- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Rental Property: "Enter Nondeductible Expenses from Prior Year"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property: "Enter Nondeductible Expenses from Prior Year"

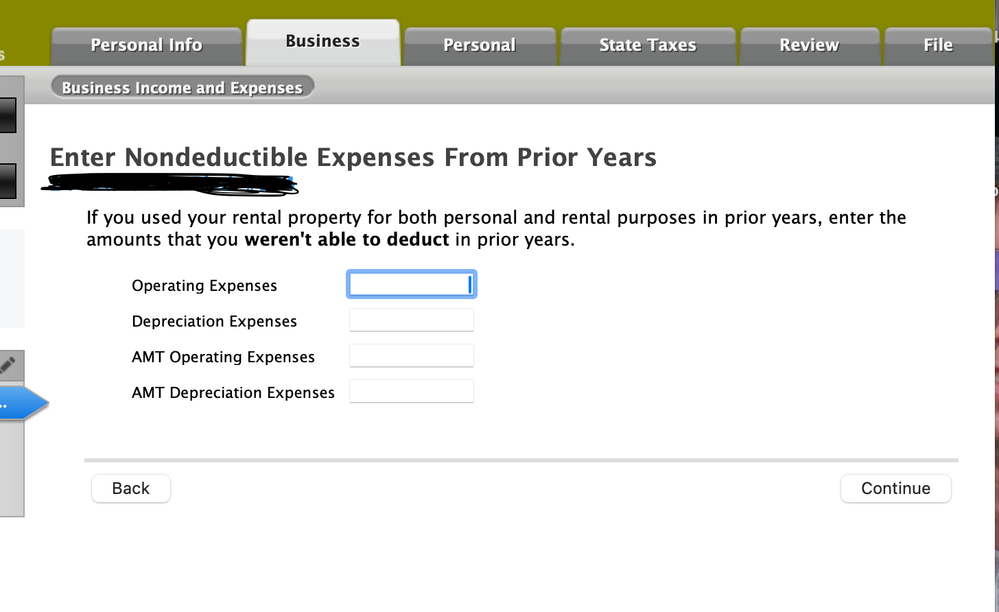

I'm very confused by this TurboTax screen for "Nondeductible Expenses from Prior Year." I have a short-term vacation rental that we use on occasion but rent out short term. I have located Form 8582 from my prior year but I don't understand which numbers go where. TurboTax 2023 screen asks for operating expenses, depreciation expenses, AMT expenses, AMT depreciation expenses. Yet Form 8582 from 2022 doesn't specify these expenses. Can anyone help me?

I'm using desktop Mac version of Home and Business.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property: "Enter Nondeductible Expenses from Prior Year"

To clarify, are there losses listed on your 2022 return listed anywhere in Part 1 or Part's 1V-V111? If so, what are they?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property: "Enter Nondeductible Expenses from Prior Year"

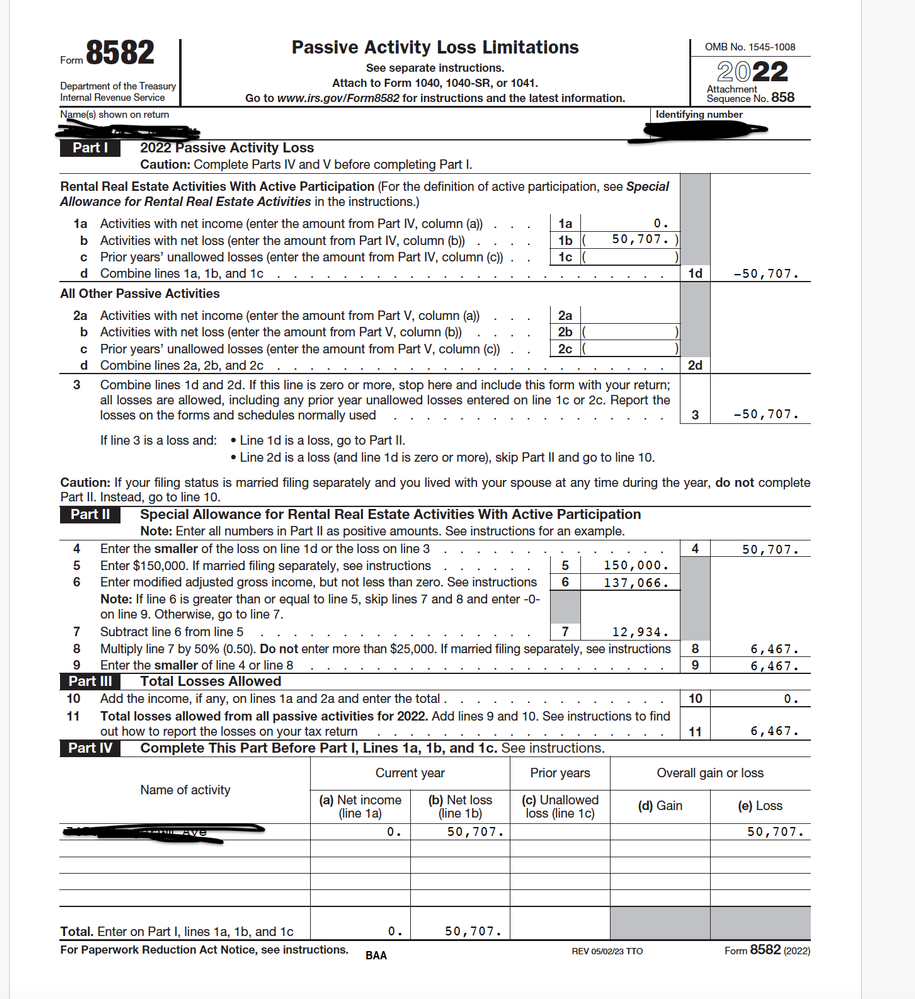

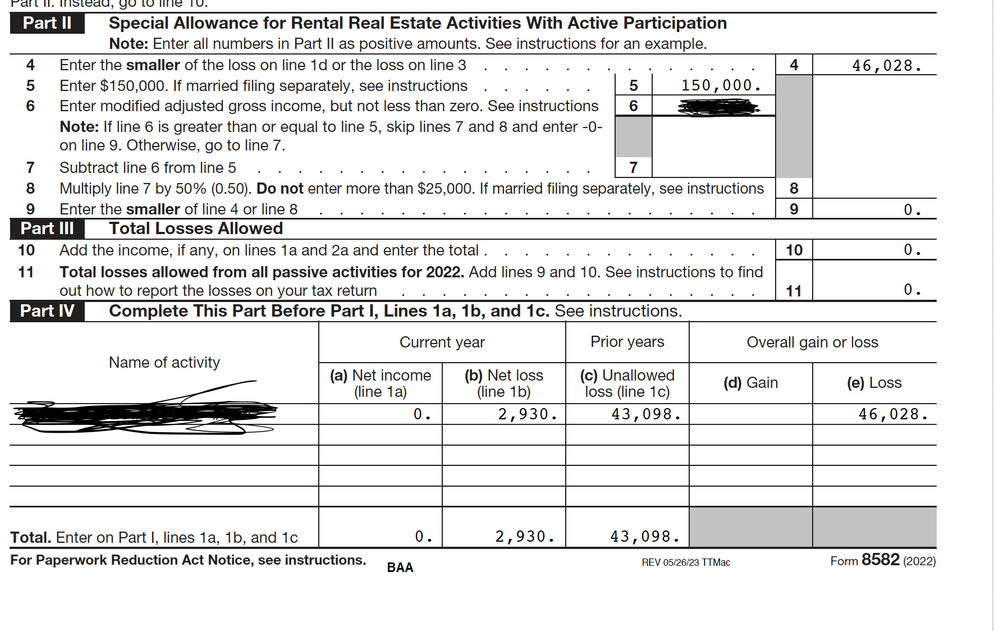

On 2022 tax return, form 8582, it has the following:

Part 1:

1a: 0

1b: 2,930.

1c: 43,098.

1d: -46,028

3: -46,028

Part 5: nothing there

Part 6: nothing there

Part 7:

(c): unallowed loss: $46,028

Part 8:

(c) allowed loss: 0

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property: "Enter Nondeductible Expenses from Prior Year"

Yes, report $46,028 in the first box under operating expenses.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property: "Enter Nondeductible Expenses from Prior Year"

I have similar question about my 2022 nondeductible expenses from prior year for my rental property and I do have a loss in 2022 but am not clear what number to put. from worksheet 8582.

Part I:

line

1a 0

1b 50,7077

1c nothing

Part 2:

4 50,707

line 8 6,467

line 9 6,467

Part 3

line 10 = 0

line 11 6,467

Part 4

(a) 0

(b) 50,707

(c) nothing

(d) nothing

(e) loss

Part 5

nothing

Part 6

(a) 50,707

(c) 6,467

(d) 44, 240

Part 7

(a) 44,240

(c) 44,240

Part 8

(a) 50,707

(b) 44,240

(c) 6,467

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property: "Enter Nondeductible Expenses from Prior Year"

this is my info from parts 1-VIII of form 8582 for 2022 return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property: "Enter Nondeductible Expenses from Prior Year"

Your total unallowed losses from 2022 is $6467 as reported on line 11 on the 8582.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property: "Enter Nondeductible Expenses from Prior Year"

That does not look correct and looks like the opposite number of what should be carried forward. 6467 is my total allowed losses from tax year 2022.

44,240 are the unallowed passive losses from 2022.

50,707 were total losses on schedule E for rental property in 2022, and due to my MAGI I was only able to deduct 6,467 so 44,240 were unallowed that year and should be carried forward. Can you confirm this or explain why that is wrong?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property: "Enter Nondeductible Expenses from Prior Year"

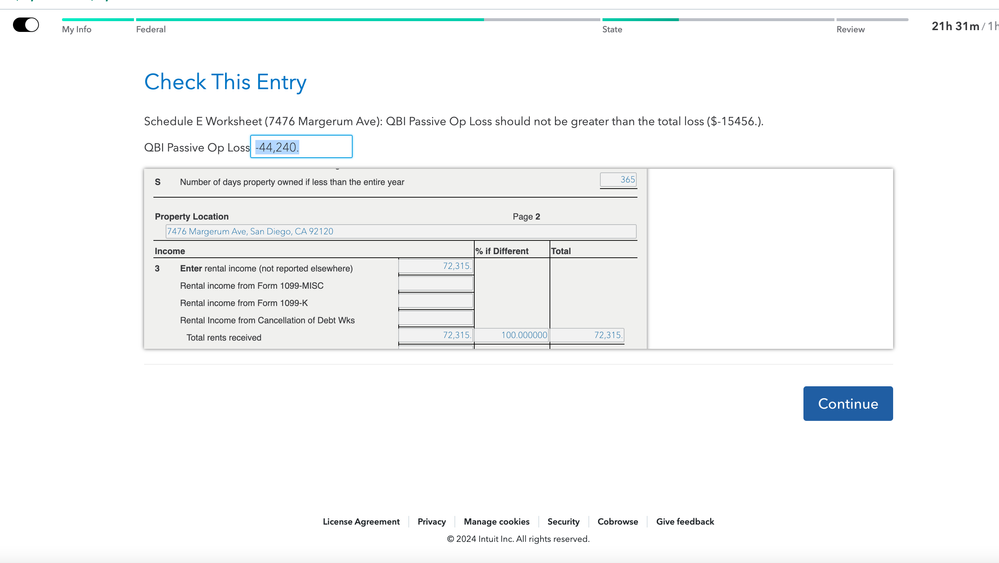

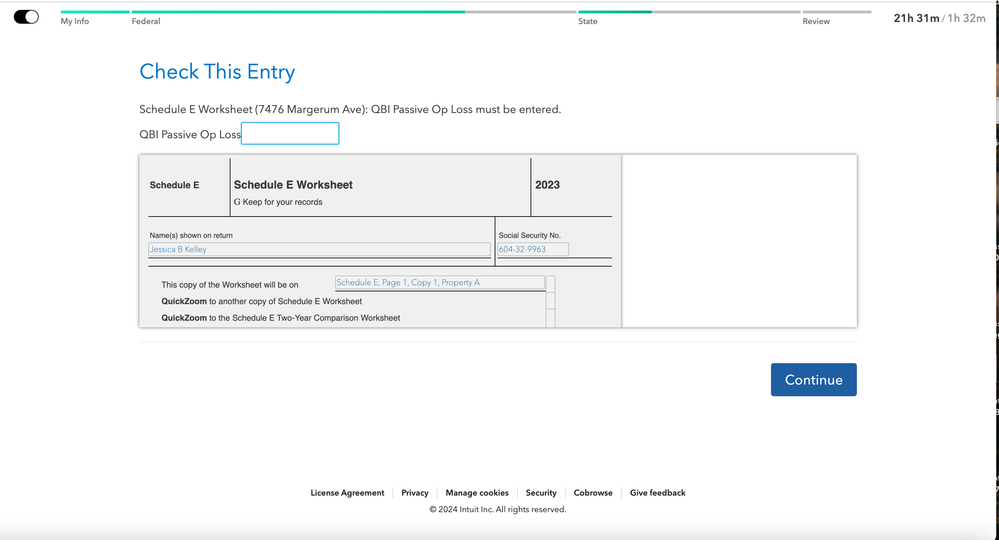

Here are screen shot [PII Removed]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property: "Enter Nondeductible Expenses from Prior Year"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property: "Enter Nondeductible Expenses from Prior Year"

This is my mistake. You are correct. Since your total losses in 2022 were $50,707 and your allowable losses are $6467, you unallowed losses should be $50,707-6467= $44,240.

I apologize for the misinformation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property: "Enter Nondeductible Expenses from Prior Year"

Thank you Dave,

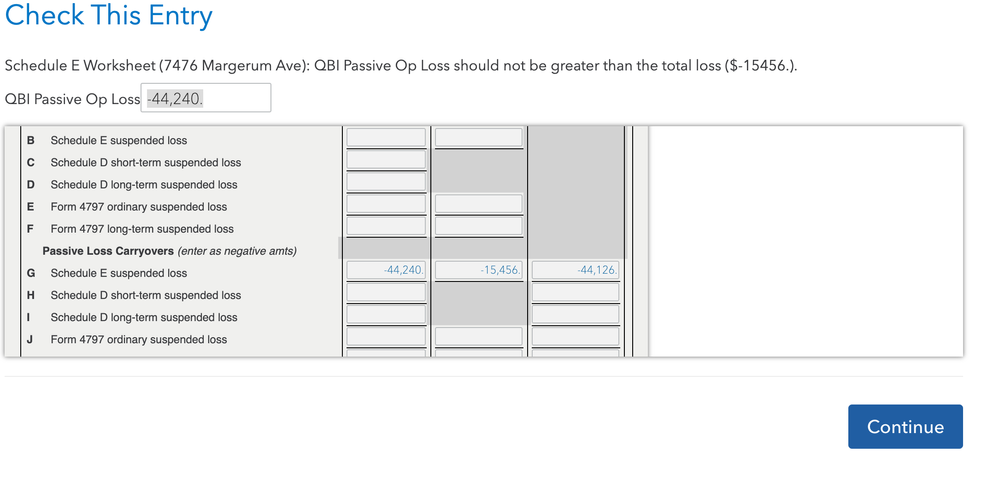

I seem to be having trouble still. I am getting these 2 screens after I go through final steps when turbo tax reviews details.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property: "Enter Nondeductible Expenses from Prior Year"

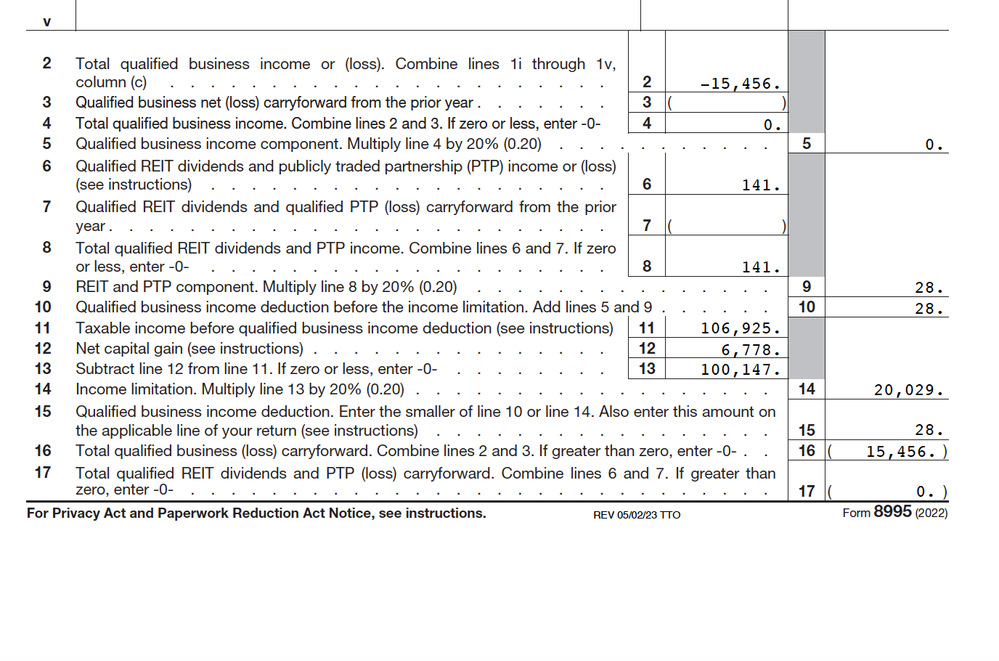

This is form 8995 for QBI

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property: "Enter Nondeductible Expenses from Prior Year"

This QBI total of 15,456 looks like it combines my allowable losses for the rental property of 6467 and 8989 for a 1099 job in 2022

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Property: "Enter Nondeductible Expenses from Prior Year"

Basically I can tell something is wrong here with how these numbers are input

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

zzz8881

Returning Member

thendric1956

Returning Member

dkonol2

Level 2

rougutou

New Member

rand90210

Level 2