- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business Income and Vehicle Expenses

Hi, Everyone:

I'm my first time using Turbotax for my self-employment, driving Uber.

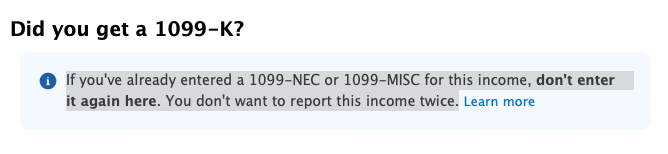

Uber sent me the 1099-NEC and 1099-K. The form shows "If you've already entered a 1099-NEC or 1099-MISC for this income, don't enter it again here. You don't want to report this income twice." So, for doing Uber do I need to enter 1099-K or not?

I purchased my Tesla for driving Uber in September 2023.

List below:

The down payment is $4750.40.

Amount Financed is $36,942.00.

FINANCE CHARGE is $7,876.56.

The total of Payments is $44,818.56.

The total Sale Price is $49,568.96

I made payments of $2000. Interest is $488.56 in 2023.

My Tesla drives for use Uber all the time, so I select “Actual Vehicle Expenses give myself the biggest deduction.

TurboTax asked me “What did you pay for the 2023 Tesla Model 3?” I calculate The down payment is $4750.40. + Amount Financed is $36,942.00. = $41,692.4. Is it correct? How to calculate it from the list if it is incorrect?

In “Section 179 Deduction” I typed the amount as The down payment is $4750.40. + Amount Financed is $36,942.00. = $41,692.4. Is it correct? How to calculate it from the list if it is incorrect?

Appreciate!