Entering Oil and Gas Royalties in Turbo Tax has always been difficult. And it certainly did not help this year when a misleading statement causes us hours of work.

Here is the situation:

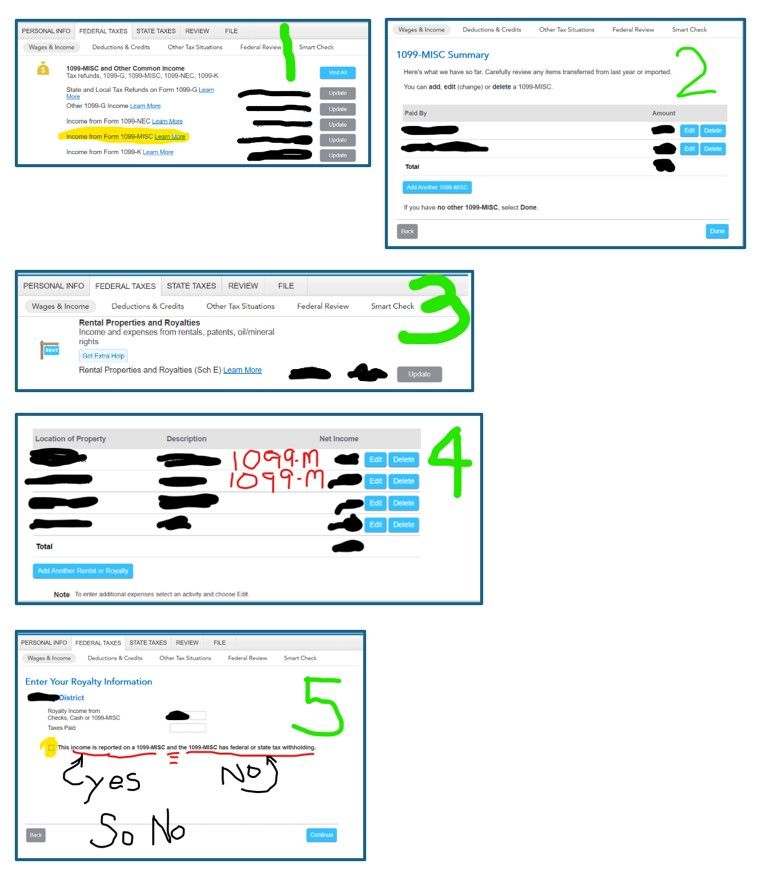

+++If you have a 1099-MISC you will input your Oil and Royalty information in two places. The first place is under the 1099-MISC section (see Figure 1). As shown in Figure 2 I had two 1099-MISCs so I had two line items. However this is not where you list your Oil and Gas Royalty expenses. So far so good.

+++Eventually you will get to the Rental Property and Royalties section (See Figure 3). You will enter the royalty property specifics in this section (see Figure 4). I had a total of four line items, but I only received 1099-MISCs for two of them (that is, the same two where I entered the two 1099-MISC line items in Figure 2.

+++ So as I was inputting my four line items in Figure 4 I encountered a check box (see Figure 5). This is where the problem comes in. (Bad!)

+++The Figure 5 check box statement says that two things have to be true: (1) The royalty income is from a 1099-MISC AND, (2) the 1099-MISC ALSO has federal or state withholding. In my case I did receive the 1099-MISC for two of the line items in Figure 4, BUT the 1099-MISCs did NOT have any federal/state tax withholding.

+++So given this, I did not mark the check box since half the check box statement was not true in my case. As I discovered this check box is what links the info from each 1099-MISC in Figure 2 to the line items in Figure 4.

+++The check box statement SHOULD be corrected to read: “This income is reported on a 1099-MISC, and the 1099-MISC may or may not have federal or state tax withholding”.

+++ REQUEST THAT TURBO TAX CORRECT THIS MISLEADING STATEMENT.

+++In my case since I did not check the box for two of the four line items in Figure 4 (i.e., the two I had received 1099-MISC for in Figure 2), Turbo Tax generated two EXTRA Royalty income line items. These appeared in Figure 4 for a total of six line items, but I have already deleted them in figuring out a solution. These two extra line items in Figure 4 doubled the income from the two 1099-MISCs; which is wrong.