- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Shouldn't the value from box 2a of a 1099-R show up on line 4d of 1040 even in the case of an in-plan conversion (i.e. rollover)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Shouldn't the value from box 2a of a 1099-R show up on line 4d of 1040 even in the case of an in-plan conversion (i.e. rollover)?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Shouldn't the value from box 2a of a 1099-R show up on line 4d of 1040 even in the case of an in-plan conversion (i.e. rollover)?

Then it appears that not all of the in-plan Roth conversion was after-tax money. The amount in box 2a is taxable and should be on the 1040 line 4d.

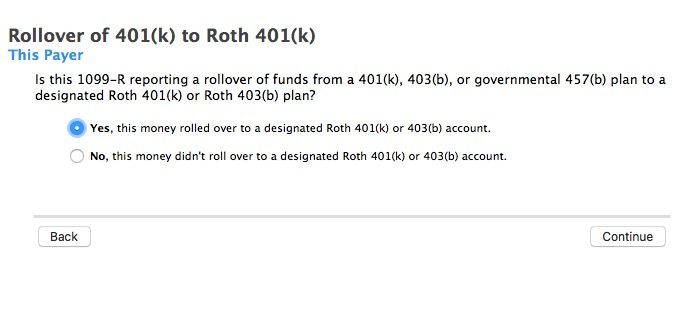

I suggest that you totally delete that 1099-R and re-enter. Be sure that you answer yes to the "Rollover 401(k) to Roth 401(k) question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Shouldn't the value from box 2a of a 1099-R show up on line 4d of 1040 even in the case of an in-plan conversion (i.e. rollover)?

Box 2a of each Form 1099-R should be the amount in box 1 minus any amount in box 5. The code in box 7 should be G and the IRA/SEP/SIMPLE box should not be marked. With these entries, there should be any way to cause the amount from each in box 2a should not be included on Form 1040 line 4d.

If a payer doesn't know the amount that should be in box 5, boxes 2a and 5 should be blank and box 2b Taxable amount not determined should be marked, but this doesn't seem to be your situation since each Form 1099-R has box 2a populated. If neither of you had any after-tax basis in the traditional 401(k), the sum of the box 1 amounts should be present on line 4d.

There should be no amount in box 4.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Shouldn't the value from box 2a of a 1099-R show up on line 4d of 1040 even in the case of an in-plan conversion (i.e. rollover)?

Is the box 7 code a G?

Is there an amount in box 5?

Is the amount in box 2a the box 1 amount minus box 5?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Shouldn't the value from box 2a of a 1099-R show up on line 4d of 1040 even in the case of an in-plan conversion (i.e. rollover)?

Yes, you are correct. On my 1099-R:

* box2a = box1 - box5

* box2b does NOT have ANYTHING checked

* box3 = box4 = box6 = 0

* box7 = G

* IRA/SEP/SIMPLE box is NOT checked

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Shouldn't the value from box 2a of a 1099-R show up on line 4d of 1040 even in the case of an in-plan conversion (i.e. rollover)?

Then it appears that not all of the in-plan Roth conversion was after-tax money. The amount in box 2a is taxable and should be on the 1040 line 4d.

I suggest that you totally delete that 1099-R and re-enter. Be sure that you answer yes to the "Rollover 401(k) to Roth 401(k) question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Shouldn't the value from box 2a of a 1099-R show up on line 4d of 1040 even in the case of an in-plan conversion (i.e. rollover)?

Looking at this some more, perhaps I answered the TT interview question incorrectly.

"Is this 1099-R reporting a rollover of funds from a 401(k), 403(b), or governmental 457(b) plan to a designated Roth 401(k) or Roth 403(b) plan?"

What exactly is meant by "designated Roth 401(k)"? I selected "NO" because I thought it was implying something outside the plan, but now I'm thinking that might should've been "YES"?

She has a single 401(k) plan thru Fidelity comprised of the standard pre-tax contributions from employer match funds, a Roth 401(k) that she contributes to each paycheck, and then some after-tax contributions that she made a few times. The Fidelity in-plan conversion was the after-tax portion into the Roth 401(k) portion.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Shouldn't the value from box 2a of a 1099-R show up on line 4d of 1040 even in the case of an in-plan conversion (i.e. rollover)?

@macuser_22 You were absolutely correct. In my last post, I was just asking about that exact thing... I simply missed your post until after I submitted. THANKS!

What exactly is "designated" or maybe I should ask what is a case that wouldn't be "designated"?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Shouldn't the value from box 2a of a 1099-R show up on line 4d of 1040 even in the case of an in-plan conversion (i.e. rollover)?

A "designated Roth account" is a Roth account in a 401(k), 403(b) or 457(b) plan. The term is used to distinguish this type of Roth account from a Roth IRA. By default an account in one of these plans is a traditional account, so by "designating" a separate account in the plan as being a Roth account, it will be treated as such rather than as a traditional account.

TurboTax will treat the Form 1099-R as erroneously indicating a nonzero taxable amount in box 2a if you indicate that a code G rollover was not to any type of Roth account and will treat the taxable amount as $0. Omitting the box 2a amount from taxable income without explanation is is sure to trigger an CP2000 notice from the IRS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Shouldn't the value from box 2a of a 1099-R show up on line 4d of 1040 even in the case of an in-plan conversion (i.e. rollover)?

Ah... thanks for that explanation @dmertz ... makes sense now.

Thanks for the help @dmertz & @macuser_22 !!

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

user41124

New Member

venks24

New Member

CMontana

New Member

clarineted

Level 2

albertlin

Returning Member