- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Rental House "sales information" entry (asset sales price, sales expense, land price and sales expense)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental House "sales information" entry (asset sales price, sales expense, land price and sales expense)?

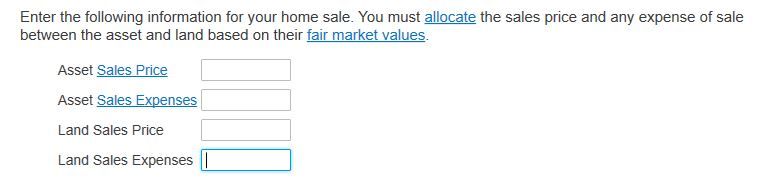

I need my hand held. Have used Turbo Tax since 2010. Find myself in new territory. I've looked X10 for the specific answer and most discussions are just that, a bunch of wordy discussion without clear answers. Is someone able and willing to help me by just answering what numbers to enter in each of the four fields below. I realize someone will feel the need to elaborate, but that's exactly what "TT help" does and HOW they elaborate is NOT helpful to me. I'm just dumb I guess. I bought a house for $106,000 to live in while fixing up. Moved out as soon as it was ready and I had a lease agreement. Rented it for years. Tenants moved out last year, I made some improvements (~$12,000) and sold it for $190,000 Sept2020. The land it sits on is valued at $23,500. What numbers do I enter in which boxes and IF there is a calculation to get to the number to enter, what is that calculation? Thanks ahead of time.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental House "sales information" entry (asset sales price, sales expense, land price and sales expense)?

You put 166,500 in the asset sales price box and 23,500 in the land sales price box. That assumes the total sales prices was $190k which included the land valued at $23.5k. You also need to know the total depreciation taken on the assets.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental House "sales information" entry (asset sales price, sales expense, land price and sales expense)?

You put 166,500 in the asset sales price box and 23,500 in the land sales price box. That assumes the total sales prices was $190k which included the land valued at $23.5k. You also need to know the total depreciation taken on the assets.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental House "sales information" entry (asset sales price, sales expense, land price and sales expense)?

Had the TT help gone as far as inputting their calculations INTO the four fields, it would have made more sense to those as challenged as I. Thank you for the specific help I asked for. The depreciation was calculated a screen or two before this one. I believe in my case depreciation came out to roughly $10,500. Not in front of me right this second.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental House "sales information" entry (asset sales price, sales expense, land price and sales expense)?

I question a few things here. You may be fine with the responses you've got so far. You may not.

Please navigate to that rental property in the TTX program and elect to start/update the Assets/Depreciation section. If you've done things correctly on prior screens, then that section will actually be titled "Sale of Property/Depreciation". If asked, elect to go directly to your list of assets.

Now, how many assets do you have listed there? If you only have one asset, and it's cost basis includes the cost of the property improvements you did after purchasing the property and before you rented it out, then you're fine and can stop reading here. Otherwise, you "may" have issues that I can help you delve in to, figure out, solve, and report this sale correctly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental House "sales information" entry (asset sales price, sales expense, land price and sales expense)?

ThNk you for the previous answers. It occurred to me the morning (woke me out of a deep sleep) that nowhere in all of these numbers and entries do I remember entering the $75,000 loan payoff. Currently the numbers show I made more profit than I did. Where do I enter this loan amount that I paid off?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental House "sales information" entry (asset sales price, sales expense, land price and sales expense)?

Your loan payoff amount is irrelevant. The only thing deductible concerning it, is the interest you paid which was reported to you on the 1098-Mortgage Interest Statement you received from the lender. The principle is never deductible and never has been under any scenario.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental House "sales information" entry (asset sales price, sales expense, land price and sales expense)?

OK. My thought process must be off. Figured that capital gains was based off sales price (minus remaining mortgage, sales costs, improvements and last years taxes).

What I’m hearing said is, capital gains equals sale price minus purchase price (and some depreciation) only.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental House "sales information" entry (asset sales price, sales expense, land price and sales expense)?

Original purhcase price, plus the cost of any improvements, minus the total depreciation taken is your cost basis. Anything over that cost basis is reportable gain, and subject to being taxed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental House "sales information" entry (asset sales price, sales expense, land price and sales expense)?

Help, this sales information with the 4 boxes is killing me. I sold my rental for $720,000 and the value of the land is $143,000 and my sales expense is $41,046. I don't think I have any land expense

Do I reduce my sales price by the land value? So the sales price will be $577,000? You would think if you put the actual sales price and the cost of the land that Turbo Tax would deduct it instead of adding to it.

I have deleted this 4 times already and the last time by me adding the cost of the land of $143000 and adding the sales of the property of $720000 my taxes went up by $43000

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental House "sales information" entry (asset sales price, sales expense, land price and sales expense)?

And do I take off the cost of depreciation to the sales price or do I put that in sales expense?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental House "sales information" entry (asset sales price, sales expense, land price and sales expense)?

And do I take off the cost of depreciation to the sales price or do I put that in sales expense?

You're overthinking things. Give the program exactly what it asks for. No more. No less.

Neither. Depreciation is not a permanent deduction. You are required to recapture all depreciation taken in the tax year you sell the property, and pay taxes on that recaptured depreciation. Two things to understand about depreciation recapture.

1) The amount of recaptured depreciation is added to your AGI.

2) The increase in your AGI "could" have the potential to bump you into the next higher tax bracket. it just depends on the numbers.

Looking back through this thread, I see the general guidance on reported the sale of rental property has not yet been provided. So here it is.

Reporting the Sale of Rental Property

If you qualify for the "lived in 2 of last 5 years" capital gains exclusion, then when prompted you WILL indicate that this sale DOES INCLUDE the sale of your main home. For AD MIL personnel who don't qualify because of PCS orders, select this option anyway, because you "MIGHT" qualify for at last a partial exclusion.

Start working through Rental & Royalty Income (SCH E) "AS IF" you did not sell the property. One of the screens near the start will have a selection on it for "I sold or otherwise disposed of this property in 2021". Select it. After you select the "I sold or otherwise disposed of this property in 2021" you continue working it through "as if" you still own it. When you come to the summary screen you will enter all of your rental income and expenses, even if it's zero. Then you MUST work through the "Sale of Property/Depreciation" section. You must work through each individual asset one at a time to report its disposition (in your case, all your rental assets were sold).

Understand that if more than the property itself is listed in your assets list, then you need to allocate your sales price across all of your assets. You will only allocate the structure sales price; you will NOT allocate the land sales price, since the land is not a depreciable asset. Then if you sold this rental at a gain, you must show a gain on all assets, even if that gain is $1 on some assets. Likewise, if you sold at a loss then you must show a loss on all assets, even if that loss is $1 on some assets.

Basically, when working through an asset you select the option for "I stopped using this asset in 2021" and go from there. Note that you MUST do this for EACH AND EVERY asset listed.

When you finish working through everything listed in the assets section, if you ever at any time you owned this rental you claimed vehicle expenses, then you must also work through the vehicle section and show the disposition of the vehicle. Most likely, your vehicle disposition will be "removed for personal use", as I seriously doubt you sold your vehicle as a part of this rental sale.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental House "sales information" entry (asset sales price, sales expense, land price and sales expense)?

Carl, your answer is very close to what I’m looking for as well. I purchased bare land in 1992, built a house on it and began renting it out as a vacation rental (furnished) in 1996. The house was on a 27.5 yr depreciation schedule, so it has completely depreciated. However, in 2013, I put a significant addition on the house (3 additional bedrooms and two baths). At the time, I put this improvement on a 27.5 yr depreciation schedule and as an asset type of “I Residential Rental”. Also around that time, I put other various assets (major purchases) on as assets such as beds, furnishings, etc.

So, I have a couple of questions based on your previous answer. I understand about splitting the land sale price out. However, with regard to the remaining sales price, do I split it proportionately across all of the assets in my asset list for this property? For instance, if the sale price was $920,000, Sale Expense: $37,500. The land, for the sake of this example, is 50% of the sale price. The original house cost $160,000, and the addition in 2013 cost $137,000. Furnishings were purchased in 2013 in two batches: batch one $2,500, batch two $3,500. Furnishings were depreciated over 5 years (which ended a couple years ago). The furnishings sold with the property but were included in the overall sales price of the house.

For the addition, which is only 8 years into the 27.5 year depreciation schedule, do I need to enter anything for the Asset Sale Price/Asset Expense of Sale?

For the Furnishings, do I need to enter anything for the Asset Sale Price/Asset Expense of Sale to indicate at least $1.00 profit as you mentioned? Or do I simply enter that they were sold on the same date as the house, and zero dollars for the sale price?

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental House "sales information" entry (asset sales price, sales expense, land price and sales expense)?

with regard to the remaining sales price, do I split it proportionately across all of the assets in my asset list for this property?

You can do it that way if you want. Seems like a lot of necessary manual math on your part though. Remember, a gain is gain. Doesn't matter if it's $10,000 or $1. It's still a gain.

Your sales price for each asset needs to be at least $1 more than the cost basis you entered for that asset. That's the only way the property will correctly and completely recapture all depreciation. The nice thing is, you don't have to split out your sales expenses. For example, if I sold a property with multiple assets for $130,00:

Asset Cost of Asset Sales Expenses Sales Price of Asset Gain

Land $10,000 $1000 $20,000 $9,000

Structure $40,000 $4000 $75,000 $39,000

HVAC $5000 $0 $10,000 $5,000

New Roof $15,000 $0 $25,000 $10,000

In the above, I split my total sales expenses across the land and the structure. Subtract cost from the gain. Then subtract sales expenses from that total and I still show a gain on the asset. The total sales price still adds up to $130,000 too. I didn't do any special math here really. I could have sold the HVAC for $5001 for a $1 gain on that asset, and the New Roof for $29,999 for a $14,999 gain on that asset. I still show a gain on every single asset, and the sales price still totals up to $130,000.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental House "sales information" entry (asset sales price, sales expense, land price and sales expense)?

I have a question on Sales Expenses. I had prorated taxes, prorated rent, transfer of security deposits to new owner, and had to bring money to closing because the sales price did not cover the mortage. Are these all listed under asset sales expense? Any portion under land expense?

$77k contract price. Land value today $11k

pay off mortgage 80k

prorated taxes $246

prorated rent $186 (do I deduct from rent received)

transfer of security deposit $700

Owed $5k to closing agent

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental House "sales information" entry (asset sales price, sales expense, land price and sales expense)?

To understand, if the sales price of the rental was 100k, land was valued at 10k, we put 90k in the asset sales price and 10k in the land sales price. When listing each asset (HVAC, Roof, appliances) I was previously told to put zero under asset sales price. Was this correct? Thanks

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

dmaloche

New Member

e15652

New Member

NS1

Level 3

LIG34

New Member

userhilarybrittan

New Member