- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- How to report Canadian pension income reported on NR4 (code 39) using desktop Turbotax 2023?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report Canadian pension income reported on NR4 (code 39) using desktop Turbotax 2023?

Can anyone walk me through the steps for reporting Canadian pension income (NR4 form with income code 39) on 2023 Turbotax premier for Mac, I am seeing a lot of conflicting post.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report Canadian pension income reported on NR4 (code 39) using desktop Turbotax 2023?

The amount in the NR4 form is in Canadian dollars, so convert it to U.S. dollars before you enter it in your U.S. tax return. Sign into TurboTax and go to your U.S. tax return.Type "1099-R" in the Search field and select the 1099-R form from the results. Select Add 1099-R and go through the interview questions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report Canadian pension income reported on NR4 (code 39) using desktop Turbotax 2023?

Thank you for the quick response, 1099-R form has 16 boxes, in my NR4, I only have 2; "Gross Income", and "Non-resident tax withheld". How do I fill in the 1099-R form?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report Canadian pension income reported on NR4 (code 39) using desktop Turbotax 2023?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report Canadian pension income reported on NR4 (code 39) using desktop Turbotax 2023?

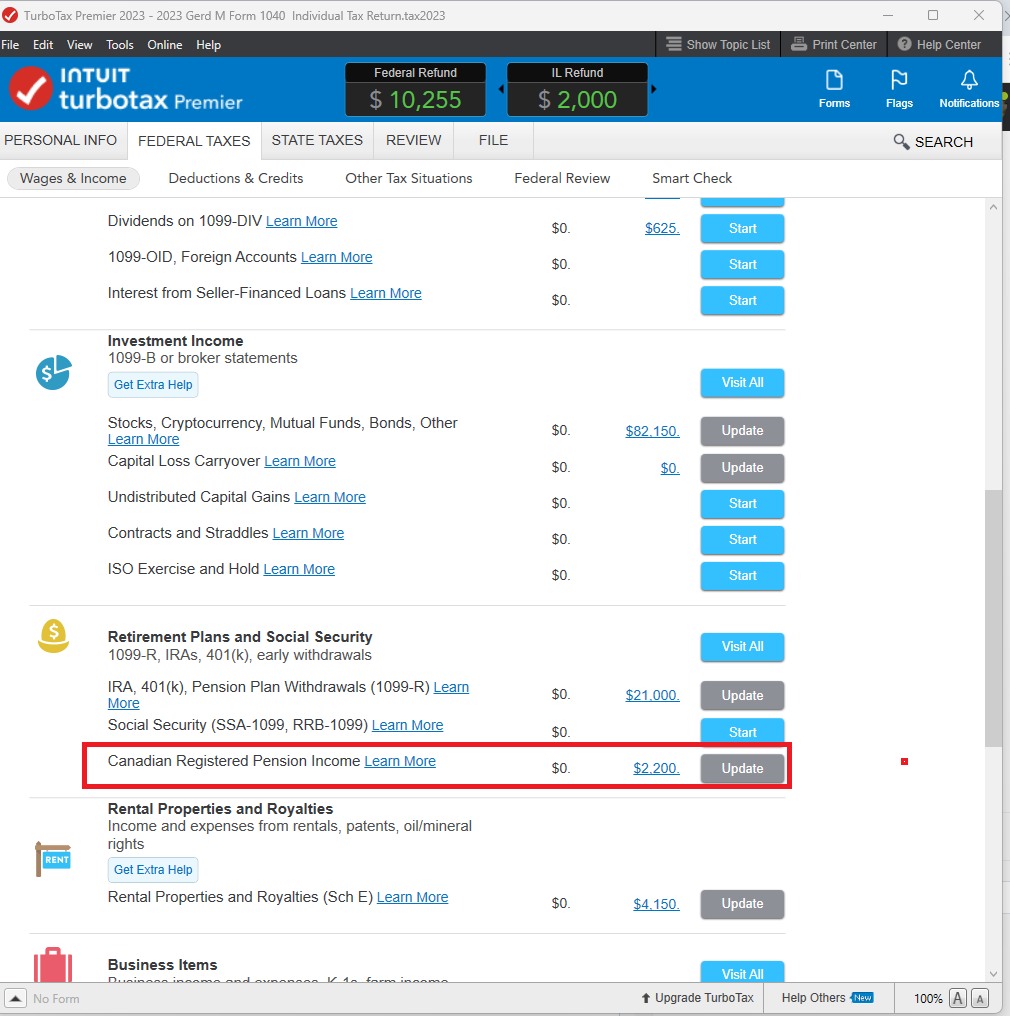

In the Wages & Income section, scroll down to Retirement Plans and Social Security > Canadian Registered Pension Income.

Since you don't have a 1099-R with a Federal EIN, your Efile will reject if you try to enter it that way.

You can claim a Foreign Tax Credit for the tax you paid.

Here's more info on Reporting Canadian Pension Income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report Canadian pension income reported on NR4 (code 39) using desktop Turbotax 2023?

@MarilynG1 Thank you, my NR4 has income code 39, which is monthly pension benefit from my prior employer. So even though my NR4 is not "Registered retirement savings plans" or "Registered retirement income funds", I should enter it in TT under "Canadian Registered Pension Income", is that correct?

Also, would you provide some guidance on "Foreign Tax Credit" you mentioned. I tried the following; under the deductions&credits, Foreign Taxes I selected "tax credit", which takes me to questions for form 1116, and I am not sure what to choose for "Income Category Type", is that the correct steps?

Thanks in advance for your assistance.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

latefiler5

Level 1

Kathyyy

Returning Member

Bluesky-888

Level 2

malvinchip

Level 1

zeishinkoku2020

Level 2