- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Schedule E Mortgage Int and Schedule A Mortgage Int when renting rooms for a portion of the year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule E Mortgage Int and Schedule A Mortgage Int when renting rooms for a portion of the year.

In 2023 I rented out some of the rooms in my primary residence. It looks like Turbo Tax is adding both the mortgage interest I've entered from my 1098 Mortgage Interest for Schedule A and the Mortgage Interest entered for the room rentals from Schedule E.

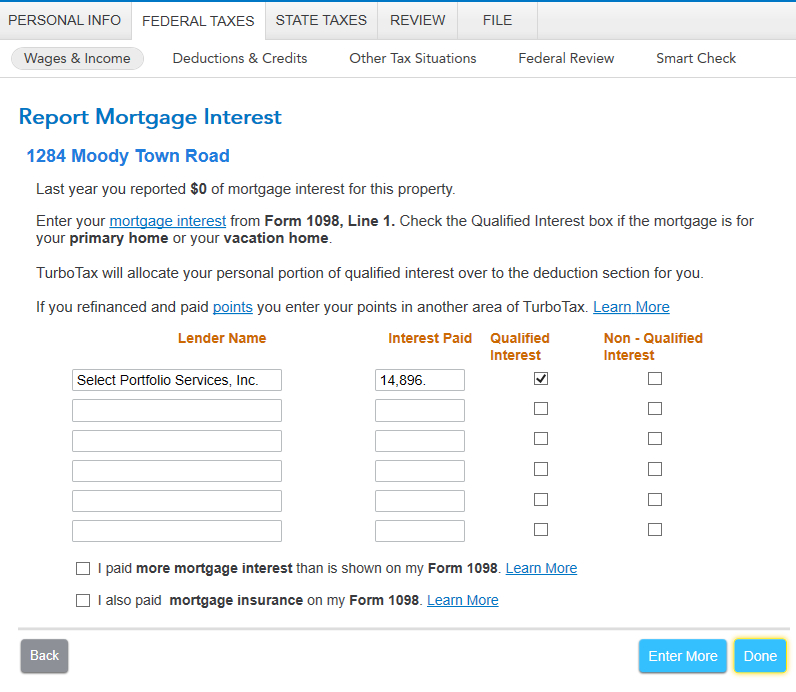

Going through the step-by-step process for Wages & Income, under the Rental Properties and Royalties section, Rental and Royalty Summary, Expenses, Report Mortgage Interest, it instructs you to "Enter your mortgage interest from form 1098, line 1." I enter $14,896. and proceed through all of the steps...

I then continue and complete the Deductions and Credits, Your Home section, Mortgage Interest, Points, Refinancing and Insurance sub section, I entered all of my 1098 information. Box 1 Mortgage Interest which was $14,896.

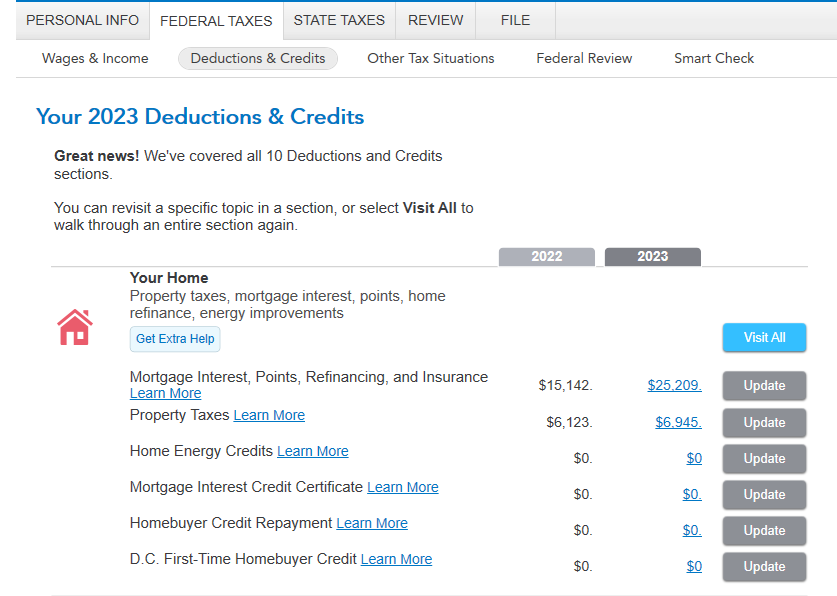

I now see in the Your 2023 Deductions & Credits summary, under Your Home, Mortgage Interest, Points, Refinancing, and Insurance $25,209. It appears it has applied a portion of the mortgage interest from the Schedule E along with the mortgage interest from the 1098 / Schedule A.

Should I manually enter the mortgage interest portion for rental in schedule E and the personal portion in Schedule A?

Thank you in advance!

Tim

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule E Mortgage Int and Schedule A Mortgage Int when renting rooms for a portion of the year.

I suspect you're missing a checkbox in the Rentals section of the program where you would indicate you rent out part of your home and then enter the percentage.

Below is a screenshot from the Deductions & Credits section (test return) and the calculation appears correct after I enter the mortgage interest in the Rentals section.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Tim C S

New Member

frustratedbeyondbelief

New Member

ruralakay

Level 2

donationsgalore

Returning Member

HKam

New Member