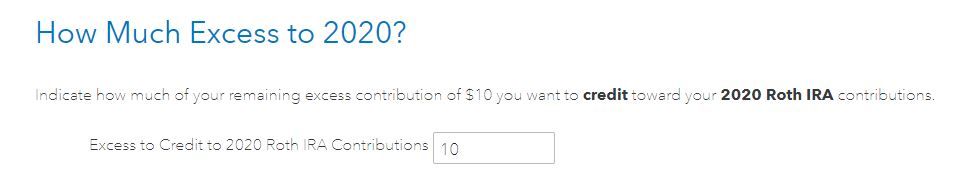

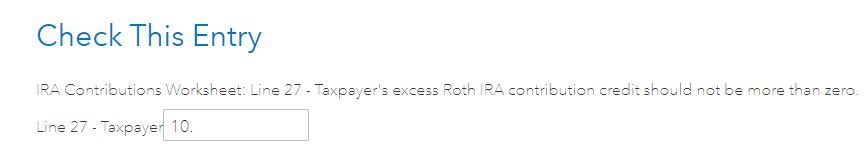

So I had $10 of over contribution to my 2019 Roth IRA. While going through, I specify that I have $10 of excess from prior years and then I am trying to apply that $10 as carryover into part of 2020 Roth IRA contributions - so I fill that out but when I get to review section it shows this error about 'IRA Contributions Worksheet: Line 27 - Taxpayer's excess Roth IRA contribution credit should not be more than zero'. If I zero this out, how am I supposed to say that I am applying the $10 excess from prior year to 2020?

(note that I also had to do a withdrawal of excess contributions for 2020 - so I did that PLUS the $10 so that I would have room for the carryover - not sure if this is causing any issues...)

Some screens below to show what I am doing/seeing. Appreciate any comments/advice!