- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Rental Property Loss Carryover Screen - TT Online 2022

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property Loss Carryover Screen - TT Online 2022

I am trying to enter my rental property loss carryover from 2021; however, it appears that the page is not asking for the correct information.

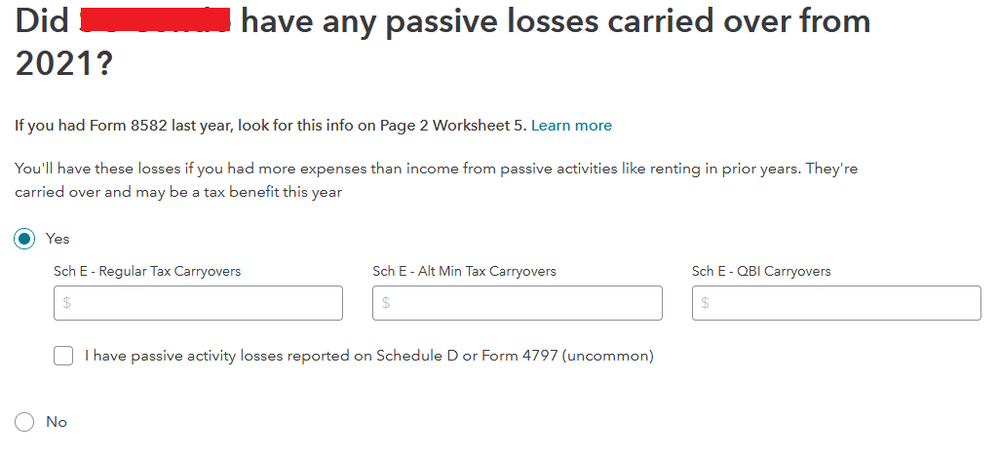

I answered "yes" to the question "Did <my property> have any passive income losses carried over from 2021?".

The boxes that are available after answering yes are:

1) Sch E - Regular Tax Carryovers

2) Sch E - Regular Tax Carryovers

3) Sch E - QBI Carryovers

None of these items appear to be relevant to passive income loss carryover. As mentioned in previous threads on this forum, I don't believe Sch E contains any information about loss carryover. At the top of the page there is even a reference to the correct location, Form 8582: "If you had Form 8582 last year, look for this info on Page 2 Worksheet 5." That is the amount I would like to enter, but I don't see where I do that?

Thanks in advance.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property Loss Carryover Screen - TT Online 2022

The boxes available after answering "yes" to passive income losses carried over from 2021, are referring to Schedule E income. It is not asking for the carryover amount from the actual form Sch E. You would select "Sch E - Regular Tax Carryovers"

Passive Loss Carryovers for Rental Activities are not reported on Schedule E. You will find the carryover amount on 2021 Form 8582, Worksheet 5, Column c. (AMT carryovers appear on a separate copy of Form 8582 with Alt Min Tax under the title.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property Loss Carryover Screen - TT Online 2022

Yes, I realize the information is found on form 8582...that's exactly what I stated in my original post.

The question I asked in my original post was (restated for additional clarity): where in Turbotax Online can I enter passive loss carryover for rental activities, as the page with this title does not appear to be asking for the correct information (see screenshot below)?

I see nowhere on this page that I can enter passive loss carryover.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property Loss Carryover Screen - TT Online 2022

They go right there under "regular tax carryovers."

The 'regular tax' part there doesn't refer to them not being passive. It's referring to how you will you use them when you do use them. You will use them against your regular income tax.

You may have a carryover for AMT purposes as well. If you have a form 6251 or a second 8582 in your return last year then it will show your passive losses for AMT purposes. (If you don't have those forms then you can leave this blank).

If your passive losses are from a qualified business then you will have QBI losses for box 3 there. Those are pretty rare.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property Loss Carryover Screen - TT Online 2022

Life got in the way so I'm finally getting back to doing taxes. Thank you for your response. I marked your reply as an answer, although one point that is strange to me:

TT is requiring me to enter a QBI amount greater than zero. Looking at my 8995 from last year line 16 is 0, so I'm not sure why the third box has that non-zero requirement? I must be missing something.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property Loss Carryover Screen - TT Online 2022

If you don't have a QBI carryover you should just leave the field blank.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

jiillll

New Member

chunhuach

Level 1

redmoose

Returning Member

VERYfrustrated1

Level 2

nirbhee

Level 3