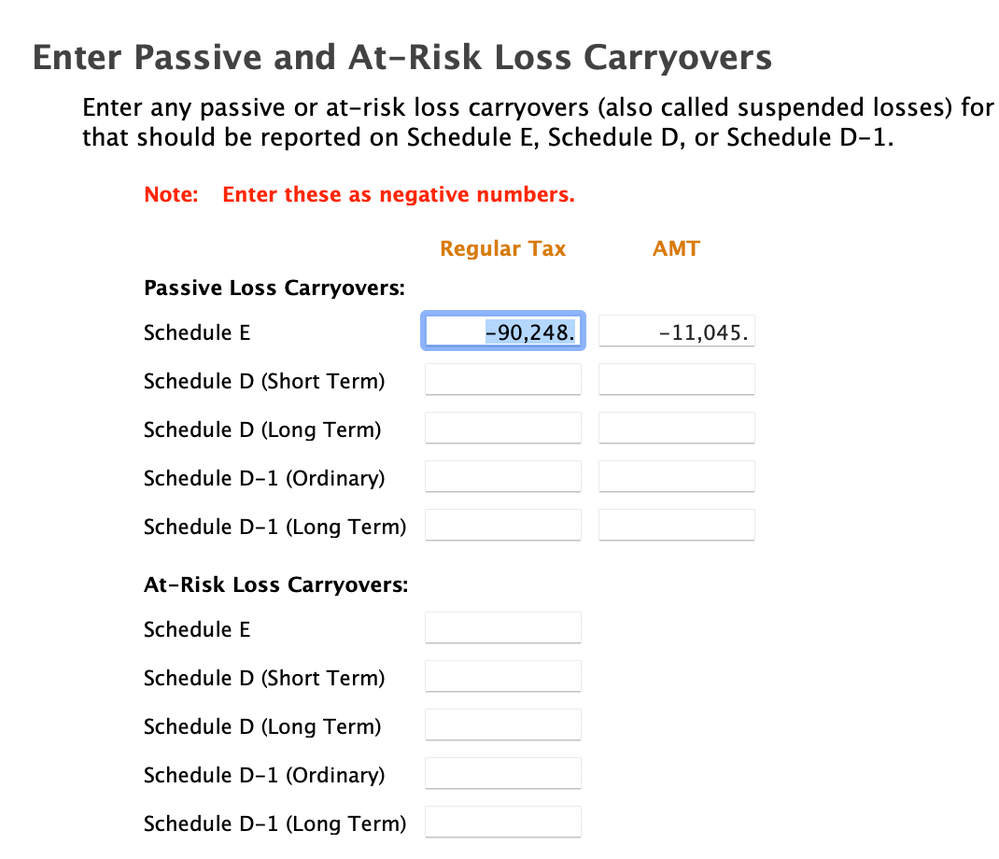

The CA return asks me to adjust the passive and at-risk loss carryovers for rental properties. I've imported last year's tax return into turbotax. I can't make sense of the the numbers automatically shown for "regular tax" and "AMT" columns. I understand that they aren't the same from federal carryover amounts since CA has more limitation on rental income to be active but I can't find these carryover numbers from last year CA tax returns. Also, I don't really understand what the "AMT" is about and how to figure out its number. Last year's federal form 8582 contains accumulated carryover loss amounts, but I don't see a corresponding form for CA tax return. How should I adjust the these numbers for CA return? Is it a good idea to just add up the 8582 form's accumulated disallowed loss amounts and allowed loss amounts? Or is it a good idea to just rely on what Turbotax automatically fills out?