- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

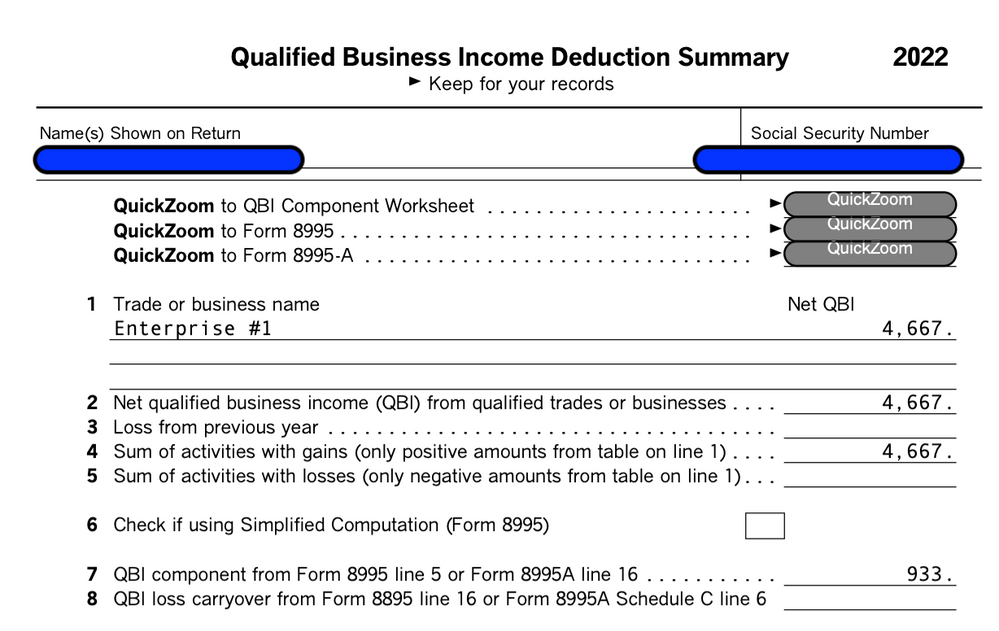

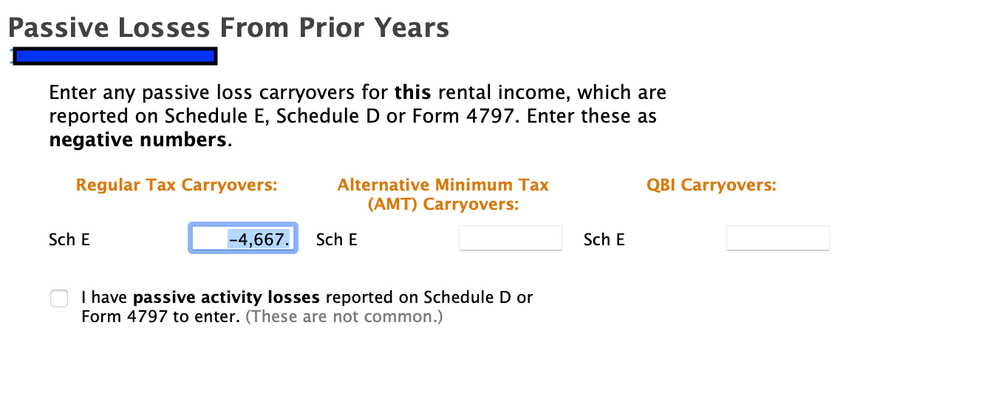

rental property QBI deduction confusion on 2022 version

Please see from picture 1, that I've entered the previous year loss carryover for a rental property -$4667. the software asks me to input it as a negative number.

March 21, 2023

8:18 PM