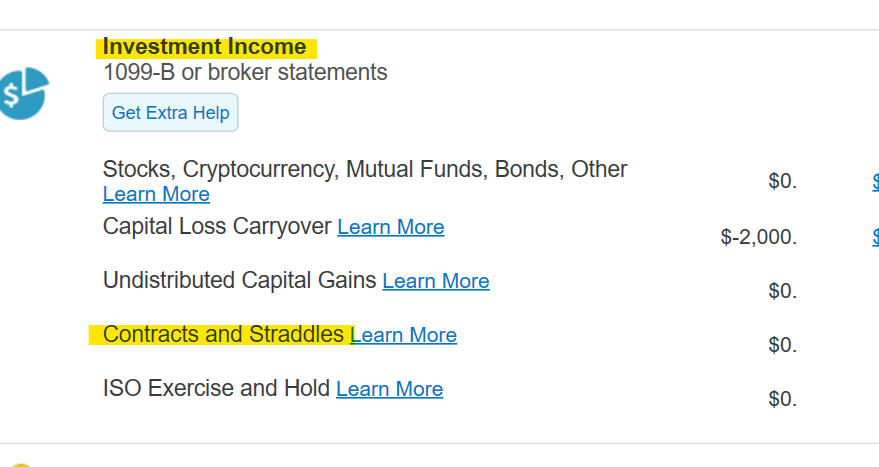

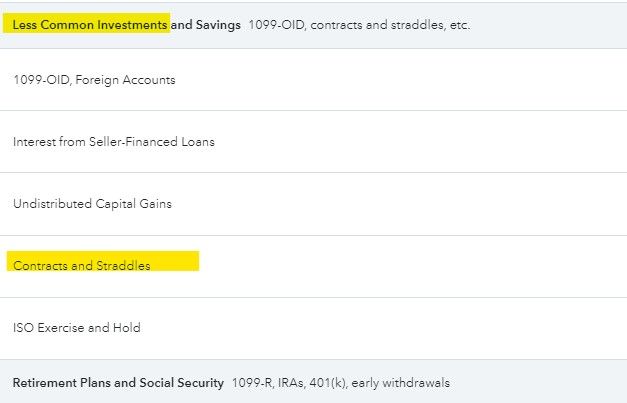

Section 1256 contracts are reported under Contracts and Straddles. You can find it in the Less Common Investments section, but they are entered separately from the rest of your 1099-B, see below.

Section 1256 contracts and straddles are named for the section of the Internal Revenue Code that explains how investments like futures and options must be reported and taxed. Under the Code, Section 1256 investments are assigned a fair market value at the end of the year. If you have these types of investments, you'll report them to the IRS on Form 6781 every year, regardless of whether you actually sell them. TurboTax does this automatically when you enter the data in the Contracts and Straddles section.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"