- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Sales of converted residential property turned business property

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sales of converted residential property turned business property

So, I've been reading through plenty of threads about this and I think I'm the right track but I just want to clarify a few things.

Situation

- Bought townhome in 4/2006 for 300000

- Converted to rental 6/2010 - (FMV ~150000 but I recorded the property tax value of 135000 in TT - I just wasn't aware at that time)

- Sold townhome in 2/2019 for 280000

Since I sold near the beginning of the year 2019 I did not have any renters during the 2019 time frame so from what I've been reading I should submit this under the Business Items section in TT. Obviously, I did not make any money on this transaction but I just want to make sure that I'm not cheating myself in taxes by trying to make a bad situation worse by paying more in taxes than I have to. In filling the Sales of Business or Rental Property section:

- Date Acquired - is this original acquisition date or converted date?

- Date Sold - 2/2019

- Total Sales Price - 280000

- Cost of Property (or Tax Basis) Plus Expenses - 135000

- Depreciation - 15000

Am I completely off in my understanding of what should be recorded?

Regarding total sales price of 280000. Should I substract closing cost and other fees from this number?

Regarding Cost of Property (or Tax Basis) Plus Expenses. I'm not sure what expenses that should be considered here?

Regarding Depreciation of 15000. I assume that this value is from the Schedule E from 2018.

One thing I noticed is that when I attempted to enter this as a Rental Section Sale the form distinguishes between the total sale Cost and the cost of the Land and it applied any fees associated with the sale in accordingly.

I'd appreciate any feedback. thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sales of converted residential property turned business property

Hi AmeliesUncle,

My follow up in bold below:

In the rental section, go through the "asset" of the house and when you get to the "Special Handling" screen say YES. Ok, I did this.

Report the sale in the "Sale of Business Property" section. Enter:

- Basis of $300,000 (plus any improvements you made) - I didn't make any improvements that I still have receipts for so $300,000 is it.

- Depreciation of what you SHOULD have claimed if you had property entered $150,000 for the rental basis rather than $135,000. - how would I calculate the depreciation from the FMV of 150,000 if I didn't enter that originally in TT? Is that illegal? I've read on the Intuit boards that I could adjust after maybe 3 years but we are talking 9 years here.

- Sale price of $280,000

- Sales expenses ... UP TO the actual amount. But if it shows a loss, decrease the amount so you show a $1 gain. It sounds weird, but that is what you need to do. - I'm not following you here. See below for what I see in the TT. If I bought the home for 310,000 plus fees added 320,000. Is this what you are suggesting?

- Enter 100% of the numbers. Don't prorate it. It was 100% rental use when it was sold. Ok

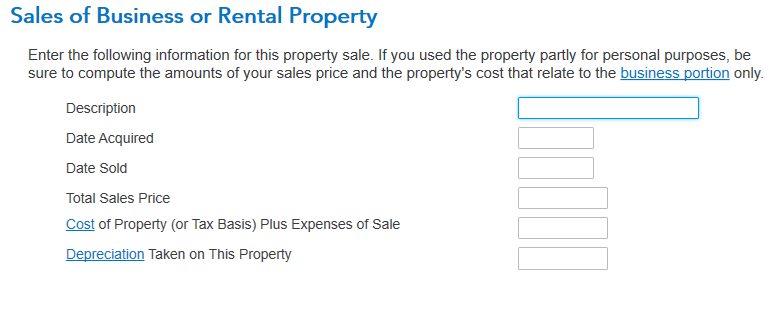

This is what I'm see in the Sales of Business or Rental Property section

- Description - Townhouse

- Date Acquired - 4/23/2006

- Date Sold - 2/23/2019

- Total Sales Price - 300000

- Cost of Property (or Tax Basis) Plus Expenses of Sale - Is this the original purchase price of the home plus expenses?

- Depreciation Taken on This Property - Again, how would I adjust the depreciation to the FMV of 150000 if I originally entered it at 135000?

Thanks. Your feedback is appreciated

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sales of converted residential property turned business property

Since I sold near the beginning of the year 2019 I did not have any renters during the 2019 time frame so from what I've been reading I should submit this under the Business Items section in TT.

Your reason of not having any rental income in 2019, is not a reason for reporting it in the business section. But you most certainly can if you want to.

If you did not live in the property for one single day after the last renter moved out, as your primary residence, 2nd home, vacation home or any other "personal pleasure" use, then you have absolutely no reason to convert the property to personal use on your 2019 tax return. However, if you did convert it to personal use on your 2018 return, then you are correct in that you have no choice but to report your 2019 sale in the "Sale of Business Property" section.

- Date Acquired - is this original acquisition date or converted date?

The date you originally purchased the property all those years ago, before you ever converted it to rental.

- Date Sold - 2/2019

THe exact closing date of the sale which is the day you and the buyer met with the closing agent to complete the process.

- Total Sales Price - 280000

Should match the sales price on your sales contract between you and the buyer.

- Cost of Property (or Tax Basis) Plus Expenses - 135000

What you paid for the property when you originally purchased it, plus the cost of any property improvements (listed in the assets/depreication section of the SCH E) that you paid for during the period of time you owned it. Doesn't matter if it was a rental or not at the time of the improvement. It still adds 'real" value to the property.

- Depreciation - 15000

For me, that's way to "round" of a number to be accurate. But of course, it could be. If you did "NOT" convert this property to a rental on your 2018 tax return, then you need the two below forms from the 2019 tax return. If you converted the property to personal use on your 2018 return, then you need the same forms from your 2018 tax return.

I am assuming you are reporting this sale in the "Sale of Business Property" section.

You need the two IRS Form 4562's that both print in landscape format. One is titled "Depreciation and Amortization Report" and the other is "Alternative Minimum Tax Depreciation". For the most part, I only expect you will need data off the first one. But have the 2nd one handy in case the program asks for AMT depreciation.

Now add together for all assets the amount in the "prior year depr" column and the "current year depr" column. That total is your total depreciation taken. So that's why I question that your statement of $15,000 even, for depreciation is the correct amount.

Am I completely off in my understanding of what should be recorded?

Overall, my response is no. But I do see people "constantly" screw up the "depreciation taken" amount when reporting the sale in the Sale of Business Property section.

Regarding total sales price of 280000. Should I substract closing cost and other fees from this number?

No. If you're looking at the same screen I am (pictured below) the 5th item down tells you to add your sales expenses to your cost basis.

Regarding Cost of Property (or Tax Basis) Plus Expenses. I'm not sure what expenses that should be considered here?

Not clear on what you're not sure of, or why you're not sure. The 5th item down clearly states, "Cost of Property (or tax basis) plus expenses of sale"

Regarding Depreciation of 15000. I assume that this value is from the Schedule E from 2018.

Only if you "COMPLETELY AND CORRECTLY" converted the property to personal use on the 2018 return. Remember, it's not just the prior year's depreciation you have to recapture. You have to include the current year's depreciation in that total too.

One thing I noticed is that when I attempted to enter this as a Rental Section Sale the form distinguishes between the total sale Cost and the cost of the Land and it applied any fees associated with the sale in accordingly.

That's because the land is not SEC 1231 property is all. After the image below, I've also included guidance on reporting the sale in the SCH E section of the program. If you did not convert the property to personal use on your 2018 tax return, then i suggest you report the sale in the SCH E section per the guidance below the image. It's less work (though you still have to do some math manually - just like you do to report the sale in the Sale of Business Property section.)

Reporting the Sale of Rental Property

If you qualify for the "lived in 2 of last 5 years" capital gains exclusion, then when prompted you WILL indicate that this sale DOES INCLUDE the sale of your main home. For AD MIL personnel who don't qualify because of PCS orders, select this option anyway, because you "MIGHT" qualify for at last a partial exclusion.

Start working through Rental & Royalty Income (SCH E) "AS IF" you did not sell the property. One of the screens near the start will have a selection on it for "I sold or otherwise disposed of this property in 2019". Select it. After you select the "I sold or otherwise disposed of this property in 2019" you continue working it through "as if" you still own it. When you come to the summary screen you will enter all of your rental income and expenses, even it it's zero. Then you MUST work through the "Sale of Assets/Depreciation" section. You must work through each individual asset one at a time to report its disposition (in your case, all your rental assets were sold).

Understand that if more than the property itself is listed in your assets list, then you need to allocate your sales price across all of your assets. You will only allocate the structure sales price; you will NOT allocate the land sales price, since the land is not a depreciable asset. Then if you sold this rental at a gain, you must show a gain on all assets, even if that gain is $1. Likewise, if you sold at a loss then you must show a loss on all assets, even if that loss is $1

Basically, when working through an asset you select the option for "I stopped using this asset in 2019" and go from there. Note that you MUST do this for EACH AND EVERY asset listed.

When you finish working through everything listed in the assets section, if you ever at any time you owned this rental you claimed vehicle expenses, then you must also work through the vehicle section and show the disposition of the vehicle. Most likely, your vehicle disposition will be "removed for personal use", as I seriously doubt you sold your vehicle as a part of this rental sale.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sales of converted residential property turned business property

Thanks for the feedback Carl. I've read a number of your posts already and they've been very helpful. I did follow your instructions for reporting the sales under Business Items but, unfortunately, while trying to report the sale there it ended up NOT resulting in a gain and TT would not let me enter this. I suppose that means I need to report this under Rental Properties and Royalties?

For clarification

The property was converted in 6/2010 and was never used for personal use (or converted) up to the sale in 2019.

With that said, per your instructions for completing the Schedule E. I did work through Schedule E as if I still owned the property still entering any associated expenses and whatnot. I do have some validation questions about stepping through Rental Properties sale process.

Question - In the Review Information section of the property it lists the following information

Review Information Description

Date - 6/1/2010

Asset Type - Residential rental real estate

Cost - 149000

Land - 36000

Business % - 58% - I'm not positive how this percentage was derived. I believe TT calculated this because I originally bought this property for personal use and TT is substracting the time it was used for personal from the time it was used for business....correct?

Prior deprec. - 20355

In the Sale Information section. For the Asset Sales Price do I multiply that percentage (0.58) by the sales price to get the Business portion of the Asset Sales price? Along with Asset Sales Expenses, Land Sales Price, and Land Sales Expenses, etc....?

Sales Information section

Asset Sales Price (Business Portion Only) - (310000 x .058) = correct?

Asset Sales Expenses (Business Portion Only) - 15000 x 0.58 etc???

Land Sales Price (Business Portion Only)

Land Sales Expenses (Business Portion Only)

I understand how to derive the percentage for cost and land. For my case, this comes out to about 0.24.

thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sales of converted residential property turned business property

@afterhours858 wrote:

Situation

- Bought townhome in 4/2006 for 300000

- Converted to rental 6/2010 - (FMV ~150000 but I recorded the property tax value of 135000 in TT - I just wasn't aware at that time)

- Sold townhome in 2/2019 for 280000

In filling the Sales of Business or Rental Property section:

- Date Acquired - is this original acquisition date or converted date?

- Date Sold - 2/2019

- Total Sales Price - 280000

- Cost of Property (or Tax Basis) Plus Expenses - 135000

- Depreciation - 15000

Am I completely off in my understanding of what should be recorded?

Regarding total sales price of 280000. Should I substract closing cost and other fees from this number?

Regarding Cost of Property (or Tax Basis) Plus Expenses. I'm not sure what expenses that should be considered here?

Regarding Depreciation of 15000. I assume that this value is from the Schedule E from 2018.

In the rental section, go through the "asset" of the house and when you get to the "Special Handling" screen say YES.

Report the sale in the "Sale of Business Property" section. Enter:

- Basis of $300,000 (plus any improvements you made)

- Depreciation of what you SHOULD have claimed if you had property entered $150,000 for the rental basis rather than $135,000.

- Sale price of $280,000

- Sales expenses ... UP TO the actual amount. But if it shows a loss, decrease the amount so you show a $1 gain. It sounds weird, but that is what you need to do.

- Enter 100% of the numbers. Don't prorate it. It was 100% rental use when it was sold.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sales of converted residential property turned business property

Hi AmeliesUncle,

My follow up in bold below:

In the rental section, go through the "asset" of the house and when you get to the "Special Handling" screen say YES. Ok, I did this.

Report the sale in the "Sale of Business Property" section. Enter:

- Basis of $300,000 (plus any improvements you made) - I didn't make any improvements that I still have receipts for so $300,000 is it.

- Depreciation of what you SHOULD have claimed if you had property entered $150,000 for the rental basis rather than $135,000. - how would I calculate the depreciation from the FMV of 150,000 if I didn't enter that originally in TT? Is that illegal? I've read on the Intuit boards that I could adjust after maybe 3 years but we are talking 9 years here.

- Sale price of $280,000

- Sales expenses ... UP TO the actual amount. But if it shows a loss, decrease the amount so you show a $1 gain. It sounds weird, but that is what you need to do. - I'm not following you here. See below for what I see in the TT. If I bought the home for 310,000 plus fees added 320,000. Is this what you are suggesting?

- Enter 100% of the numbers. Don't prorate it. It was 100% rental use when it was sold. Ok

This is what I'm see in the Sales of Business or Rental Property section

- Description - Townhouse

- Date Acquired - 4/23/2006

- Date Sold - 2/23/2019

- Total Sales Price - 300000

- Cost of Property (or Tax Basis) Plus Expenses of Sale - Is this the original purchase price of the home plus expenses?

- Depreciation Taken on This Property - Again, how would I adjust the depreciation to the FMV of 150000 if I originally entered it at 135000?

Thanks. Your feedback is appreciated

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sales of converted residential property turned business property

You can try Googling to find an online calculator for what you should have taken for depreciation. Yes, that is required that you include the "allowed or allowable" depreciation (the greater of the amount (a) that you actually took and (b) what you COULD have taken).

Yes, I guess that section asks you to include the sales expenses are part of the Basis. However, depending on the exact amount of depreciation, this is really close to the situation that TurboTax does NOT support (and misleads you to the wrong result). You may consider using a tax professional.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sales of converted residential property turned business property

Hey AmeliesUncle,

Thanks for getting back to me on this. So, I think I'm following you correctly on all accounts.

I was able to find a depreciation calculator online and derived the depreciation I should have taken given the FMV that I computed from the sale of the same townhomes in the same neighborhood in the year of conversion. I pulled that information from Zillow and have printed those url's for tax purpose. I believe this is the best that I can do without having gotten an appraisal initially.

For the most part, I appear to have a tax gain which I was expecting.

I appreciate the guidance. This stuff is confusing to say the least.

afterhours858

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

saalves2424

New Member

jeprice2842

New Member

Raju15

New Member

roger622

New Member

kf_7

New Member