- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Why is line 14 on the K-1 Worksheet greater than line 13?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

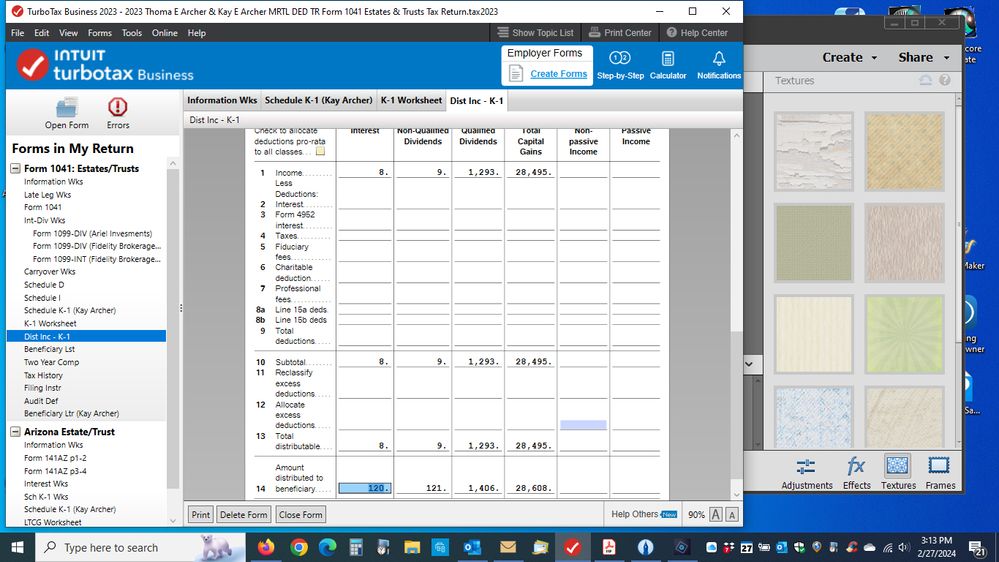

Why is line 14 on the K-1 Worksheet greater than line 13?

I am preparing a tax return for a trust with TurboTax Business. The Worksheet and also K-1 produced for this trust have erroneous figures. The numbers are correct where entered in the program and on Form 1041. How can I correct this? Do I need to delete the file and start over? As you can see from the screenshot below, line 14, and the information transferred to the K-1 is incorrect. The numbers above line 14 correspond to the information that I entered from the brokerage 1099. The trust earned $8 in interest last year, and surely the beneficiaries do not have to pay taxes on $120.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is line 14 on the K-1 Worksheet greater than line 13?

Since you are working in TurboTax Business, you can track the source of the numbers on forms.

Right-click on the number in Line 14 and choose "Data Source." Here is what the tax help pop-up says:

"The amount of income distributed to the beneficiaries for each column is the smaller of Schedule B (Form 1041), line 15, or Schedule B (Form 1041), line 15 multiplied by the ratio of the amount on line 13 for each column to the sum of line 13, columns (a) through (f)."

Schedule B is found on Form 1041.

You may find that you need to adjust allocation percentages or other numbers to arrive at a meaningful number on Dist Inc - K1 Line 14.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is line 14 on the K-1 Worksheet greater than line 13?

@kayelena wrote:

The numbers are correct where entered in the program and on Form 1041....

Are you absolutely certain that is the case? For one thing, your qualified dividends are greater than your non-qualified dividends which should not be the case as qualified dividends are a subset of ordinary dividends.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is line 14 on the K-1 Worksheet greater than line 13?

Well, now, that is interesting. I looked back at the form where the entries were made and qualified dividends entered were $1293, ordinary dividends $1302. I'm not an accountant and am relying on TurboTax to do the math and transfer figures accurately, so there must be a formula somewhere that reduced the ordinary dividends.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is line 14 on the K-1 Worksheet greater than line 13?

@kayelena wrote:

.........qualified dividends entered were $1293, ordinary dividends $1302.

Whoops, sorry @kayelena. I was looking at the wrong worksheet. The one you posted is correct because the figure in that column is the difference between the ordinary dividends and qualified dividends.

In your case, it's $9 and that's exactly right since the formula is $1302 MINUS $1293.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is line 14 on the K-1 Worksheet greater than line 13?

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

BobbyC777

Level 2

Bill413

Level 1

mrgrnt

Returning Member

hilde74

New Member

joycesyi

Level 2