducted as part of payroll)

2. Remained unemployed between mid-Feb and mid-Jul (collected unemployment)

3. Filed 2019 taxes in June using Turbotax Home & Business

4. Have undertaken couple of consulting jobs on 1099 from mid-July which is likely to continue till end of the year

How do I calculate my tax obligations for this year and should I be planning to make advance tax payments using 1040ES on Sep 15?

I tried calculating this in Turbotax and trying to generate payment vouchers. But since the 2019 taxes are already filed (dont want it to file it again since the option to generate payment vouchers seem to be at the time of file) and I may have only one possible payment that could be made (Sep 15), how do go about it?

This is the first time I have been a consultant on 1099. Appreicate any guidance.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimated Tax Payments using 1040ES

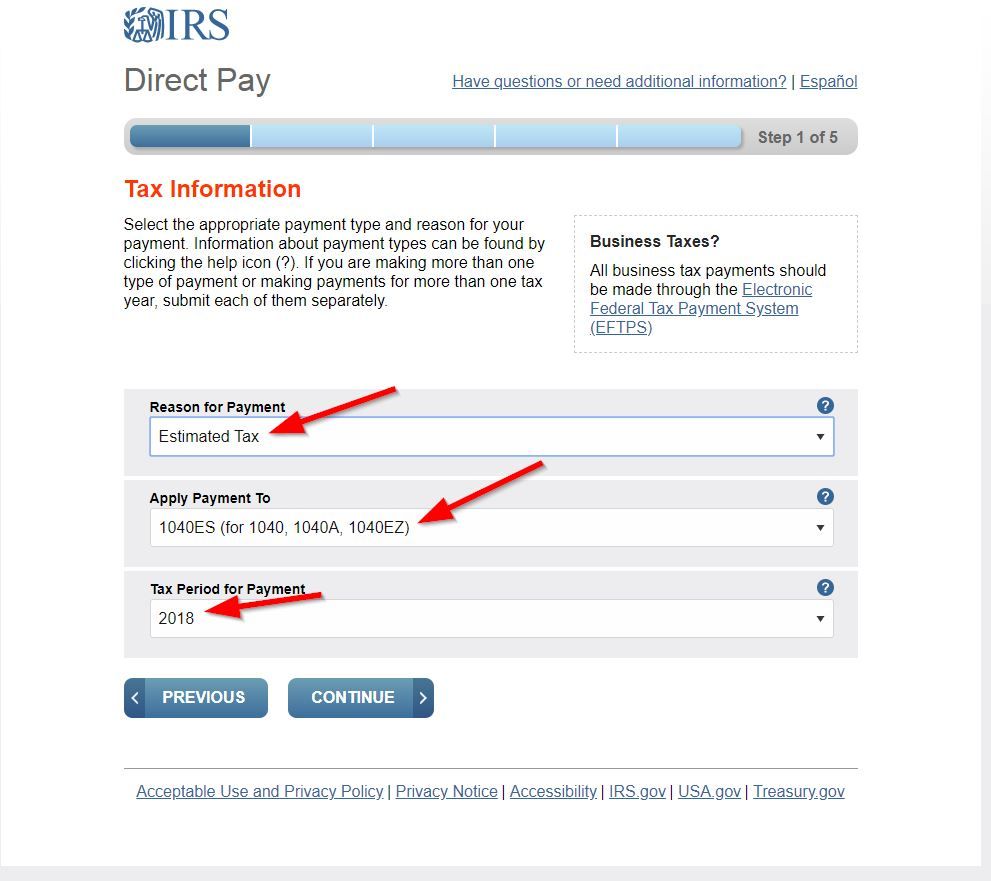

If you pay directly online at the IRS you don't need the 1040ES vouchers. Just be sure to pick the right payment online. Like this, except pick the year 2020

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimated Tax Payments using 1040ES

For SE self employment tax - if you have a net profit (after expenses) of $400 or more you will pay 15.3% SE Tax on 92.35% of your net profit in addition to your regular income tax on it. So if you have other income like W2 income your extra business income might put you into a higher tax bracket.

You must make quarterly estimated tax payments for the current tax year if both of the following apply:

- 1. You expect to owe at least $1,000 in tax for the current tax year, after subtracting your withholding and credits.

- 2. You expect your withholding and credits to be less than the smaller of:

90% of the tax to be shown on your current year’s tax return, or

100% of the tax shown on your prior year’s tax return. (Your prior year tax return must cover all 12 months).

For the Desktop program you can start with your real 2019 return or copy it and work in Thebes copy. Go to File-Save As

You can just type W4 in the search box at the top of your return , click on Find. Then Click on Jump To and it will take you to the estimated tax payments section. Say no to changing your W-4 and the next screen will start the estimated taxes section.

Or Go to….

Federal Taxes or Personal (Desktop H&B)

Other Tax Situations

Other Tax Forms

Form W-4 and Estimated Taxes - Click the Start or Update button

Or Here are the blank Estimates and instructions…..

http://www.irs.gov/pub/irs-pdf/f1040es.pdf

The 1040ES quarterly estimates are due April 15, 2020, June 15, Sept 15 and Jan 15, 2021. The first 2 quarters are not due until July 15 this year. Your state will also have their own estimate forms.

Or you can pay directly on the IRS website https://www.irs.gov/payments

Be sure to pick the right kind of payment and year.....2020 Estimate

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimated Tax Payments using 1040ES

Some general info on self employment...........

You will need to keep good records. You may get a 1099Misc at the end of the year if someone pays you more than $600 but you need to report all your income no matter how small. You might want to use Quicken or QuickBooks to keep track of your income and expenses.

There is also QuickBooks Self Employment bundle you can check out which includes one Turbo Tax Online Self Employed return....

http://quickbooks.intuit.com/self-employed

When you are self employed you are in business for yourself and the person or company that pays you is your customer or client.

To report your self employment income you will fill out schedule C in your personal 1040 tax return and pay SE self employment Tax. You will need to use the Online Self Employed version or any Desktop program but the Desktop Home & Business version will have the most help.

Here is some IRS reading material……

IRS information on Self Employment

http://www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/Self-Employed-Individuals-Tax-Center

Pulication 334, Tax Guide for Small Business

http://www.irs.gov/pub/irs-pdf/p334.pdf

Publication 535 Business Expenses

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimated Tax Payments using 1040ES

Thank you so much. If I am using Turbotax H&B, can I just use it to calculate the estimated tax payments and print payment vouchers? If I go through this process, do I use the 1040ES and payment vouchers at the time of making the payment to IRS online?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimated Tax Payments using 1040ES

If you pay directly online at the IRS you don't need the 1040ES vouchers. Just be sure to pick the right payment online. Like this, except pick the year 2020

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimated Tax Payments using 1040ES

Thank you. One last question - how do I calculate how much is due to be paid on Sep 15? Do I use the https://www.irs.gov/individuals/tax-withholding-estimator or https://www.irs.gov/pub/irs-pdf/f1040es.pdf or TurboTax H&B?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimated Tax Payments using 1040ES

I would send in about 20% of your self employment income for federal. And some to the state if your state has an income tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Estimated Tax Payments using 1040ES

Since I started working as a consultant in July, I am estimating my self-employment income for the rest of the year and taking 20% towards federal. Let us say that amount is $10k. Can I split that payment into 2 - basically one payment of $5k on Sep 15 and remaining by Jan 15?

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

jiminrb

New Member

Loucapo

Level 2

Brenda1203

New Member

Bearcat252

Level 2

MyTTForumAcct

New Member