- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Groups

- :

- Self employed

- :

- 1065 K-1 Box 20 AJ Code

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

Here is how to enter. First of all in Box 20, the first line put a code Z and leave blank. In the second line, put the code AJ and leave blank. Press continue at the bottom and there will be a series of questions that will follow that reports the information needed.

After you press continue, there will be a series of questions. You will answer yes to the question regarding your investment is at risk and that the income comes from the partnership that generated the K-1. You will then reach a screen titled "We need some information about your 199A income. Here you will check the first box indicating you have business income (loss). Then you will check the box stating you have other deductions. See the screenshot below.

Once you have done this, you will have fulfilled your reporting requirements. Here is the screenshot showing where to put the information you have just provided. once done, you should see a QBI deduction on line 13 of your 1040.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

Are you saying AJ is also part of 199A?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

I don't believe AJ is part of 199a. Right click on amount field for code AJ and use "Add Supporting Details" for each separate AJ amount.

Per the K-1 directions box 20: Code AJ. Excess business loss limitation. If the partnership has deductions attributable to a business activity, it'll provide a statement showing your distributive share of the aggregate gross income or gain, and aggregate deductions, from the business activity of all of the partnership's trades or businesses. You can use this to figure any excess business loss limitation that may apply. See section 461(l) and Form 461 and its instructions for details.

Form 461 (Only applies over a certain limits for single or joint filers)

Excess business losses.

Excess business losses are now computed without regard to any deduction allowed under section 172 or 199A and without regard to any deductions, gross income, or gains attributable to any trade or business of performing services as an employee.

How to use AJ with regard to Form 461 is a good question not addressed since TurboTax does not support that form. Maybe next year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

My K-1 AJ have two items: aggregate business activity gross income of say $1000 and aggregate business activity total deductions $3000. On turbotax AJ is excess business loss limitations. I subtract the income with deduction to -$2000. Do I enter the Turbotax AJ excess business loss limitations a positive number 2000 or negative number -2000?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

@DaveF1006

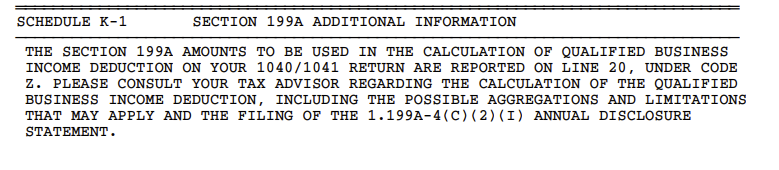

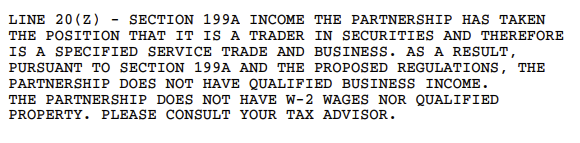

I do not have form 199A in my K-1P, but there is this statement in the footnotes:

How do I go about this? Should I still assume it does not matter because the loss in not even close to the 289K cutoff limit?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

How do I unsubscribe from this topic? I've already filed my taxes and it's annoying to get an email for every reply.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

If you have e-mail notifications set up on your community profile, you will be notified when someone responds. Or you will see a notification at the top of your screen if you are signed in to the community.

Click on your avatar in the top right corner and view your profile to change your notification settings.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

Yes. Since the information from Code AG/AJ will be used only if your net losses from all businesses are more than $289,000 ($578,000 if filing a joint return), you have the option to omit the code and the amount(s) from Schedule K-1.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

Any guidance for Code AN? I see no thread on this code, and the not so helpful IRS instructions refer you to Section 1301 of the tax code. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

Schedule K-1 Box 20 Code AN reports Farming and Fishing Business income(loss). Section 1301 of the tax code allows for averaging of farming income that is inconsistent over several years.

If you are not familiar with this aspect of your K-1 investment, you may wish to contact 1) the company that sent you Schedule K-1 and/or 2) a tax local tax professional with experience in reporting farming income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

After Selecting Code Z a few questions later you will see a screen titled: We need some information about your 199A income.

Below you must select the first check box: XXX has business income (loss)

Fill in the new boxes in accordance with your K-1 Statement.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

Thanks @PatriciaV for the advice. If you don't care to do income averaging, do you think this code can safely be ignored?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

Yes, if the information for Box 20 Code AN doesn't apply to you, you may omit both the box code and the amounts.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1065 K-1 Box 20 AJ Code

Under the TurboTax 1065 box 20 code AJ, it shows " Excess business loss limitation", it's not Aggregate business income or deductions.

- « Previous

- Next »

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

dwk33190

New Member

vossko

Level 1

siraseranant

Level 2

allanvan

New Member

vdawg

Level 3