- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Property Transfer

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Property Transfer

I have a rental property that I have had for 18 years. In April of 2018 I took on a partner to redevelop the property and we formed a new LLC and I transferred the property to that LLC. For 2018 I will have income and expenses for the property through April and then get a K1 from the new entity for the rest of the year. In TurboTax do I add the new LLC as a new property or is that business dealt with elsewhere?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Property Transfer

@NerakMac wrote:

I have a rental property that I have had for 18 years. In April of 2018 I took on a partner to redevelop the property and we formed a new LLC and I transferred the property to that LLC. For 2018 I will have income and expenses for the property through April and then get a K1 from the new entity for the rest of the year. In TurboTax do I add the new LLC as a new property or is that business dealt with elsewhere?

You really should seek professional tax guidance and legal counsel with respect to this transaction.

Effectively, you have a new entity, the LLC, with a new member (owner) and a separate, initial income tax return will have to be filed for the entity (Form 1065). Each member's contribution of property, cash, etc., will have to be recorded and tracked and you should absolutely have a partnership agreement drafted by a legal professional tailored to your specific set of facts and circumstances.

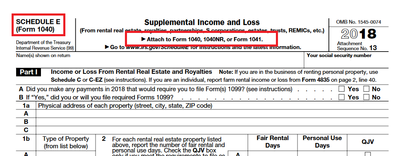

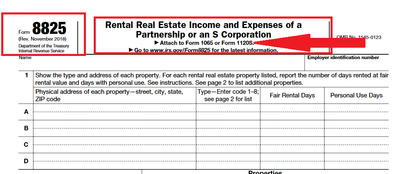

Additionally, you will have to show the transfer (whether it was for cash or other consideration) on your personal income tax return. You will not, however, add the LLC as a "new property". Rather, you will receive a K-1 from the LLC and enter the information from that K-1 into your income tax return. In subsequent years, the LLC will appear in Part II of your Schedule E but the rental property will not (it will appear on Form 1065 and related schedules filed on behalf of the LLC).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Property Transfer

I sold a four units rental property partly used as my principal residence

in exchange for a new single home residential house but earned extra gain..What and how do you calculate taxes to both State and Federal?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Property Transfer

You also need to seek professional assistance with this situation as this is complicated and this forum is not the right medium to discuss all the possible variations of your issue. If you did an actual 1031 exchange that involved partially personal use property then professional help will be needed to get this done correctly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Property Transfer

the llc had a partnership return due 4/15/19. the penalties for late filing are about $200 per month per partner so about now they could be about $2,000. in addition a state return may have be due and some states have a tax on the partnership's net income. also many states impose an annual fee on an LLC - (like a franchise fee for a corp) get professional help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Property Transfer

I have a rental property that I have had for 18 years. In April of 2018 I took on a partner to redevelop the property and we formed a new LLC and I transferred the property to that LLC.

Couple of things here that matter big time.

For starters, on your personal return you will show the property as converted to personal use one day before it was transferred to the LLC. Then you will print out the IRS Form 4562 titled "Amortization and Depreciation Report" as you will need it.

Since you have a multi-member LLC that means the rental property will be reported on SCH E of the 1065 return. You'll be showing it as a capital contribution to the LLC. However, the acquisition dates, in service dates, and everything will be identical to what is on the 4562 from your personal return. For the "prior depreciation already taken" you have to add together the amounts in the "prior years depr" column and the "current year depr" column on the 4562 and enter that total amount. Then the program can correctly figure the remaining depreciation for the rest of the 2018 tax year.

Next, if there's a mortgage on this property then you need to have the lender's permission to transfer ownership of the property from you, to your multi-member LLC. Without that permission you are in violation of your loan agreement and that makes the remaining mortgage balance due immediately. Otherwise the lender can *and most likely will* foreclose on the property for your violation of the loan agreement.

Next, you need to update the rental dwelling insurance policy to show the new owner. Otherwise if there's a claim, the insurance company can quite easily get out of paying such claim and there isn't a thing you can do about it. Additionally, without a valid insurance policy that's another violation of your mortgage loan agreement.

For 2018 I will have income and expenses for the property through April and then get a K1 from the new entity for the rest of the year. In TurboTax do I add the new LLC as a new property or is that business dealt with elsewhere?

I covered the basics of this above. Overall if you don't feel confident in doing this right I would suggest you seek professional help for at least the 2018 tax year. Doing things wrong wil be *EXPENSIVE* and will make the cost of professional help seem like a pittance in comparison. If your state also taxes personal income, then you can double your costs for doing things wrong that first year.

One final note of warning here. The one ship that is guaranteed to almost never make it to port, is a partnership. Sail at your own risk and peril.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Property Transfer

Partnership return due date was changed to 3/15/19 a couple of years ago unless you put it on extension until 9/16/19 ... if you didn't the penalties are adding up quickly so seek local professional assistance ASAP.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Property Transfer

@Critter wrote:

Partnership return due date was changed to 3/15/19 a couple of years ago unless you put it on extension until 10/15/19 ... if you didn't the penalties are adding up quickly so seek local professional assistance ASAP.

Right, and some of the answers demonstrate why professional assistance is absolutely necessary.

First of all the due date is 3/15/19 but a tax professional could recommend a fiscal year beginning April, 2018, which would, at least, reduce the amount of any penalties.

Further, if for whatever reason the nonrecognition rules do not apply, the original poster probably cannot merely indicate the property was converted to personal use.

Finally, partnerships do not even file a Schedule E.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Property Transfer

Thanks for all the replies. I got help with how to do the transaction in my books and the new entity has it's own accountants. I just wasn't exactly sure how to get it into TurboTax. It's all figured out now so thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Property Transfer

Finally, partnerships do not even file a Schedule E.

Ummmmm. you wanna check that? Last time I reported a rental owned by a multi-member LLC, it was reported on SCH E as a part of that 1065 return. The K-1's that were issued were also reported on page 2 of the SCH E on each partner's personal return. If it's not reported on SCH E, then it's not residential rental property. (But could be something short term like a B&B or an AirB&B rental reported on SCH C)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Property Transfer

@Carl wrote:Ummmmm. you wanna check that?

Perhaps screenshots of the two forms (below) will convince you otherwise.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

MyKnew

New Member

mooney1234

New Member

Ash94

New Member

cabg

New Member

taxquestion222

Returning Member