- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- TurboTax is making me depreciate a foreign rental property over 27.5 years. Should it not be 40 years? I've made sure I entered a foreign address.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is making me depreciate a foreign rental property over 27.5 years. Should it not be 40 years? I've made sure I entered a foreign address.

All e-filed, already.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is making me depreciate a foreign rental property over 27.5 years. Should it not be 40 years? I've made sure I entered a foreign address.

This is wrong. As per lower down where they say it's 30 years. Why did you keep the wrong info? I know I should read all of the article. That's my fault. But why continue to include bad information?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is making me depreciate a foreign rental property over 27.5 years. Should it not be 40 years? I've made sure I entered a foreign address.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is making me depreciate a foreign rental property over 27.5 years. Should it not be 40 years? I've made sure I entered a foreign address.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is making me depreciate a foreign rental property over 27.5 years. Should it not be 40 years? I've made sure I entered a foreign address.

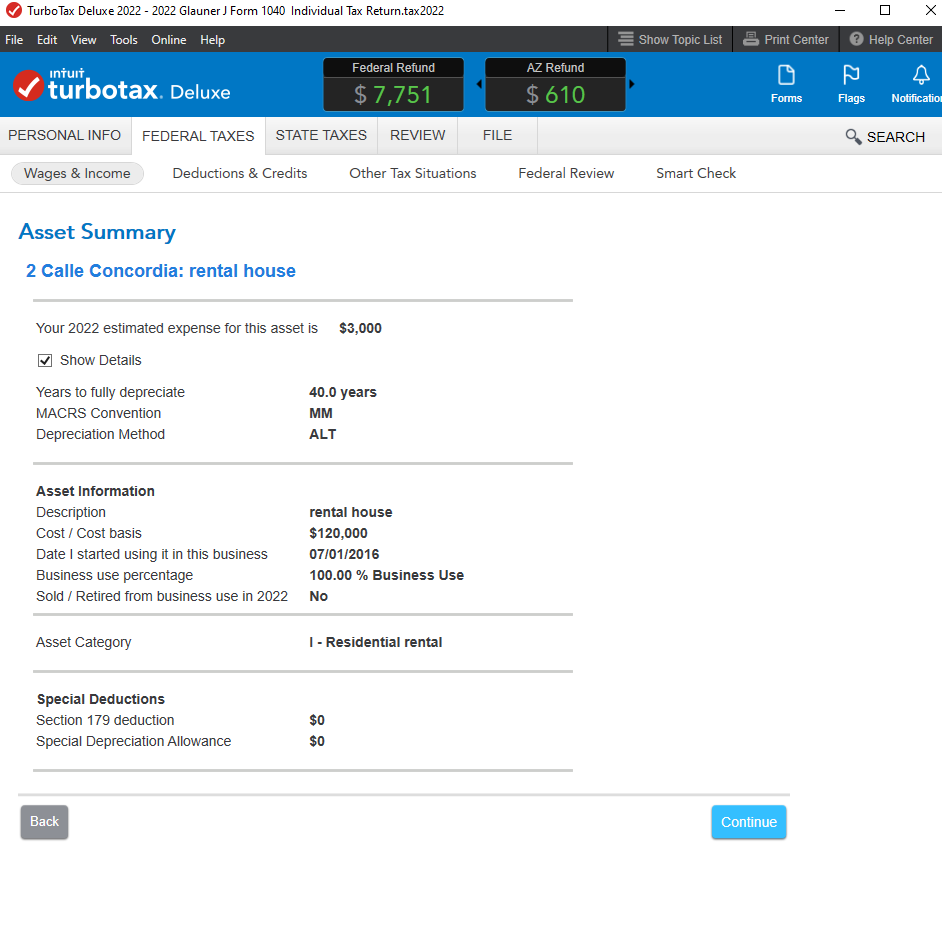

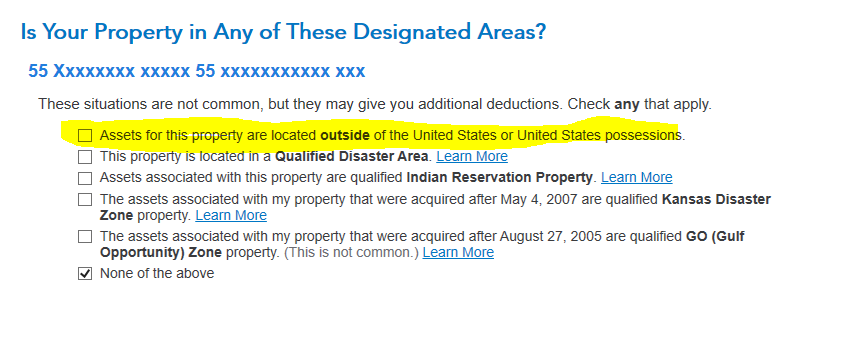

In the Property Profile section under Rentals, after entering the Foreign Rental Property address, continue to a screen where you indicate 'Assets for this property are located outside the US' (screenshot).

Then, in the Rental Assets section, at the Asset Summary page, click on 'Show Details' and you should see a 40-year depreciation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is making me depreciate a foreign rental property over 27.5 years. Should it not be 40 years? I've made sure I entered a foreign address.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax is making me depreciate a foreign rental property over 27.5 years. Should it not be 40 years? I've made sure I entered a foreign address.

Make sure that not only the address is correctly entered as Foreign you also want to make sure that this option is selected as well to ensure the 30-40 year depreciation. (dependent on when placed in service).

- « Previous

- Next »

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

frankdigiu

Level 1

obeteta

New Member

latefiler5

Level 1

zeishinkoku2020

Level 2

green2ski

Level 2