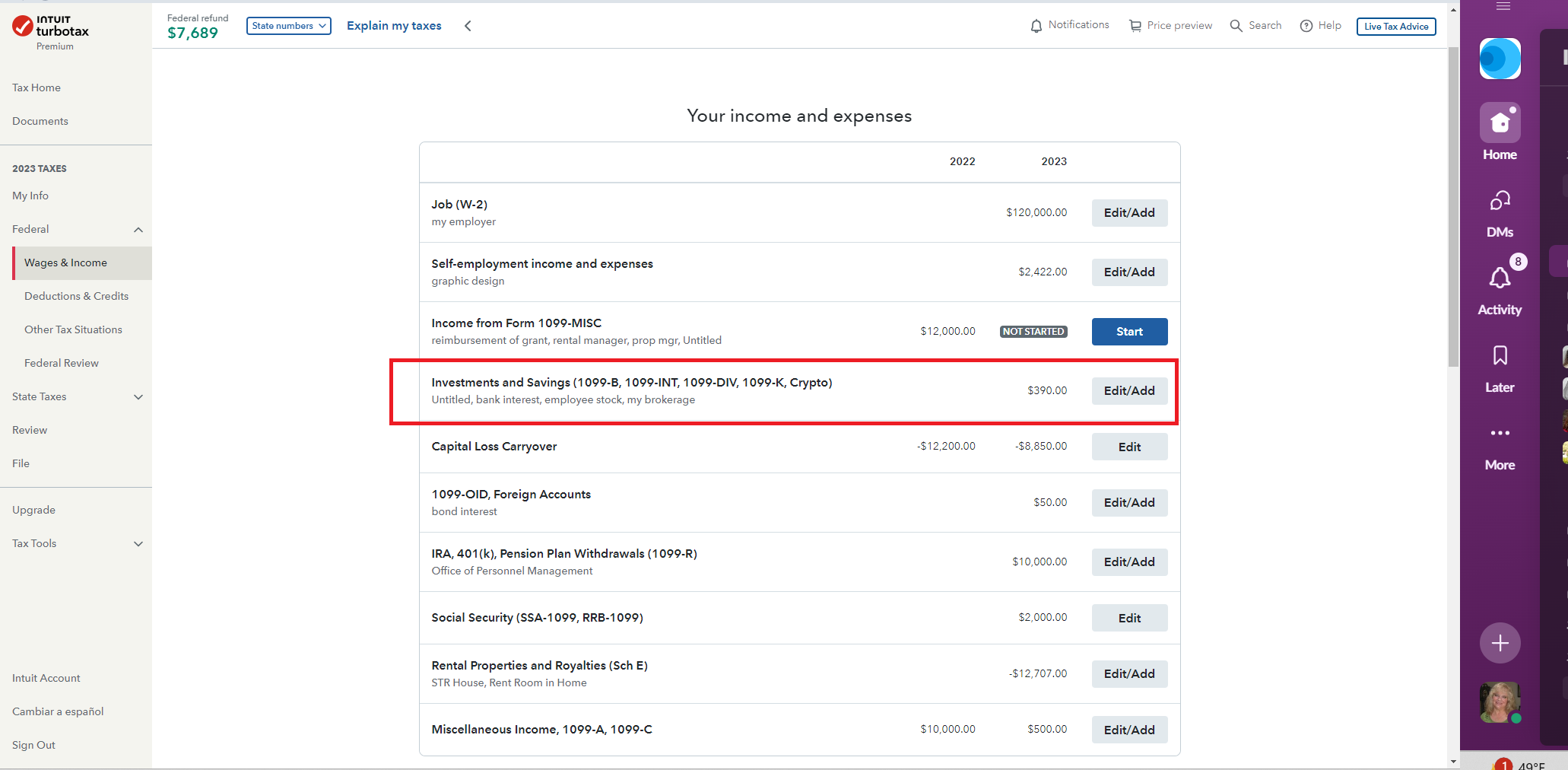

It sounds like he entered Summary Totals for 1099-Div, 1099-Int and 1099-B transactions.

In the Wages & Income heading, these are three separate topics where totals can be entered.

Your dad, being a CPA, I would think would favor using TurboTax Desktop, where you can View/Edit/Make Entries directly on the forms in FORMS mode, as well as use the step-by-step interview.

Using his 1099 comprehensive form, here's:

How to Enter 1099-INT

How to Enter 1099-DIV

How to Enter 1099-B

TurboTax prepares Form 8949 for you based on your entries.

If you're currently in TurboTax Online and want to switch to TurboTax Desktop, here's How to Transfer from TurboTax Online to TurboTax Desktop, Some of the graphics have changed a bit this year which may be a bit confusing.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"