- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Loss on short term rental offsets passive income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Loss on short term rental offsets passive income?

I have a short term rental on AirBnB and VRBO. For the second year now, expenses, exceed revenue. I understand that this is a passive loss and therefore it can only offset passive income. We do have other passive income. Turbo Tax Deluxe seems to be adjusting my depreciation so that the rental shows $0 income. This is when going through EasyStep. Last year it didn't do this. The Schedule E showed a loss for the rental, and it offset the other passive gains. This year Turbo Tax doesn't seem to want to do that. Has something changed? Can passive losses still be used to offset passive income?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Loss on short term rental offsets passive income?

@go_dores wrote:And it says my profit or loss is zero. It subtracts from my expenses to force the total to zero.

It is doing that because you use it for personal use. Because of the personal use, some of the expenses are limited, so it forces it to $0 rather than allowing the loss. The non-usable expenses will be carried forward to next year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Loss on short term rental offsets passive income?

short-term rentals can be non-passive or passive

***************

Rental Activities

A rental activity is a passive activity even if you materially participated in that activity. An activity is a rental if real property is used by customers or held for use by customers, and the gross income from the activity represents amounts paid mainly for the use of the property. It doesn’t matter whether the use is under a lease(other than a triple net lease), a service contract, or some other arrangement.

Exceptions. Your activity isn’t a rental activity (and hence not passive and thus reported on Schedule C) if any of the following apply:

-

The average period of customer use of the property is 7 days or less. You figure the average period of customer use by dividing the total number of days in all rental periods by the number of rentals during the tax year. If the activity involves renting more than one class of property, multiply the average period of customer use of each class by a fraction. The numerator of the fraction is the gross rental income from that class of property and the denominator is the activity's total gross rental income. The activity's average period of customer use will equal the sum of the amounts for each class.

-

The average period of customer use of the property, as figured in (1) above, is 30 days or less and you provide significant personal services with the rentals. Significant personal services include only services performed by individuals. To determine if personal services are significant, all relevant facts and circumstances are taken into consideration, including the frequency of the services, the type and amount of labor required to perform the services, and the value of the services relative to the amount charged for use of the property. Significant personal services don’t include the following.

-

Services needed to permit the lawful use of the property;

-

Services to repair or improve property that would extend its useful life for a period substantially longer than the average rental; and

-

Services that are similar to those commonly provided with long-term rentals of real estate, such as cleaning and maintenance of common areas or routine repairs.

-

-

You provide extraordinary personal services in making the rental property available for customer use. Services are extraordinary personal services if they’re performed by individuals and the customers' use of the property is incidental to their receipt of the services.

-

The rental is incidental to a nonrental activity. The rental of property is incidental to an activity of holding property for investment if the main purpose of holding the property is to realize a gain from its appreciation and the gross rental income from the property is less than 2% of the smaller of the property's unadjusted basis or fair market value. The unadjusted basis of property is its cost not reduced by depreciation or any other basis adjustment. The rental of property is incidental to a trade or business activity if all of the following apply.

-

You own an interest in the trade or business activity during the year.

-

The rental property was used mainly in that trade or business activity during the current year, or during at least 2 of the 5 preceding tax years.

-

Your gross rental income from the property is less than 2% of the smaller of its unadjusted basis or fair market value. Lodging provided to an employee or the employee's spouse or dependents is incidental to the activity or activities in which the employee performs services if the lodging is furnished for the employer's convenience.

-

-

You customarily make the rental property available during defined business hours for nonexclusive use by various customers.

-

You provide the property for use in a nonrental activity in your capacity as an owner of an interest in the partnership, S corporation, or joint venture conducting that activity.

what would be included in significant services

Substantial services, as described by the IRS, include the following and other “hotel-like” services:

Cleaning the property daily while the same guest occupies it

Changing linens daily while the same guest occupies the property

Conducting outings or guest tours

Providing entertainment and meals

Providing transportation

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Loss on short term rental offsets passive income?

Thank you. We meet the criteria for #1 (our average rental is less than 7 days). So the income is not passive? Any idea why Turbo Tax Easy Step isn't coming to that conclusion? Which IRS Publication are you quoting? Thanks again for the answer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Loss on short term rental offsets passive income?

See https://www.irs.gov/publications/p527#en_US_2023_publink1000219123

If you used the rental property as a home during the year, any income, deductions, gain, or loss allocable to such use is not to be taken into account for purposes of the passive activity loss limitation.

See https://www.irs.gov/publications/p925#en_US_2022_publink1000104578

Activities That Aren’t Passive Activities

The following aren’t passive activities.

.......................

3.The rental of a dwelling unit that you also used for personal purposes during the year for more than the greater of 14 days or 10% of the number of days during the year that the home was rented at a fair rental.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Loss on short term rental offsets passive income?

Thank you! Yes we used it for more than 14 days.

Any idea why Turbo Tax Premier isn't picking up on this? I entered the number of personal use days.

Do I need to start over and enter all this under the Schedule C section of Easy Step?

Any advice on how to get Turbo Tax Premier to handle this properly would be greatly appreciated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Loss on short term rental offsets passive income?

Do not enter the rental under Schedule C unless you perform significant services for your renters.

TurboTax should pick up on the fact that you're using the rental for more than the greater of 14 days or 10% of the days rented at fair value.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Loss on short term rental offsets passive income?

It isn't. I just went through and added all of the information again. And it says my profit or loss is zero. It subtracts from my expenses to force the total to zero. How do I get help on this? Does Intuit support the product?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Loss on short term rental offsets passive income?

@go_dores wrote:

....And it says my profit or loss is zero. It subtracts from my expenses to force the total to zero.

You're likely be limited by Section 280A.

This is difficult to understand. If you use your vacation rental as a residence, then that takes the property out of Section 469 (passive activity loss limitations). However, personal use still needs to be accounted for and any loss can still be limited by Section 280A.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Loss on short term rental offsets passive income?

I Googled that and I see some descriptions of it, but I don't see how it applies in my situation. Can you point to anything specific that might apply in my case?

Is it possible that Turbo Tax just has a bug? How would I report that? Does Intuit support their software?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Loss on short term rental offsets passive income?

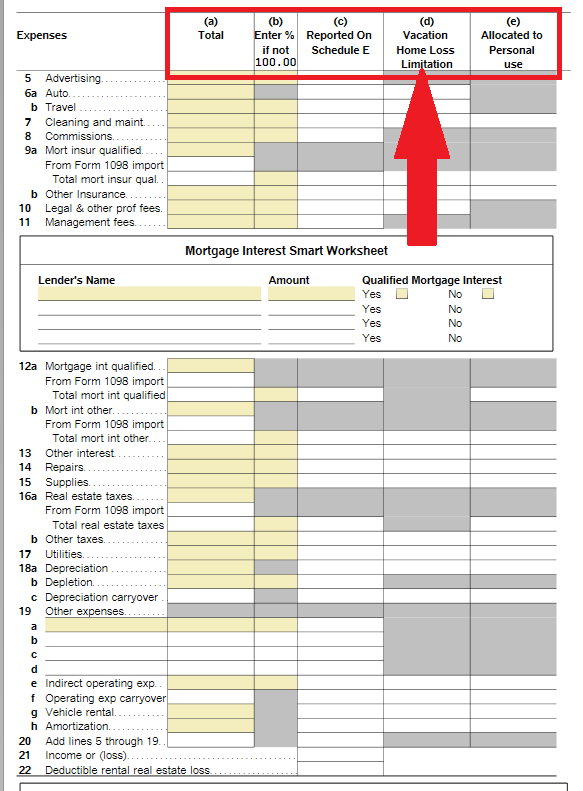

If you look at your Schedule E and see amounts in the Expenses section, Column E 'Vacation Home Loss Limitation', then those amounts are being limited or reduced to $0, most likely due to number of rental vs. personal use days.

Compare this to your last year's Schedule E.

Since we can't see your return in this forum, if you Contact TurboTax Support they can actually view your return to help you resolve this.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Loss on short term rental offsets passive income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Loss on short term rental offsets passive income?

Thank you. Yes there is a bunch of stuff in the "Vacation Home Rental Loss Limitation" column. Earlier in this thread, somebody pointed out that my rental activity is not passive if we used the home for more than 14 days for personal use. We used it for 19 days. So why is the loss being limited?

I called support, and he seemed very stumped. He finally landed on telling me that Turbo Tax doesn't support my scenario unless I received a 1099-MISC from AirBnB and VRBO. Does that sound right? They didn't send those forms either this year or last year. And Turbo Tax handled it fine last year.

He did send me a link to request a refund. I may just have to get a refund from Turbo Tax and try different software. Does anybody know of tax software that handles this situation well?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Loss on short term rental offsets passive income?

@go_dores wrote:

.........So why is the loss being limited?

The loss is being limited by Section 280A (the vacation rental home loss rules).

@go_dores wrote:I called support, and he seemed very stumped. He finally landed on telling me that Turbo Tax doesn't support my scenario unless I received a 1099-MISC from AirBnB and VRBO. Does that sound right?

No, that does not sound the least bit correct (except for the part where support seemed "very stumped").

@go_dores wrote:......Does anybody know of tax software that handles this situation well?

No other software will handle this scenario differently or better. TurboTax is most likely handling it properly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Loss on short term rental offsets passive income?

Is there a way to find out which section of 280A is impacting me?

This so strange; it seems that Turbo Tax has decided to disallow my expenses. No explanation is offered within the program itself. The support team gives an explanation that you say does not sound the least bit correct. And nobody here in the community support can do any better than "maybe there is something somewhere in 280a that impacts you".

I get that you can't see my taxes, and I genuinely appreciate all the help. But wow, is Turbo Tax really this opaque? There isn't an explanation of why it's doing what it's doing? We are just supposed to trust it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Loss on short term rental offsets passive income?

@go_dores wrote:

Is there a way to find out which section of 280A is impacting me?

Did you look at the Schedule E Worksheet in Forms Mode?

That will lay out exactly what is being allocated to rental use, personal use, and the vacation home loss limitation.

Here's Section 280A: https://www.law.cornell.edu/uscode/text/26/280A

I've tested this over the years and the program handles this issue correctly. If you don't understand it, that might be because you're simply not familiar with the law and regulations.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

ccacioppo

Level 1

MiniMe

Returning Member

fillini00

Level 2

embedded_guy

Level 3

lllbby

Level 2