- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- For rental property, Turbotax treats my expenses as though I had selected the de minimis safe harbor, even though it never asks if I want to use the safe harbor. Why?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For rental property, Turbotax treats my expenses as though I had selected the de minimis safe harbor, even though it never asks if I want to use the safe harbor. Why?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For rental property, Turbotax treats my expenses as though I had selected the de minimis safe harbor, even though it never asks if I want to use the safe harbor. Why?

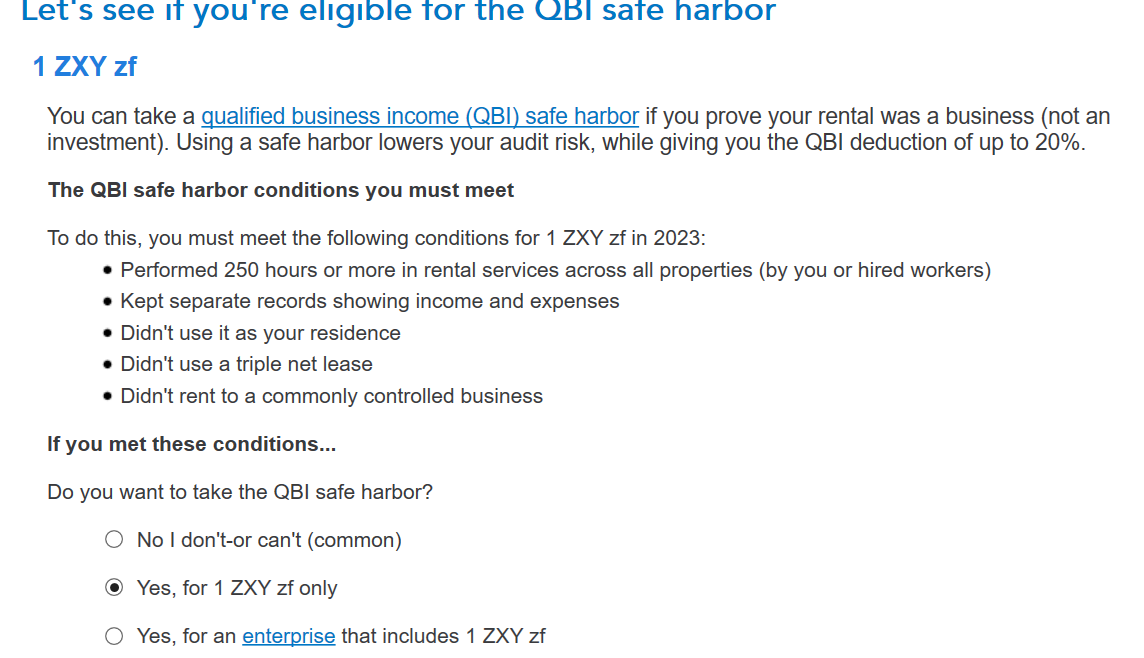

You should have seen a screen after you entered your rental income and expenses regarding your eligibility for the QBI safe harbor:

Even if you didn't indicate that you qualified for the safe harbor, you may have indicated the property qualified for qualified business income (QBI) treatment :

You can qualify for QBI treatment even if you don't qualify for the safe harbor. Maybe you had indicated that it qualifies for QBI treatment without the safe harbor election.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For rental property, Turbotax treats my expenses as though I had selected the de minimis safe harbor, even though it never asks if I want to use the safe harbor. Why?

My understanding is that "de mimimis safe harbor" and "QBI safe harbor" are not the same thing, as they are different, distinct elections based on different provisions of the tax code. So while I understand and appreciate the reply regarding QBI safe harbor, I don't think it resolves the question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For rental property, Turbotax treats my expenses as though I had selected the de minimis safe harbor, even though it never asks if I want to use the safe harbor. Why?

Your expenses get expensed whether you elected the safe harbor or not. You will be able to elect the de minimis safe harbor when you enter ASSETS.

The De Minimis Safe Harbor election lets you deduct the full cost of items (assets) worth $2,500 or less, instead of depreciating. You can also use the Safe Harbor Election for Small Taxpayers to expense the cost of improvements (assets) to business buildings if you qualify. These elections are available for Schedule C businesses, rentals, farms, and farm rentals.

For instructions on claiming the De Minimis Safe Harbor Election in TurboTax, select your product.

TurboTax Online

TurboTax Desktop

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

-kendunn

New Member

KaitlinSimone93

New Member

iamramiro

New Member

casraecav

New Member

Irasaco

Level 2