in Investing

- Community

- Topics

- Community

- :

- Discussions

- :

- Investing

- :

- Investing

- :

- 1099 Comprehensive form?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 Comprehensive form?

I am a long term customer of turbo tax. My dad is a retired cpa but he was never savvy with computers. That being said he knows what he want to do but even I am unable to help him get to input information. The comprehensive form has 1099 b, div and misc. He wants to enter the info related to short term gain proceeds or long terms losses located on the bottom. I have searched all over to manually input these numbers for 8949 or a connection to Schedule D. He says he was able to do this last year. Anyone know why?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099 Comprehensive form?

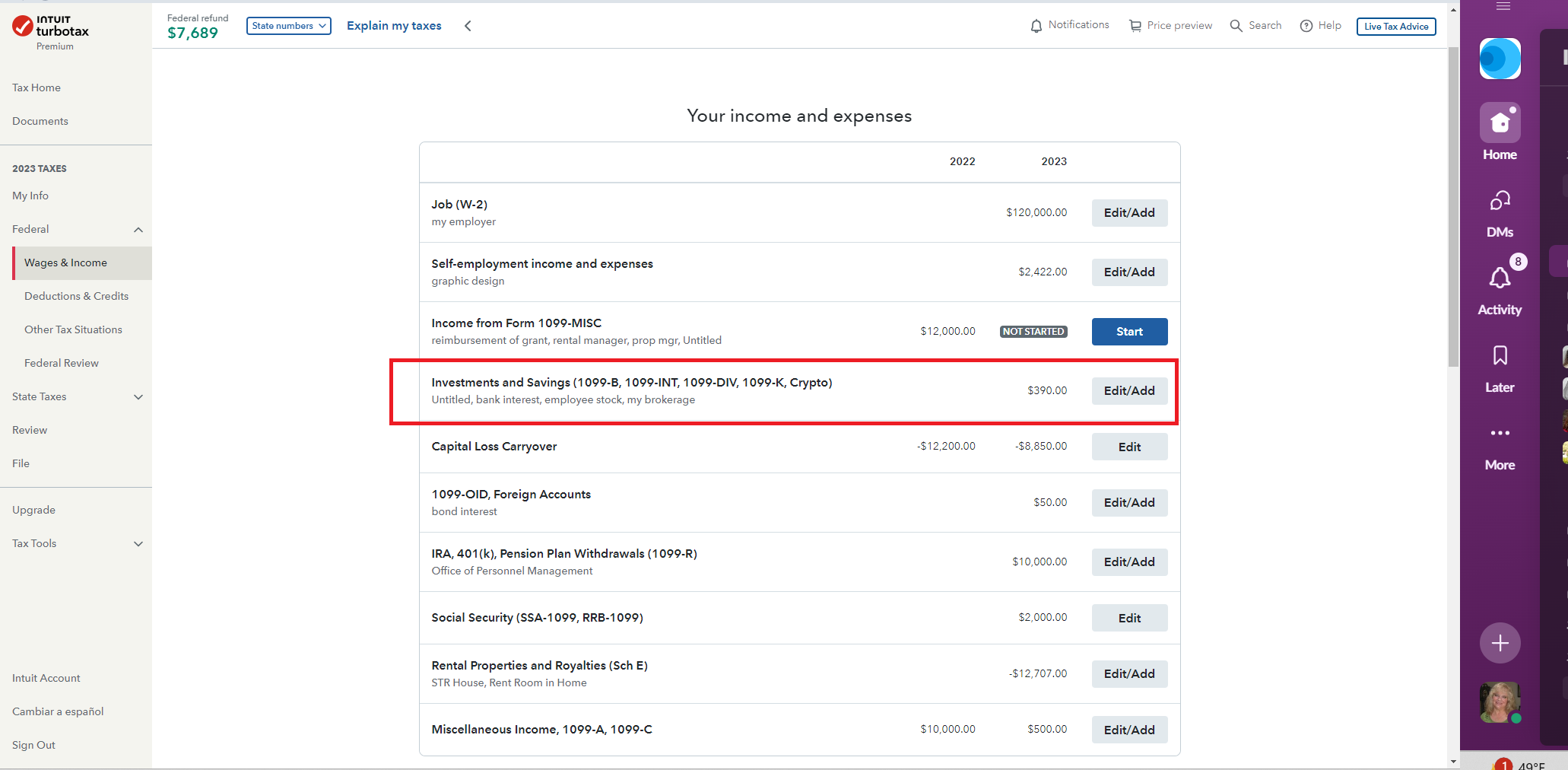

It sounds like he entered Summary Totals for 1099-Div, 1099-Int and 1099-B transactions.

In the Wages & Income heading, these are three separate topics where totals can be entered.

Your dad, being a CPA, I would think would favor using TurboTax Desktop, where you can View/Edit/Make Entries directly on the forms in FORMS mode, as well as use the step-by-step interview.

Using his 1099 comprehensive form, here's:

TurboTax prepares Form 8949 for you based on your entries.

If you're currently in TurboTax Online and want to switch to TurboTax Desktop, here's How to Transfer from TurboTax Online to TurboTax Desktop, Some of the graphics have changed a bit this year which may be a bit confusing.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

b_g_bou

New Member

user17548719818

Level 2

in Investing

cowboyjeff

Returning Member

in Investing

DixieB

New Member

in Investing

juham2013

Level 3

in Investing