- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Help with form 8606 for backdoor ROTHs

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help with form 8606 for backdoor ROTHs

Hi everyone,

Last year was the first year that I entered a backdoor ROTH into Turbotax for Tax Year 2021 (special thanks to @macuser_22 and @dmertz for their clear directions and explanations last year)

I’m hoping someone can please tell me if I have correctly entered my information into Turbotax for my

- Backdoor ROTH (converted in March 2022 for tax year 2021)

- and for my nondeductible IRA that I contributed to in March of 2023 for tax year 2022 (which I immediately converted into backdoor ROTH)

For Tax Year 2021:

- I made a $6000 contribution into my 2021 tax year ROTH IRA in 2021.

- I realized in March 2022 that my MAGI was too high (for the first time) for me to have contributed to a ROTH IRA in 2021.

- Before filing my 2021 taxes, I recharacterized my excess contribution into a traditional IRA (I’d never had a traditional IRA before) and I converted my non-deductible traditional IRA into a backdoor ROTH.

- Because my entire ROTH IRA (not individual funds in the ROTH IRA) had an increase in value of $501 attributed to the $6,000 contribution, $6501 was recharacterized into my Traditional IRA account. I entered the amount of the original Roth contribution - not any earnings or losses - into Turbotax and for the explanation statement, I stated that the original $6000 contribution plus $501 earnings were recharacterized.

- I entered my $6000 nondeductible IRA contribution into my 2021 taxes (which was converted into a backdoor ROTH IRA in 2022).

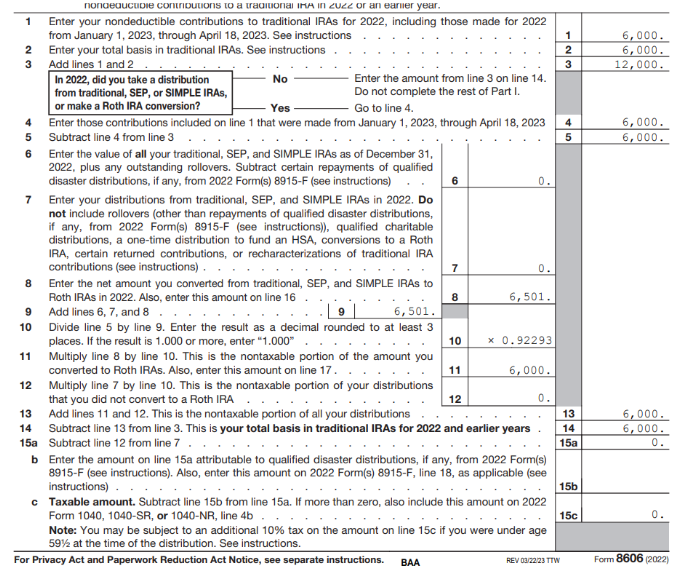

– My form 8606 from Tax Year 2021 shows my $6,000 non-deductible contribution listed on lines 1, 3, and 14. **I believe this is correct - please tell me if I’m mistaken!

Tax Year 2022:

- In March 2023 (for tax year 2022), I contributed $6000 into my $0 balance traditional IRA and converted the $6000 into my ROTH IRA (backdoor ROTH IRA).

- I received two 1099-Rs for 2022, which were both imported into Turbotax through Vanguard. I read that I can ignore the 1099-R for the recharacterization with the code "R" in box 7, because the code R 1099-R will be ignored by TurboTax since its only purpose is for the IRA custodian to tell the IRS. I imported both 1099-Rs from Vanguard into Turbotax but can manually delete the 1099-R with code “R” in box 7 if necessary.

Here’s what I’ve done for Turbotax 2022:

- I imported my 1099-R(s) and followed the directions here from Turbotax for entering a backdoor ROTH conversion.

- I completed Step 1: Enter the Non-Deductible Contribution to a Traditional IRA, for the backdoor ROTH I converted in March 2023 (for tax year 2022).

- I completed Step 2: Enter the Conversion from a Traditional IRA to a Roth IRA, for the backdoor ROTH that I converted in March of 2022 (for tax year 2021).

- I followed the steps for If your conversion contains contributions made in 2022 for 2021, and answered the questions about the basis from line 14 of 2021 Form 8606 ($6000) and the value of all traditional, SEP, and SIMPLE IRAs ($0).

Questions I’m hoping you can answer:

1) Should I manually delete the 1099-R with R in box 7 (I imported it into my 2022 taxes)? Or will it simply be ignored by Turbotax?

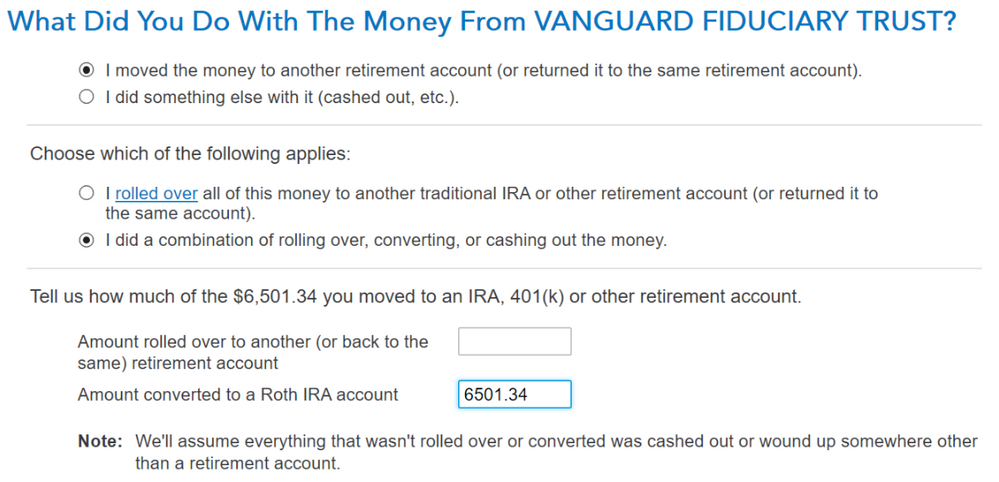

2) For the question (*step 2, part 8* for my 2022 backdoor Roth conversion: What did you do with the money from Vanguard, should I enter that I converted $6501.34 (original $6000 contribution plus $501 earnings)? Or would I enter $6000 (the original $6000 contribution)? I entered $6501.34, as seen in the screenshot below.

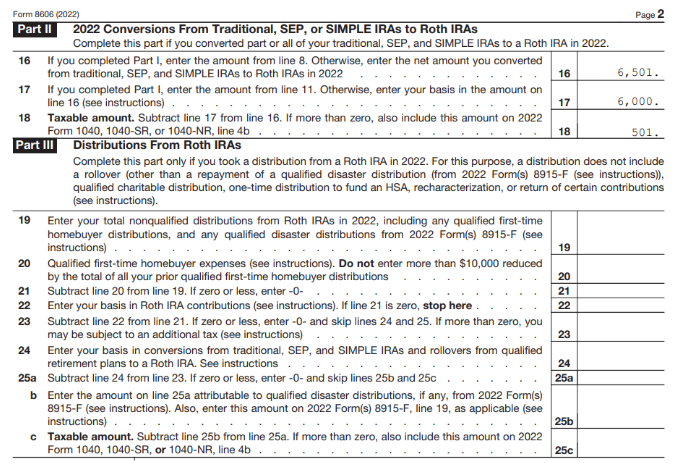

3) Here is my (current) 2022 form 8606. Can you please tell me if my form looks correct based on the above information, or if there is anything I need to change?

Thank you very much!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help with form 8606 for backdoor ROTHs

1) You can leave Form 1099-R with code R it won't make any changes to your return.

2) Yes, you will enter $6,501.34 as converted (the amount you moved from the traditional IRA to the Roth IRA).

3) Yes, your 2022 Form 8606 looks correct. You have a $6,000 basis to carry over to 2023 and $501 of the conversion (earnings) is taxable.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tianwaifeixian

Level 4

tianwaifeixian

Level 4

tianwaifeixian

Level 4

gagan1208

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

tianwaifeixian

Level 4