- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- How do I adjust AMT cost basis for ISOs sold in a qualifying disposition (line 2k Form 6251)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I adjust AMT cost basis for ISOs sold in a qualifying disposition (line 2k Form 6251)

Hello,

I have exercised and held ISOs in 2021. I have reported them on my 2021 tax return and paid AMT tax. In 2022, I was able to recoup all of the AMT tax paid previously via a credit (my AMT Tax Credit Carry forward for 2023 is now zero).

I have sold all of the ISOs in 2023 (qualifying disposition) for a capital gain. I have reported the sale on form 8949 and Schedule D using exercise price as my cost basis.

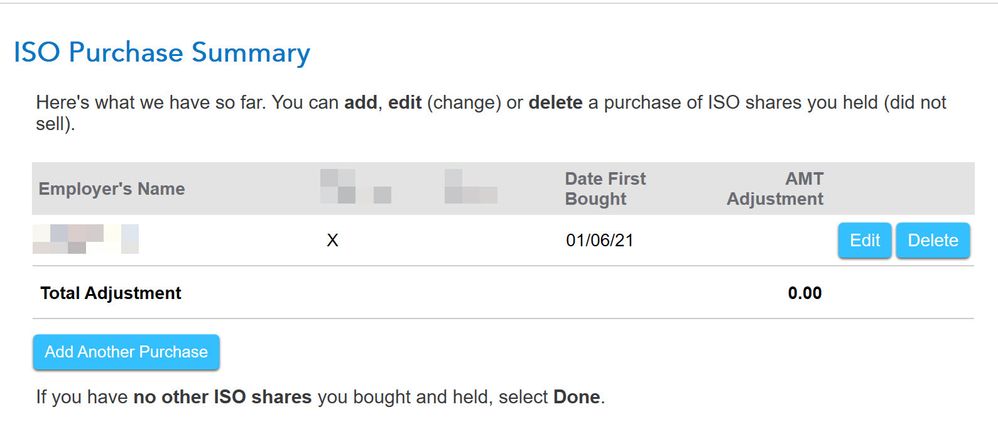

If I understand correctly, since ISOs are dual basis, I need to adjust my AMT cost basis (line 2k Form 6251). But I cannot figure out how to do it in TurboTax. I see the AMT Adjustment field on the "ISO Purchase Summary" but I don't know how to make that adjustment.

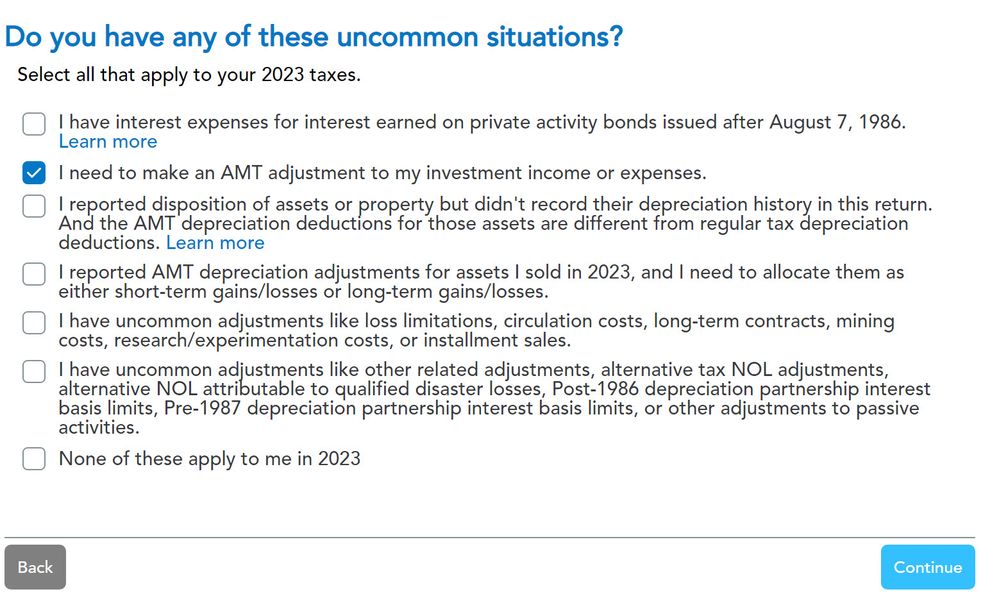

Is this done by checking the "I need to make an AMT Adjustment to my investment income or expenses" box?

If I do that, I still don't see anything on line 2k of Form 6251.

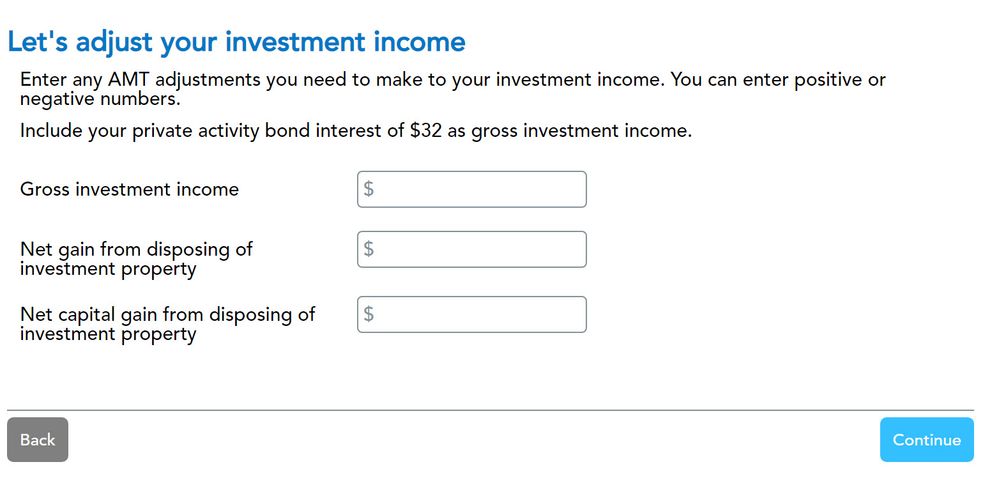

I am also not sure which box of the three (see screenshot) to put the AMT adjustment into and how to calculate the amount to put on line 2k.

Alternatively, I also tried to check the "The cost basis is incorrect or missing on my 1099-B" while entering the ISO sale and providing the info from form 3921 in subsequnt interview questions. This does seem to adjust the amount in column h (Gain or Loss) on Schedule D AMT, but 'line k" on my form 6251 is still zero.

Which one is the correct way to do it?

Finally, since I sold all of the ISOs in 2023 do I need to delete the "ISO Purchase Summary" for 2023 tax year or do I still keep it there and delete it next year?

Thank you!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I adjust AMT cost basis for ISOs sold in a qualifying disposition (line 2k Form 6251)

You have an AMT income adjustment for the difference between the regular tax basis and the AMT basis of the stock. This occurs because the AMT income recognized due to the exercise of the ISOs in the year of exercise is added to the stock's basis for AMT purposes, but not for regular tax purposes. If the price of the stock at the time you disposed of the stock is greater than or equal to the price of the stock at the time the ISOs were exercised, your adjustment will be a negative adjustment for the same amount as the original positive AMT ISO adjustment.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

MS456

Level 2

kcoub1

New Member

mironov

Level 1

taxqn24

Returning Member

w15

Level 2