- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Pro-rata calculation - first time converting from Traditional IRA to ROTH IRA

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pro-rata calculation - first time converting from Traditional IRA to ROTH IRA

Hello,

companies. First account has 30k (with non-deductable basis

of 10K). Last week, I have converted all 30K to ROTH IRA.

now in ROTH IRA account.

If I convert 15K out of this 50K into ROTH IRA next week(12/16/19),

AFter this conversion, I will have 35K (50-15) remaining in the

Traditional IRA at the end of this year.

On these two accounts I have contributed over these years. Not

withdrawn any amount also did not do any conversion to ROTH IRA.

I did filledout/filed form 8606 when contributed to non-deductable

IRA during those years.

Take the non-deductable "basis" and end of this year TOTAL All

Traditional IRA accounts amounts.

I will have 35K in traditional IRA left and rest of the amount

in the ROTH IRA since I converted this month (December 2019).

TOTAL end of the year 2019 Traditional IRA amount of 35K OR TOTAL

end of the year 2019 Traditional IRA amount is 80K (30K+50K) please??

amount converetd amout taxable

10K / 80K = 0.125 (or 12%) of the converted amount not taxable. remaining amount

converetd amout taxable

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pro-rata calculation - first time converting from Traditional IRA to ROTH IRA

Fill in the 8606 to get the answer you seek ... or let the program do so for you ... https://www.irs.gov/pub/irs-dft/f8606--dft.pdf

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pro-rata calculation - first time converting from Traditional IRA to ROTH IRA

"Enter the value of all your traditional IRAs as

of December 31, 2019". I have an ROTH IRA account

at this mutual fund company from last year already.

Since I will be converting 15K to ROTH IRA from

Traditional IRA next week, so I need to tell mutual

fund company, not to mingled this 15K converted amount

with old/existing ROTH IRA and put in new ROTH IRA account

since I need the end of the year amount from this account

to fill in the form 8606 please or ??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pro-rata calculation - first time converting from Traditional IRA to ROTH IRA

OK ... the devil is in the details ... READ that line again ... it asks for Year End Value of all your TRADITIONAL IRAs ... at no time does it ask for the ROTH.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pro-rata calculation - first time converting from Traditional IRA to ROTH IRA

As was explained to you in responses to the essentially identical question that you asked a month ago, the basis in nondeductible traditional IRA contributions does not reside in any particular traditional IRA account, it applies to all of your traditional IRA accounts in aggregate.

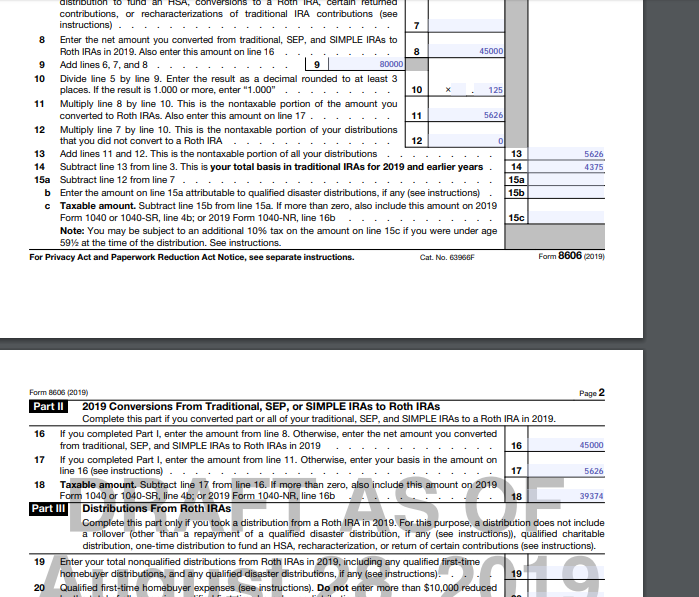

With $30K + $15K =$45K converted leaving a year end balance of $35K in traditional IRAs and you have $10k of basis, the nontaxable amount will be 12.5% of the $45K converted:

$45K * $10K / ($45K + $35K) = $5,625 nontaxable, $39,375 taxable and your traditional IRAs will have $4,375 of basis remaining to be distributed with future distributions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pro-rata calculation - first time converting from Traditional IRA to ROTH IRA

Look at the screenshot above ... line 9 is the total of lines 6+7+8 ... you cannot see line 6 but if you subtract line 8 from line 9 line 6 is obvious.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pro-rata calculation - first time converting from Traditional IRA to ROTH IRA

Respectfully, I agree with you. I was aware I need to

include Total all Traditional IRA accounts. Where I converted

30K at that fund company I do not have ROTH IRA from last year.

So I was asking was, at other fund company I have ROTH IRA

already so not mingled with next week converted amount so

I can use this amount end of the year amount(to include total

Traditional IRAs amounts). That is all.

May be I did not explain properly when I was typing going through

different other issues,... My initial entry I did say: 10K / 80K = 0.125

(or 12%) of the converted amount not taxable. remaining amount

converted amount taxable.

Thanks again!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Pro-rata calculation - first time converting from Traditional IRA to ROTH IRA

I agree with you sir!

In my initial entry I had calculated also 12.5% amount not taxable.

I was checking my math was correct and I am missing anything. As others

noted here and at other web sites, I need to pay estimated tax for the converted

amount (taxable amount part ) so I am calculating pay taxes for this quarter, That is all.

Thanks again. I will stop on this pro-rata.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Linda C2

Level 2

frankiestylez

Returning Member

tnanaihsoj

Level 1

wendyle1993

Level 3

tb001

Level 2