- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Groups

- :

- Self employed

- :

- Placement of income (1099)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Placement of income (1099)

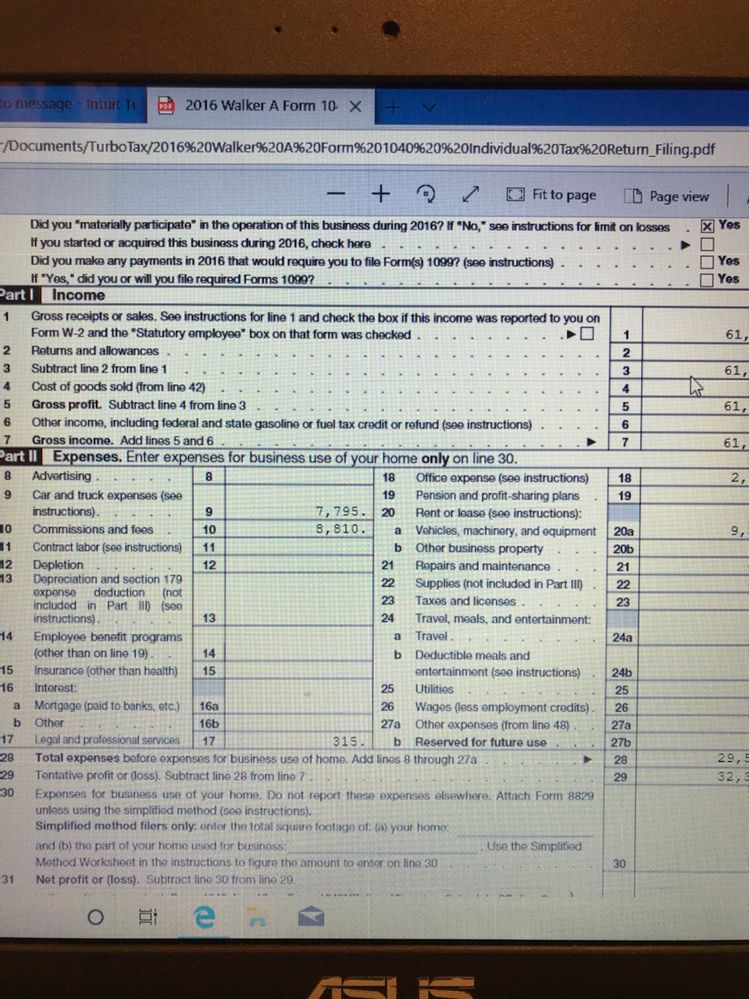

Ok guys only taxable income I have is a 1099 (s), I have zero tax because of the deductions. But if I just put the 1099's in business income I get a 4500 self employment tax. Up until now I always put everything in personal income. Is that the correct way cause I grossed 61k and had write offs of 50k but it says I owe 4500 cause of S.E.T. (Uber driver)

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Placement of income (1099)

Yes you have to report that as self employment income. Did you enter all your expenses? If you reported it as personal income before that was very wrong. What 1040 lines was it on in 2017 and before? Did you fill out a schedule C?

Something sounds wrong if you had a Net Profit of 11,000. The self employment tax should be about $1,500 in addition to the regular income tax on it.

Self Employment tax (Scheduled SE) is automatically generated if a person has $400 or more of net profit from self-employment on schedule C. You pay 15.3% SE tax on 92.35% of your Net Profit greater than $400. The 15.3% self employed SE Tax is to pay both the employer part and employee part of Social Security and Medicare. So you get social security credit for it when you retire. You do get to take off the 50% ER portion of the SE tax as an adjustment on 1040 Schedule 1 line 27. The SE tax is already included in your tax due or reduced your refund. It is on the 1040 Schedule 4 line 57 which goes to 1040 line 14. The SE tax is in addition to your regular income tax on the net profit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Placement of income (1099)

Thx for the reply, yes that's what I thought been looking at it for a couple hours trying to figure out why. I made 61k gross, I had over 50k in E. I was 0 b4 that. I need to look at my H& R I think they did it the wrong way but got away with it. I am going to have too waste my time with a adduct

any money back off the table.t

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Placement of income (1099)

What is your Net Profit on Schedule C?

Some expenses, such as home office or section 179 depreciation can only be used to reduce your schedule C taxable income to zero, and not to create a loss. Excess deductions for these carry over to the next year. And you have to answer yes to both questions about exclusive and regular use, not just one. The area of your home office must be used regularly and exclusively for business to deduct it.

Or you checked the box on 32b saying Some Investment is Not at Risk.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Placement of income (1099)

sorry do not know what happened to the middle of the message. I had to buy a laptop to process the info and it must be moving slow. Again I had 50k in deductions, they only gave me credit for 40k cause that made it 0. So they deducted 10k and it put me at 30k then added taxable self employment tax of like 4500. If it was 1500 I could of got some credits to kill it. Something has to be wrong cause at 11k profit I made no money and to pay them 45% of that is horrible.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Placement of income (1099)

Yes Mam I have plenty of deductions it is all about is there a way to reduce the SE tax, its all zero up till that line then it goes bad.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Placement of income (1099)

How much is the profit on schedule C line 31 (which goes to 1040 schedule 1 line 12 for 2018, (don't know line #s for 2019). I can't follow what you said. Didn't all your expenses show up on schedule C? Which ones weren't qualified?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Placement of income (1099)

Yes Mam and this is a 2016 amend not a 2018, I think the income was like 32k on C.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Placement of income (1099)

Even if your Net Profit was 21,000 (61,000-40,000) the SE Tax would only be about $3,000. But if you owe more than 1,000 total tax you probably have a underpayment penalty. So how much is on every line?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Placement of income (1099)

Yep, the SE tax on 32,000 is 4,500. What expenses are missing on schedule C? Why are you amending?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Placement of income (1099)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Placement of income (1099)

Right. What's missing? Where are they?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Placement of income (1099)

I have not eaten today lets rest it for today and I am going to try and move some things tomorrow and I will get back to U thx for helping me figure some of this out 2019 is going to be a pain I can already see.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Placement of income (1099)

Ok, good luck. Get some rest and look at it with fresh eyes.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

DLK59

Returning Member

jontriesault

New Member

mkmuscat

New Member

wjschriver

New Member

griffin35

New Member