- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- How do I report tax-loss carryforward for rental property

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report tax-loss carryforward for rental property

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report tax-loss carryforward for rental property

after you enter some initial property info, you should come to a screen where it asks if you have a passive activity real estate loss carried over from prior years. check the box and then on the next screen as a negative number enter the loss carryover as a negative number for both regular tax and amt tax. it will also ask about a QBI carryover. you would have to look at your 2018 return to see if you classified it as a Qualified Buisness activity.

if so the losses for 2018 through 2020 would be entered.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report tax-loss carryforward for rental property

Thanks @Mike9241 , trying to follow your directions but unable to make it work. I am using online premier version, perhaps it's different.

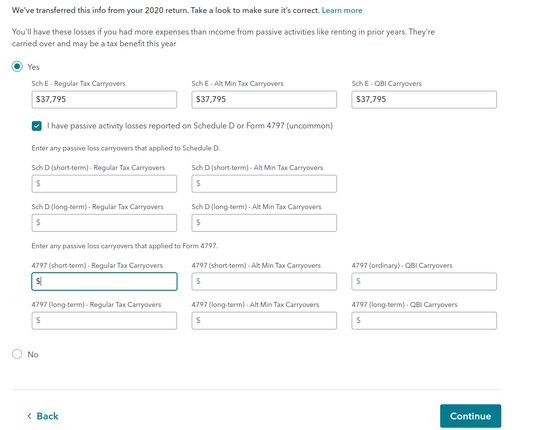

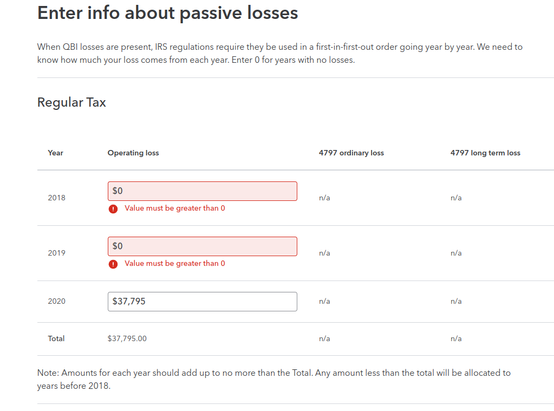

But best match I found is this, in section: 'Carryovers, limitations..' I see passive income loss carryover amounts, when I click 'make changes' there's a checkbox 'I have passive activity losses reported on Schedule D or Form 4797', If I click the checkbox I see 2 sets of boxes: 1- Sch D (short term) regular tax carryover, Sch D (short term) Alt Min tax carryover and 2 - 4797 (short term and long term). Either of those boxes would not allow me to enter a negative number. If I enter a positive number and continue to the next screen where it prompts me to enter amount of passive losses for years 2018, 2019 and 2020 (pre-populated). Instructions for the boxes say that if there were no losses - enter zero. But when I try to enter zero for years 2018 and 2019 and submit - form validation says 'Value must be greater than 0'.

Let me know if I am not looking at a right section etc. Thank you!

here are some screenshots:

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

bruced63

New Member

frank790628

Returning Member

lueylu33-

New Member

taxdoofus

New Member

loyal-but---user

Level 3