- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- I over contributed last year to Roth. I payed fine and contributed less this year. Error: Taxpayer excess roth ira contribution credit cannot be more than zero. Solution?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I over contributed last year to Roth. I payed fine and contributed less this year. Error: Taxpayer excess roth ira contribution credit cannot be more than zero. Solution?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I over contributed last year to Roth. I payed fine and contributed less this year. Error: Taxpayer excess roth ira contribution credit cannot be more than zero. Solution?

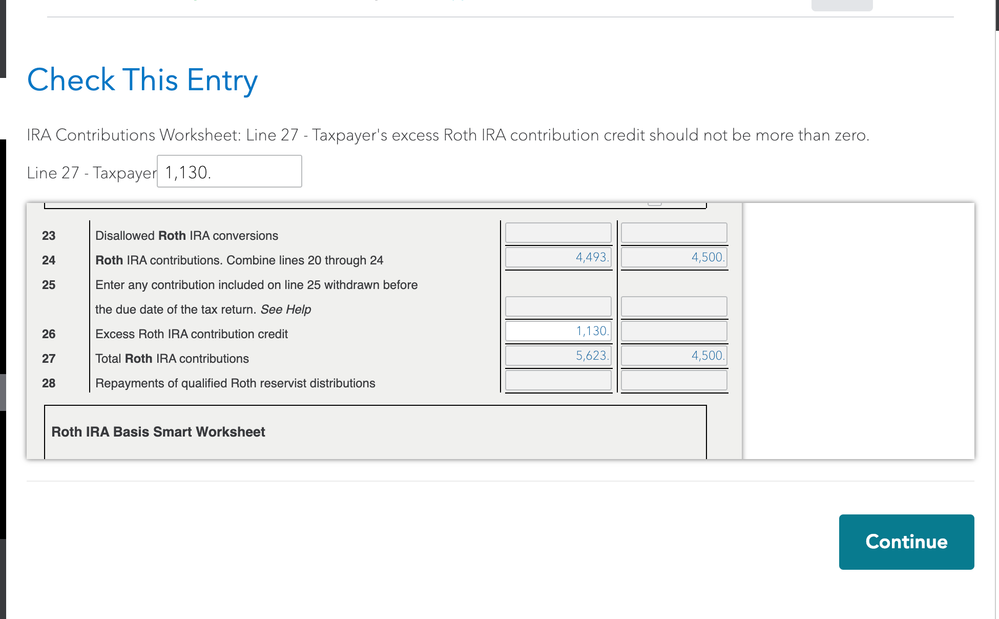

Here is the screenshot

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I over contributed last year to Roth. I payed fine and contributed less this year. Error: Taxpayer excess roth ira contribution credit cannot be more than zero. Solution?

You need to enter a negative number, since the credit would reduce your overpayment. A credit is a negative amount, that is.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I over contributed last year to Roth. I payed fine and contributed less this year. Error: Taxpayer excess roth ira contribution credit cannot be more than zero. Solution?

So maybe I didn't filled up the form correctly and it is probably not a credit. If I overpayed by 1130 last year(I payed the 6% fine) and this year reduced my contribution so that excess is no longer carried going forward in future, should I add 1130 to the amount I contributed this year and have that in the form?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I over contributed last year to Roth. I payed fine and contributed less this year. Error: Taxpayer excess roth ira contribution credit cannot be more than zero. Solution?

At some point in the recent past the TurboTax developers changed TurboTax to automatically apply as a current-year Roth IRA contribution as much of an excess Roth IRA contribution carried into the current year as possible, so the entry in question is no longer needed. Simply delete the $1,130 entry.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Nick2024

New Member

Vladimir101

Level 2

gowrish

New Member

SoCalRetiree

Level 1

ayubruin7777

Level 1