- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: I began renting part of my home this tax year. TT makes the split for time not rented vs rented, but not for the part rented vs owner occupied. How to fix?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I began renting part of my home this tax year. TT makes the split for time not rented vs rented, but not for the part rented vs owner occupied. How to fix?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I began renting part of my home this tax year. TT makes the split for time not rented vs rented, but not for the part rented vs owner occupied. How to fix?

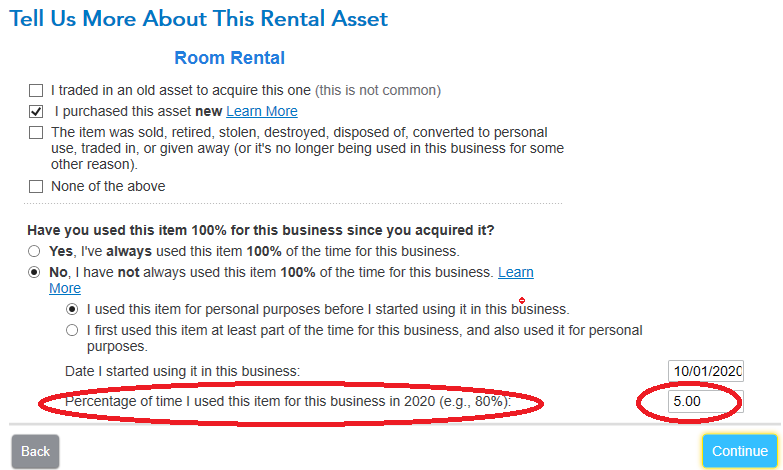

When renting a part of your home, in that first year you do that, one of the questions is mis-worded, resulting in you providing in incorrect percentage figure. You don't even realize it, and the program does not flag it either, because "mathamatically" it's not an error.

The question asked is "Percentage of time I used this item for business in 2020 (e.g. 80%)" The question should be "percentage of floor space that is being rented out". Now you were asked that question earlier. So if you put the same percentage in this box, and you did on a previous screen, the program will figure things correctly. Below is a screen shot of the screen in question here.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I began renting part of my home this tax year. TT makes the split for time not rented vs rented, but not for the part rented vs owner occupied. How to fix?

Thanks, This would be an awesome reply, if I could find the screen you're referring to in your response, but I'm not seeing it -- can't figure out how to get there.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I began renting part of my home this tax year. TT makes the split for time not rented vs rented, but not for the part rented vs owner occupied. How to fix?

Just wk through the property in the SCH E section the same exact way you did the first time. The only difference is, on that screen where you see "Add Another Rental or Royalty", you won't click that button. Instead, you'll click the EDIT button next to that property, as you'll see it listed there since you've already entered it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I began renting part of my home this tax year. TT makes the split for time not rented vs rented, but not for the part rented vs owner occupied. How to fix?

Yes, I see where I edit the existing property, but in those screens, I never see the one you've shown above.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I began renting part of my home this tax year. TT makes the split for time not rented vs rented, but not for the part rented vs owner occupied. How to fix?

Wondering if the best course of action at this point might be to delete the property and start again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I began renting part of my home this tax year. TT makes the split for time not rented vs rented, but not for the part rented vs owner occupied. How to fix?

If *and only if* 2020 is the first year you are reporting rental income, then it's fine to just delete it and start over. This is not at all uncommon for someone dealing with rental property for their very first time.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

debjit21

New Member

hawkinsbren56

New Member

tljackson1542

New Member

nh_624

Returning Member

saalves2424

New Member