- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- We do not owe tax on the sale of our primary residence for federal. Do I need to report the gain to Colorado? Primary residence for more than 24 months. Gain $62K

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We do not owe tax on the sale of our primary residence for federal. Do I need to report the gain to Colorado? Primary residence for more than 24 months. Gain $62K

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We do not owe tax on the sale of our primary residence for federal. Do I need to report the gain to Colorado? Primary residence for more than 24 months. Gain $62K

Doesn't look like it. See https://finance.zacks.com/capital-gains-tax-laws-state-colorado-8351.html and read the section, "Real Estate - Capital Gains Tax". That writeup is rather ambiguous though on weather you even need to report it, and it's not clear if the exclusion applies to CO state taxes either.

I'd say work it through the program anyway. I would fully expect if CO won't be taxing the gain, that the program would tell you this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We do not owe tax on the sale of our primary residence for federal. Do I need to report the gain to Colorado? Primary residence for more than 24 months. Gain $62K

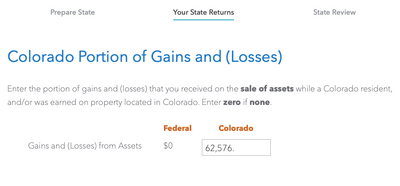

I really really appreciate your response! I read through that link before my original question but I am still confused about what to put here in the Colorado box. The $62k is what the federal taxes said our gain was but since we are not required to pay capital gains at the federal level it switched it to $0 (and we don't have to report it). So, in Colorado, my understanding is that we don't owe capital gains tax either however, if I put the $62k in the box we get hit will a lot of tax but I don't know if it is acceptable to put $0.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We do not owe tax on the sale of our primary residence for federal. Do I need to report the gain to Colorado? Primary residence for more than 24 months. Gain $62K

Yes, you will be able to enter a 0. CO follows the Federal return on home sale exclusion.

Additionally, if any of that Capital Gain was included on your federal return, you may be able to exclude up to an additional $100,000 on your CO return.

From the CO instructions:

You might be eligible to subtract some or all of the capital gain included in your federal taxable income, if the gain is derived from the sale of tangible personal property or from the sale of real property located in Colorado. The amount of this subtraction is limited to $100,000. We recommend that you read publication FYI Income 15 if this applies to you. You must complete and submit the DR 1316 with your return. Take precaution to completely fill out each item of this form. Be as detailed as possible, especially when providing property descriptions, ownership, and dates of acquisition and sale.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Sea3_G

New Member

Ash94

New Member

kiMurphy

Level 2

Andy_W

Level 1

AllApplicableUserIDsTaken

Level 1