- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Where do in enter royalty income in TurboTax? Schedule E or 1099-MIC? It is getting double counted, it seems.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do in enter royalty income in TurboTax? Schedule E or 1099-MIC? It is getting double counted, it seems.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do in enter royalty income in TurboTax? Schedule E or 1099-MIC? It is getting double counted, it seems.

If you received a 1099-MISC for royalty income, enter it under the Rental and Royalty section, and not in the Other Common income section. This will properly link the 1099-MISC with the schedule E. Enter in the Royalty Income section on the summary page. Delete the form if you entered it elsewhere.

Note: Be certain to deduct any production taxes, depletion (15%) and any other expenses you have. You will only want to pay taxes on the net amount you received, not the 1099-MISC gross. Any additional depletion that your state may allow (OK does) will be an adjustment under your state taxes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do in enter royalty income in TurboTax? Schedule E or 1099-MIC? It is getting double counted, it seems.

I have entered royalty income and expenses on Schedule E, and it is effective. However, there is no place to enter State (OK) withholding tax on the 1099 in the Schedule E section. If I enter a 1099-MISC in other income, it double counts the royalty income. If I enter $1 there as a place holder, it says income reported must be at least as much as state withholding. This defeats the purpose of entering the state withholding, which is to get most of it refunded.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do in enter royalty income in TurboTax? Schedule E or 1099-MIC? It is getting double counted, it seems.

When you enter a 1099-MISC, it will usually appear in several places. But it's only counted once. For example, if you enter a 1099-MISC for rental income or royalty income, it will appear in the SCH E section of the program, as well as the Other Income/1099-MISC section of the program. But it's still only counted once.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do in enter royalty income in TurboTax? Schedule E or 1099-MIC? It is getting double counted, it seems.

I appreciate your response, Carl. The problem I am having is not being able to enter state withholding in the Schedule E area. The program never provides a place to enter it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do in enter royalty income in TurboTax? Schedule E or 1099-MIC? It is getting double counted, it seems.

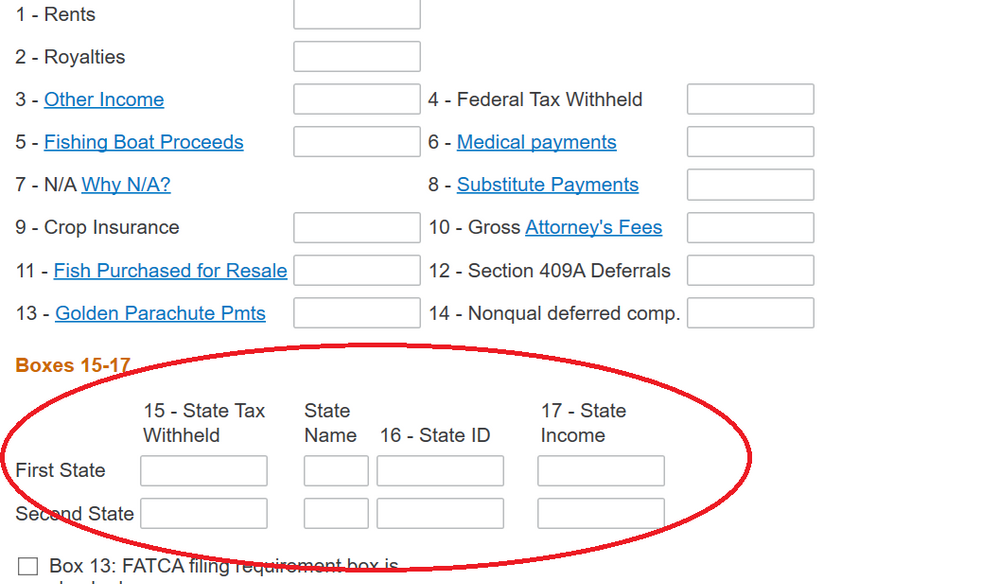

Most likely, you just need to scroll down on that page to see it. I'm using the desktop version of the program and definitely had to scroll down to see it. Screen shot below. You may even have to scroll "this" post image down to see it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do in enter royalty income in TurboTax? Schedule E or 1099-MIC? It is getting double counted, it seems.

Problem solved by two of your experts named Linda. I needed to enter a 1099 in the schedule E, for just the State withholding. The trick was to leave the royalty income (box 2) blank.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

ecbricker

New Member

potentilla

Level 3

latefiler5

Level 1

Melinda2538

New Member

Shannerzzzz

New Member