in Investing

- Community

- Topics

- Community

- :

- Discussions

- :

- Investing

- :

- Investing

- :

- rental property QBI deduction confusion on 2022 version

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

rental property QBI deduction confusion on 2022 version

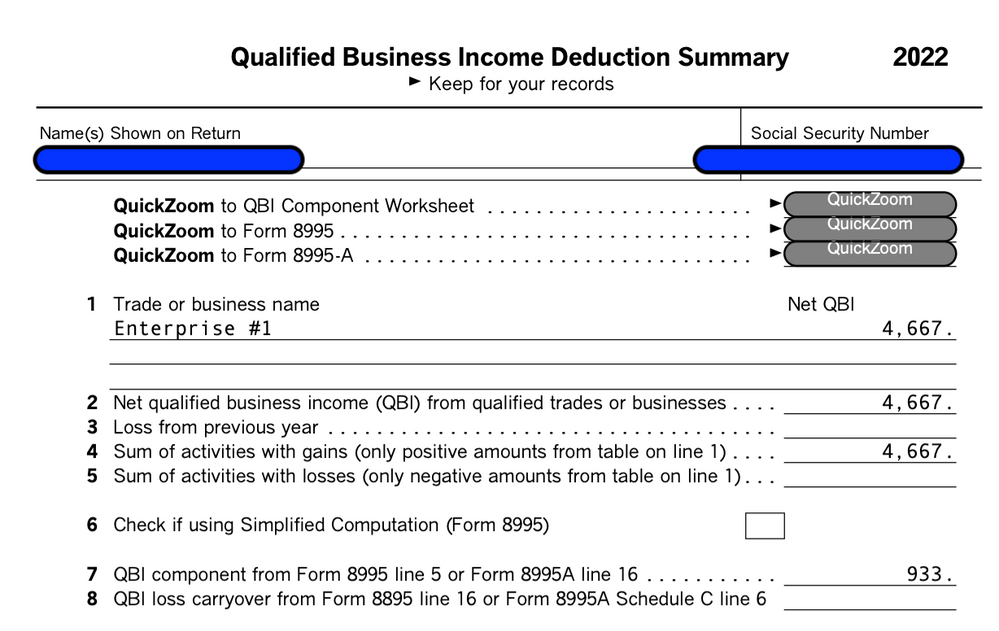

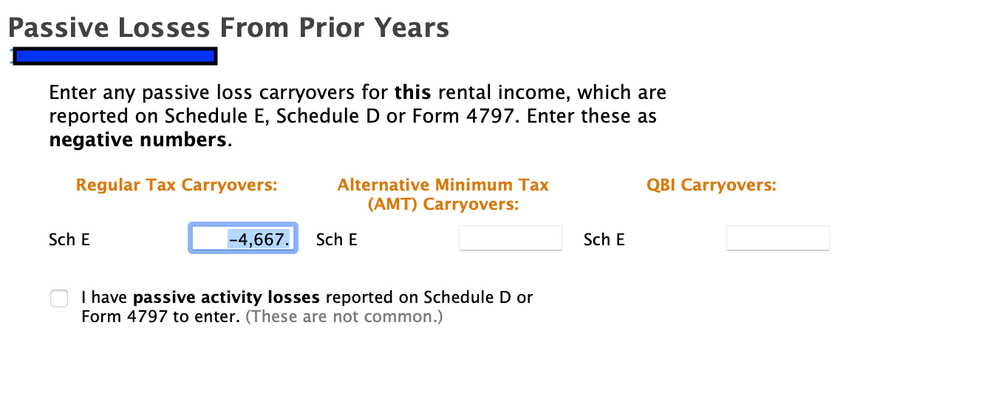

Please see from picture 1, that I've entered the previous year loss carryover for a rental property -$4667. the software asks me to input it as a negative number.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

rental property QBI deduction confusion on 2022 version

It's likely the $4,667 is your net income from your rental for 2022 and you answered the questions after the entry of your rental activities that it qualified as QBI. The first screenshot is showing where you applied your passive activity losses from prior years and should reflect the whole amount carried over, not just the amount to apply to this year. Also, ensure you don't have any QBI carryovers to enter in the last column on the right of your first screenshot.

If your rental does not qualify for QBI, you can re-visit the questions by following these steps in TurboTax Desktop:

- Within your tax return, under Federal Taxes and Wages & Income click I'll choose what I work on

- Scroll down to Rental Properties and Royalties and click Update

- On the Rental and Royalty Summary screen click Edit for the property that is reporting QBI

- Verify your entries and Continue until you get to the Let's see if you're eligible for the QBI safe harbor screen

- Verify your entries and if you do qualify then you are eligible for the QBI deduction even if you have offset your passive activity income with carryover losses

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

thejeepdriver

Level 2

yj0

Level 2

in Investing

j0ntaxID00

Level 2

in Investing

drewgen

Returning Member

in Investing

billcrider

Returning Member

in Investing