- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- First Year Depreciation on Rental Property

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

First Year Depreciation on Rental Property

Hello,

I have started renting what used to be my primary residence (since 2018). In service date for rental was Sept 2023. Am I allowed to take depreciation this year?? Turbo Tax doesn't seem to be guiding me through it.

Also, I have to prorate all expenses (HOA, Insurance, Property Taxes & Utilities) for the rental period correct? I thought TurboTax would do it automatically, but it is not, so I'm entering in the prorated values based on my manual calculations.

Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

First Year Depreciation on Rental Property

Yes, when you enter your home asset (be sure to find the land value which can come from the city or county tax assessment record). Enter the total cost, then the amount for land. TurboTax will calculate the depreciation on the house over 27.5 years. The method is MACRS straight line using a mid-month conversion - this just means that the first month placed in service (September, 2023) there will be a half month of depreciation and then a full month for each month remaining in the year.

I advise for this year to do all of the proration of other expenses yourself as you have done. Next year, you won't have to do that.

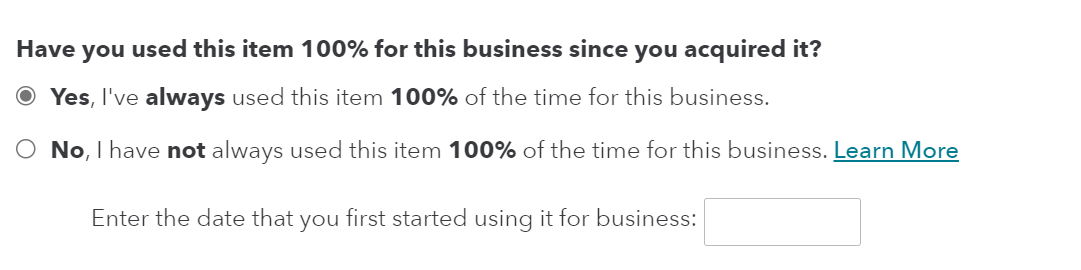

A key question you must answer is that 'Yes' I've always used this item 100% of the time for business.' Next, enter the date placed in service appropriately. Once the property was converted from personal use to rental use it was used 100% of the time for rental purposes. Also, it must be rented at fair rental value during the rental period. See the image below

- In TurboTax, search (upper right) for rentals and select the Jump to link > Edit beside your rental property

@AJ_52

[Edited: 03/11/2024 | 8:03 AM PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Mdlle8899

Level 2

skibum11

Returning Member

cparke3

Level 4

Tax117

Level 1

TaxAdvice

Level 1