- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How to handle large number of crypto transactions in turbotax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to handle large number of crypto transactions in turbotax

Hello,

I have always used turbo tax and appreciate the ease with which it connects to my coinbase account. However, this year turbotax seems to want me to examine each of over one hundred crypto transactions and mark them as taxable or perform some other evaluation. These are all from an unstaking of ETH2 that occurred in 2023. How do I handle all these transactions? I examine an individual one and I still don't understand how to make it so it does not still need to be reviewed. This is very confusing. Any help would be appreciated.

Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to handle large number of crypto transactions in turbotax

For more details: each transaction is the staking reward for ETH2 and they are very small amounts, like $0.02. Some are purchases of between $10 and $20. They all show zero realized gain, so I'm not sure if they will even be taxed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to handle large number of crypto transactions in turbotax

Yes, without knowing the specifics that are asked for in each transaction, please refer to this guide published by Turbo Tax for further clarification with this issue. There is a lot of information in this guide that I can't print in this thread due to limited space. If you have any specific questions after reviewing the guide, reach out to us.

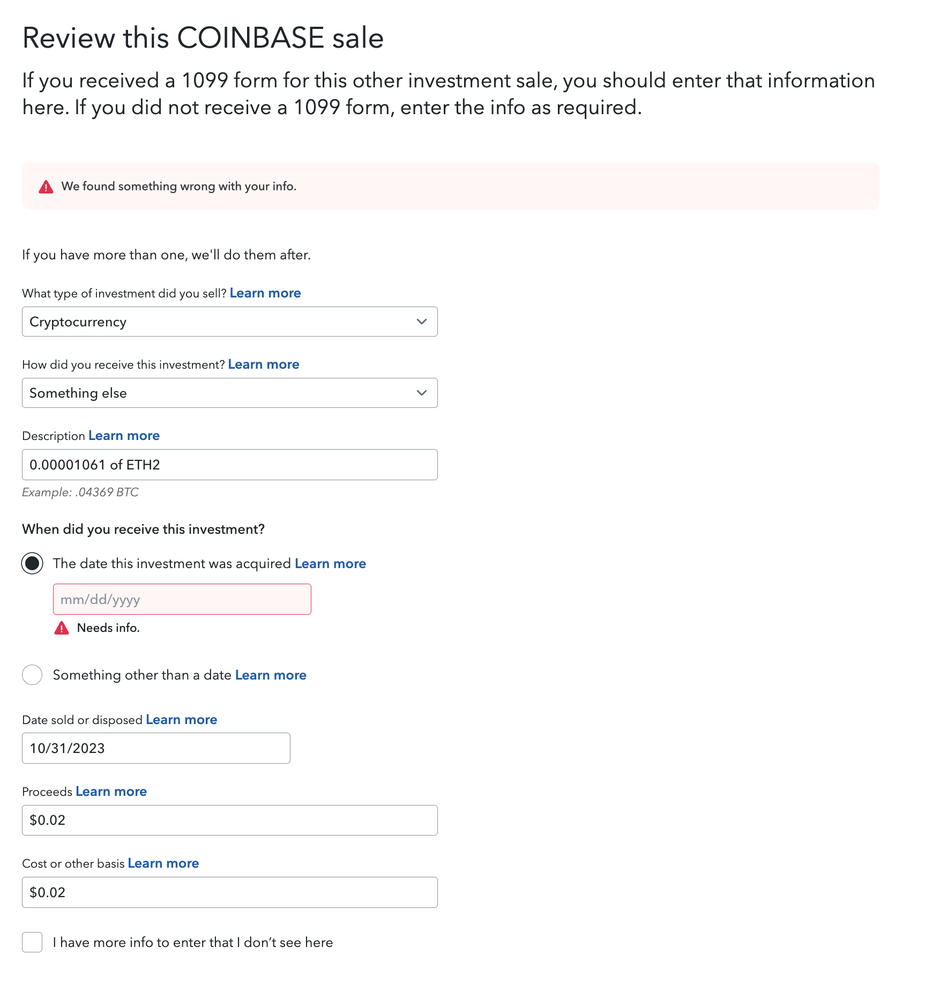

Usually reviews occur because there is missing information in the transaction. Review these first to see if the transaction is missing any of these elements. Check these thoroughly and make sure all of the information is contained within each transaction.

- Cost basis

- Date acquired

- Description

- Proceeds

- Date sold

If there are no missing information, see if you can move on. In the program, after you review the transactions, there are checkmarks that appear as ( "x's)

Also, for the amounts that are small, combine those transactions instead of leaving them as separate line items. This may simplify the reporting.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to handle large number of crypto transactions in turbotax

It appears that the information missing on these transactions is the date the investment was acquired. These were all downloaded directly from coinbase. Since there are so many, and many of the same amount, it is impossible to know which one was acquired on which date.

Also, many of the staking rewards end up with a zero cost basis and turbotax doesn't seem to like that. I have to verify each one individually.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to handle large number of crypto transactions in turbotax

Here is what I see for over a hundred transactions. Why is the date missing? Shouldn't coinbase provide this information in the download? And for staking rewards, is the "Something Else" correct for the question "how did you receive the investment"?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to handle large number of crypto transactions in turbotax

Is Bulk Edit available to you? Click on the box to the left of the transaction and Bulk Edit is invoked. Then click on as many entries as you like to Edit in bulk.

Also the strange icon to the right of the Search box allows you to sort transactions in a variety of ways and speed up the Edit process.

What version of TurboTax are you using? This example is from TurboTax Online Premium.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to handle large number of crypto transactions in turbotax

Looks like the transfer from coinbase was the problem. I downloaded the gain/loss CSV file and after deleting the transferred transactions, I uploaded the CSV file and that had only one transaction that needed reviewing. I would let coinbase know that sometimes their direct transfer leaves out some information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to handle large number of crypto transactions in turbotax

For staking rewards, "Something else" should be an appropriate response to "How did you receive the investment" if that clears the Review message.

You would think that the date that the investment was created would be information that would be readily available.

[Edited 03/28/24 | 12:35 pm PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

ldane123

New Member

Edge913

New Member

7606366520

New Member

Darnil

Level 1

Racheld1

New Member