- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Where do I enter Section 1256 contracts from my 1099B? I do not see it under Federal Taxes>Wages & Income>Investment Income>Stocks, Mutual Funds, Bonds> Add more Sales> ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter Section 1256 contracts from my 1099B? I do not see it under Federal Taxes>Wages & Income>Investment Income>Stocks, Mutual Funds, Bonds> Add more Sales> ?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter Section 1256 contracts from my 1099B? I do not see it under Federal Taxes>Wages & Income>Investment Income>Stocks, Mutual Funds, Bonds> Add more Sales> ?

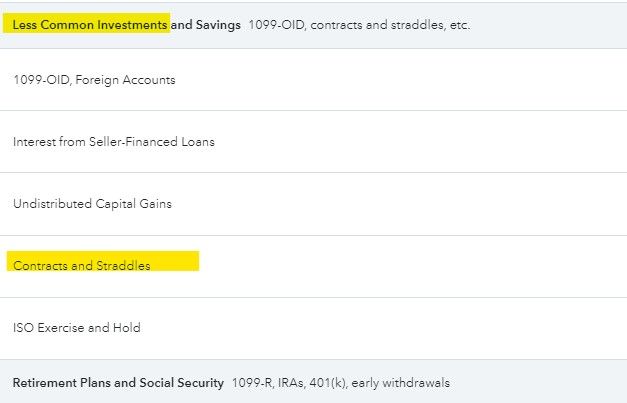

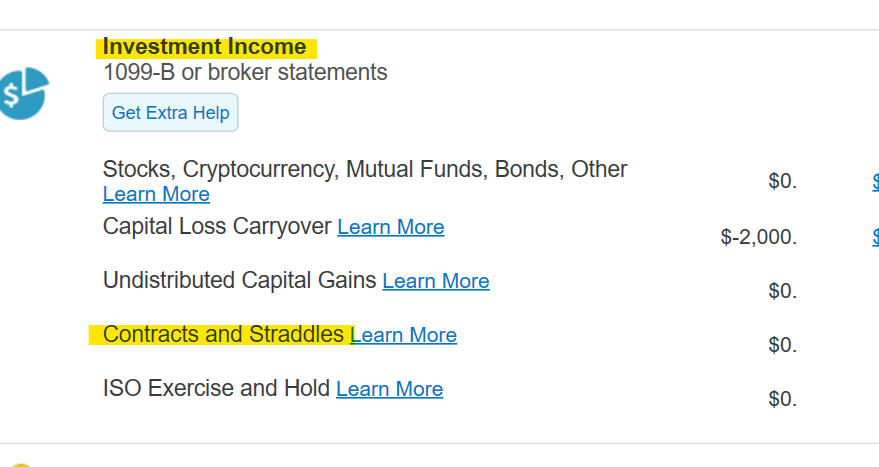

Section 1256 contracts are reported under Contracts and Straddles. You can find it in the Less Common Investments section, but they are entered separately from the rest of your 1099-B, see below.

Section 1256 contracts and straddles are named for the section of the Internal Revenue Code that explains how investments like futures and options must be reported and taxed. Under the Code, Section 1256 investments are assigned a fair market value at the end of the year. If you have these types of investments, you'll report them to the IRS on Form 6781 every year, regardless of whether you actually sell them. TurboTax does this automatically when you enter the data in the Contracts and Straddles section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter Section 1256 contracts from my 1099B? I do not see it under Federal Taxes>Wages & Income>Investment Income>Stocks, Mutual Funds, Bonds> Add more Sales> ?

WARNING: This is a major flaw in TurboTax. Schwab reports and list this information directly in its 1099B, and TurboTax Premier and other versions should at least flag it for inclusion in the return. In my opinion, this is a major reason to start using another software and/or approach to reporting taxes. My money was essentially wasted on purchasing Deluxe, then Premier, when it doesn't accurately report taxes.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.