- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Groups

- :

- Self employed

- :

- 1065 K-1 Box 20 AJ Code

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

Hello,

I am currently working on my tax on Turbo Tax Windows version. We paid an accountant to issue us the 1065 K-1 partnership for 2023. In box 20, it is shown code AJ with STMT, which refers us to the Supplemental Information, page 2. In the descriptive information, there are 2 AJ codes listed with 2 different amounts:

AJ Aggregate Business Activity Gross Income $10,000.

AJ Aggregate Business Activity Total Deductions $ 800.

When input this data into turbo tax for box 20, do we list these 2 AJ codes separately per line into the system? exactly as listed?

Thank you for your input!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

Please let me know if you get this figured out. I’m having the exact same issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

Same exact issue. I hope they post an official "Correct" answer to this soon.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

To be accurate, you should enter Box 20 Code AJ twice - once for Gross Income and again for Total Deductions.

Note, however, that this information will be used only if your net losses from all businesses are more than $289,000 ($578,000 if filing a joint return).

See also:

- IRS Instructions for Form 1065 Schedule K-1 Box 20 Code AJ

- IRS Instructions for Form 461 - Limitations on Business Losses

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

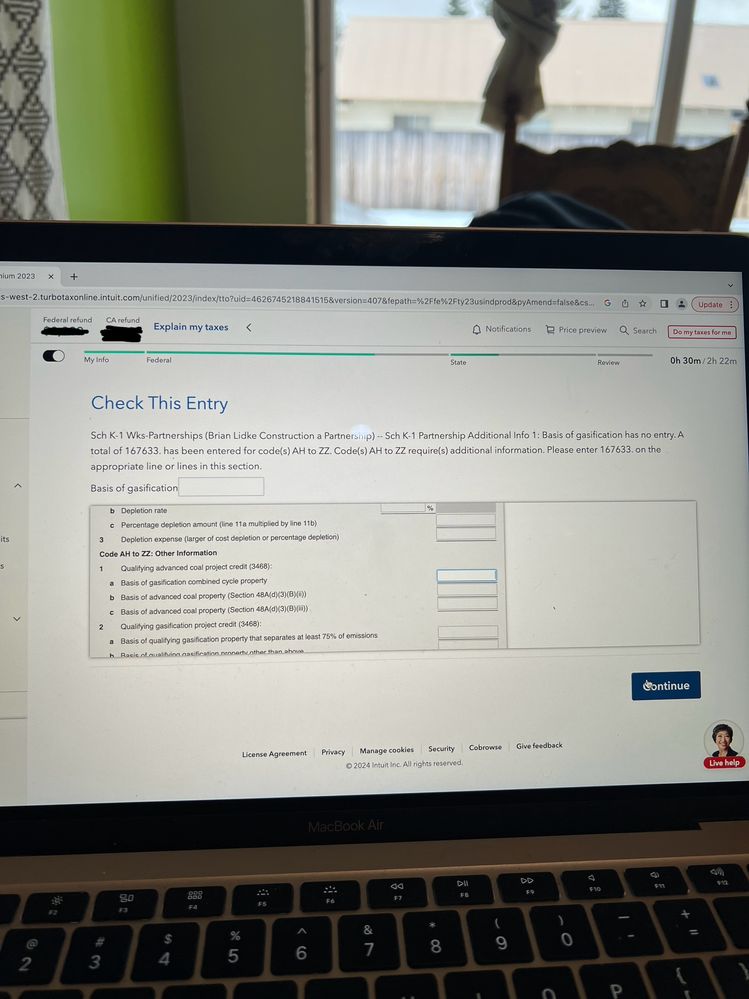

Still get this gasification page after I enter it twice. Really need help with this. @PatriciaV

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

@Lalo86 I am having the same issue. I have spent several hours on trying to figure out what I was missing. Have you had any luck?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

I spent about an hour on a chat with a “tax expert” and then they finally needed to transfer me to a business “tax expert” more familiar with the k-1’s. I allowed them access to my k-1’s, in order for them to try and find a work around. Still waiting for an answer from the Business Tax Expert. When I get one I’ll try and pass it along. @kmadsen12

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

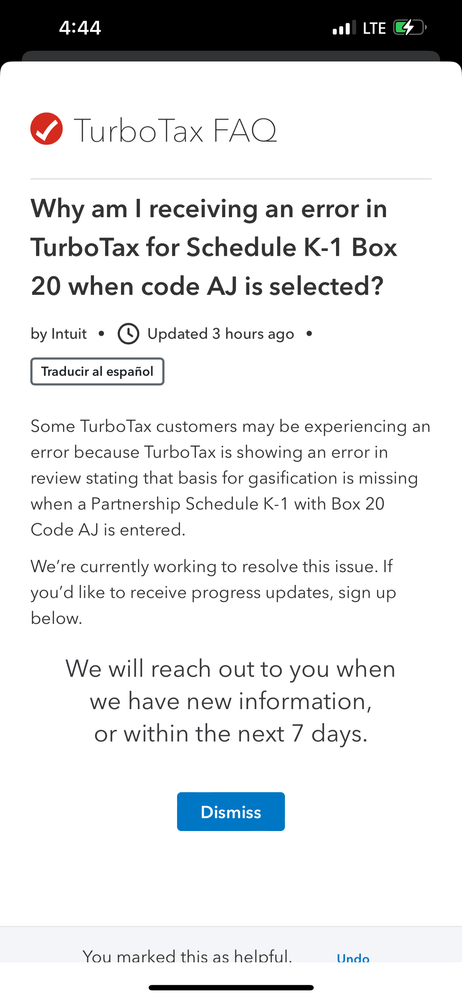

Hey @kmadsen12 it looks like turbo tax is aware of the issue now, and working to resolve it. Found a page you can sign up for updates regarding this issue on turbo tax. I believe if you search the question in the picture it’ll come up, and you can sign up for updates. Hope this helps 🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

On the AJ code with suggestion to enter twice: once for Gross Income and again for Total Deductions.

The AJ option does not distinguish between these two which would seem to be necessary for proper allocation should you meet any criteria for them to take effect.

Is this an open issue that Intuit is aware of or an unimportant detail or ???

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

Same issue.

Do we enter AJ twice for each value?

Do we put both numbers as positive? Or one as negative? How does TurboTax know what the difference between these two are?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

The entry and handling of Schedule K-1 Box 20 Code AJ will be updated as referenced in the TurboTax FAQ Why am I receiving an error in TurboTax for Schedule K-1 Box 20 when code AJ is selected? The estimated release date is March 7, 2024.

Because updates are released after business hours Pacific time, we recommend waiting until the day after, updating TurboTax (if using Desktop), then try entering Schedule K-1 again.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

Thanks for the update about the bug fix-- just to clarify, will the new release include guidance on how to denote the different descriptions of values entered under code AJ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

Should we enter the deductions as a negative number?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

No. Please see Why am I receiving an error in TurboTax for Schedule K-1 Box 20 when code AJ is selected?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

There are two issues for box AJ. Can I get confirmation which will be fixed in the patch?

1) AJ is not able to determine Gross Income vs Total Deductions. K-1s this year have both as a statement for that box. We need guidance on where to put Gross income and Gross Deductions in the box.

2) Filling out AJ produces a gasification error.

Please advise which is being fixed: Both, or issue 1, or issue 2. I'm pretty close to paying my business accountant to do this, because I'm losing trust in Intuit's ability to handle new tax code.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

dwk33190

New Member

vossko

Level 1

siraseranant

Level 2

allanvan

New Member

vdawg

Level 3