- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Groups

- :

- Self employed

- :

- Business Income and Vehicle Expenses

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business Income and Vehicle Expenses

Hi, Everyone:

I'm my first time using Turbotax for my self-employment, driving Uber.

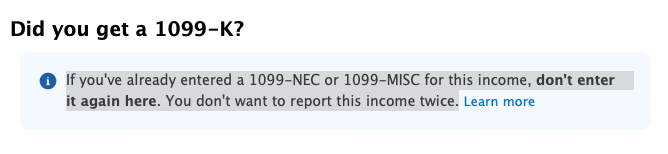

Uber sent me the 1099-NEC and 1099-K. The form shows "If you've already entered a 1099-NEC or 1099-MISC for this income, don't enter it again here. You don't want to report this income twice." So, for doing Uber do I need to enter 1099-K or not?

I purchased my Tesla for driving Uber in September 2023.

List below:

The down payment is $4750.40.

Amount Financed is $36,942.00.

FINANCE CHARGE is $7,876.56.

The total of Payments is $44,818.56.

The total Sale Price is $49,568.96

I made payments of $2000. Interest is $488.56 in 2023.

My Tesla drives for use Uber all the time, so I select “Actual Vehicle Expenses give myself the biggest deduction.

TurboTax asked me “What did you pay for the 2023 Tesla Model 3?” I calculate The down payment is $4750.40. + Amount Financed is $36,942.00. = $41,692.4. Is it correct? How to calculate it from the list if it is incorrect?

In “Section 179 Deduction” I typed the amount as The down payment is $4750.40. + Amount Financed is $36,942.00. = $41,692.4. Is it correct? How to calculate it from the list if it is incorrect?

Appreciate!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business Income and Vehicle Expenses

If you've already entered the 1099-NEC, do not enter the 1099-K.

You can report a business deduction for your vehicle in one of two ways. You can choose to use either the actual expense method or the standard mileage rate method. If you choose the actual method, your cost is the total cost of the vehicle, not the amount financed. Based on the information you provided above, the correct cost would be $41,962.

For more information on the business use of a vehicle see the following TurboTax Help article: Business Use of Vehicles

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business Income and Vehicle Expenses

Thank you for the reply!

What is the difference, $269.6 coming from between your answer of $41962 and my calculated $41692.4?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business Income and Vehicle Expenses

Yes, your total cost is correct. The total cost should be the down payment and the amount financed per your figures above.

- $4,750.40 + $36,942.00 = $41,692.40 (these two figures together should be the full cost of the vehicle).

Keep in mind that only the business use percentage of the vehicle can be used for depreciation and all expenses related to the vehicle. The business use percentage is the business miles divided by total miles driven in 2023 and this will fluctuate each year.

The standard mileage rate (SMR) is only available if it is used the first year a vehicle is placed in service. If you choose not to use this the first year, you can never use it for this vehicle.

- Self-employed and business SMR 2023: 65.5 cents/mile

TurboTax will walk you through this.

Depreciation limits on business vehicles. The total section 179 deduction and depreciation you can deduct for a passenger automobile, including a truck or van, you use in your business and first placed in service in 2023 is $20,200, if the special depreciation allowance applies, or $12,200, if the special depreciation allowance does not apply. See Maximum Depreciation Deduction in chapter 5

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business Income and Vehicle Expenses

Thank you for the details!

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

MeltedIceCream

New Member

InvisibleCrow

Level 1

cat1221

Level 1

Ylanda Pedroza

New Member

oracler

New Member