- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Where do I go to edit the Schedule E worksheet for the Owner-Occupied Rental section Q (percentage of rental use)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I go to edit the Schedule E worksheet for the Owner-Occupied Rental section Q (percentage of rental use)?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I go to edit the Schedule E worksheet for the Owner-Occupied Rental section Q (percentage of rental use)?

Go back to the Rental Properties and Royalties section

Click Update

Continue through the interview until you get to the "Rental and royalty Summary screen

Click EDIT by the rental listed

Click Update for the "Property Profile"

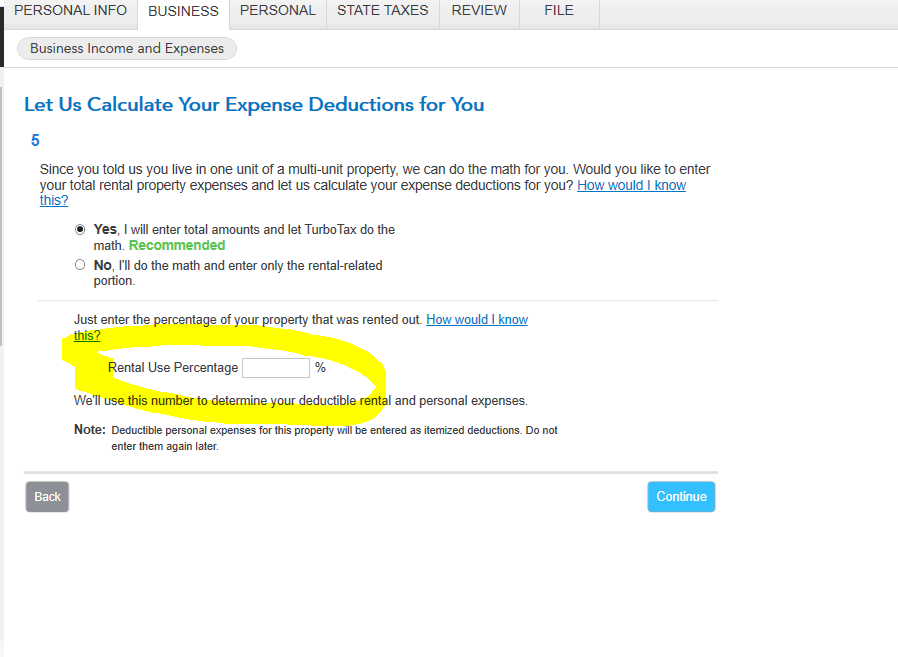

Continue the interview to get to the "Let Us Calculate Your Expense Deductions for You" screen

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I go to edit the Schedule E worksheet for the Owner-Occupied Rental section Q (percentage of rental use)?

Be aware you deal with two percentages when renting out a part of your residence. Percentage of floor space and percentage of time.

The screenshot provided earlier is asking for percentage of floor space. The percentage you enter here is for the floor space that is exclusive to the renter and typically does not include common areas shared with the owner. Typically this will be less than 100%.

Percentage of time is for the time the space exclusive to the renter it was used as a rental, starting from the date it was placed in service. This will almost always be 100%. The only way it's less than 100% business use is if the owner used it for any personal reasons *after* the date it was converted to rental. What that space was used for before it was converted, doesn't count for anything.

Finally, double-check the depreciation amount, as I expect it will be wrong. In IRS Pub 946 at https://www.irs.gov/pub/irs-pdf/p946.pdf use the worksheet on page 36, and for line 6 of that worksheet table A-6 on page 71 is used.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I go to edit the Schedule E worksheet for the Owner-Occupied Rental section Q (percentage of rental use)?

Does your comment address the difference between:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I go to edit the Schedule E worksheet for the Owner-Occupied Rental section Q (percentage of rental use)?

I don't know what line Q is on the worksheet, as it's blank on mine since I don't have an owner occupied rental. But in a prior post in this thread I explained the difference between the two percentages the program asks for.

Getting those numbers right matters big time, as if either is wrong then the program will not figure the correct amount of depreciation for that first year in service.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Kenn

Level 3

Blue Storm

Returning Member

benderseatwell

New Member

Waylon182

New Member

mstruzak

Level 2