- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- I can't find where to depreciate a New Roof for business rental not residental rental

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't find where to depreciate a New Roof for business rental not residental rental

I can't find where to depreciate a new roof for a business rental, not a residential rental.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't find where to depreciate a New Roof for business rental not residental rental

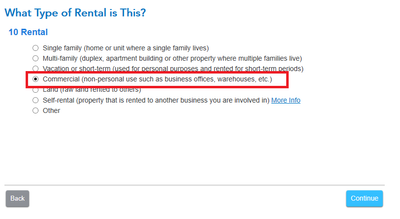

You have to select the correct type of rental in your Property Profile first (see screenshot).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't find where to depreciate a New Roof for business rental not residental rental

I assume you are reporting your business income/expenses on SCH C as a phyiscal part of your personal 1040 tax return.

Basically, it's a business asset that gets entered in the business asset section. How you enter it depends on if you own the building you put the new roof on, or if you are renting the building you put the new roof on.

If you don't own the building you put the new roof on, then it's classified as a leasehold improvement.

Otherwise, if you already own the building you'll work it through the business assets section. Select Real Estate Property, then Non-residential real estate. Since this is for a new roof, you'll enter what you paid for it in the COST box, and enter a zero in the "cost of land" box.

The roof will be depreciated over 39 years.

If you do not own the building, then the new roof you paid for is classified as a leasehold improvement.

Select Real Estate Property, then Qualified Improvement Property. Call it what it is *new roof* and enter what you paid for it. Note that for this there is no "cost of land" box. Finally on that screen, date it was finished and placed in service.

With this,you can take a full or partial deduction the first year. I only recommend this *IF* your business has the taxable income from which you take the deduction. If not, then it's a waste of your time and does you no good on the tax front for the 2019 tax year.

Weather you spread it out over the years or take the partial deduction, whatever's left gets depreciated over the next 39 years.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Lolajean123

New Member

mackyd

Level 1

JohnASmith

Level 4

trrsj

New Member

dmarchello

New Member