- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Do Any of These Situations Apply to This Property

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do Any of These Situations Apply to This Property

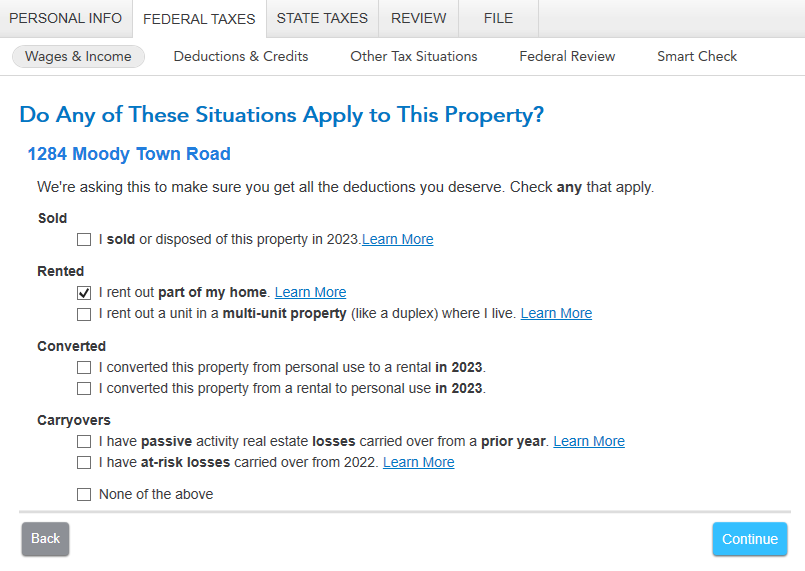

I rent rooms in my home during the fall and the spring to contractors that come into town to perform maintenance at a local utility. In TT 2023 on the page "Do Any of These Situations Apply to This Property?" I select the option “I rent out part of my home.”

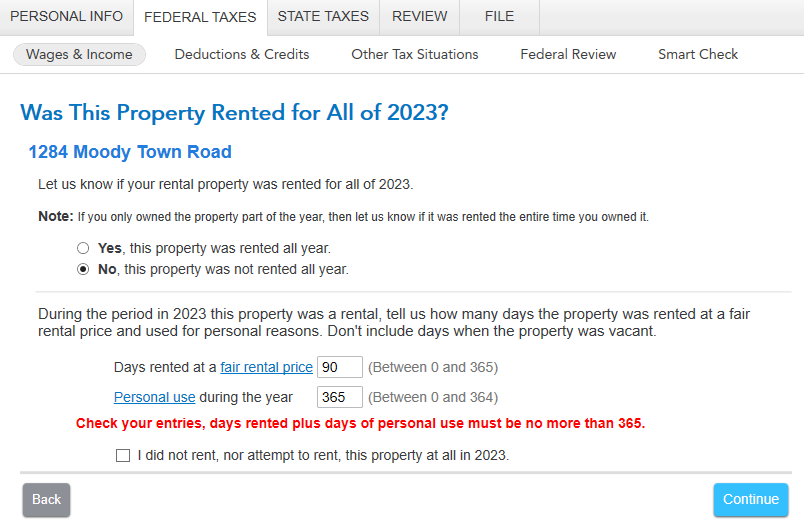

When I continue onto the next page titled “Was This Property Rented for All of 2023?”, I obviously select “No, this property was not rented all year.” But, I am then confronted with a dialog to enter the number of days rented at a fair rental price (0 to 365) and the number of days for Personal use during the year (0 to 364).

This question clearly is intended for someone that was not renting a room but rather the entire home. If I enter 90 days for rented and 364 for personal I get an error in red stating “Check your entries, days rented plus days of personal use must be no more than 365.” The logic flow from the previous page regarding renting our part of the home does not apply to the current page with only two options.

What should you do if you rented rooms / part of your home???

TYIA

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do Any of These Situations Apply to This Property

You were on the right track. If you rented a room for 90 days, then your personal use of that room was only 275 days. The room can't be used for both Personal and Business at the same time.

The important part is to calculate the % of your home that the room represents (Business Use %). If your home is 2500 sq. ft. for example, and the room you rent is 250 sq.ft., then 10% is your Business Use %.

So when you enter expenses like Mortgage Interest, Property Tax, Insurance, Repairs, Utilities, etc. for the whole house, TurboTax will calculate the Business Use % for you.

Here's more info on Renting a Room in Your Home.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do Any of These Situations Apply to This Property

You were on the right track. If you rented a room for 90 days, then your personal use of that room was only 275 days. The room can't be used for both Personal and Business at the same time.

The important part is to calculate the % of your home that the room represents (Business Use %). If your home is 2500 sq. ft. for example, and the room you rent is 250 sq.ft., then 10% is your Business Use %.

So when you enter expenses like Mortgage Interest, Property Tax, Insurance, Repairs, Utilities, etc. for the whole house, TurboTax will calculate the Business Use % for you.

Here's more info on Renting a Room in Your Home.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do Any of These Situations Apply to This Property

Thank you for your reply. What was confusing to me and perhaps others is the wording "the property" which has the infers that it is the entire home, not a room in the home.

Thank you again!

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

chiefbisonhawk

New Member

tbaz237499

New Member

rataea

Level 1

roger622

New Member

hnpot

Level 2