- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- Re: I paid way more in tuition than what shows on the 1098T.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I paid way more in tuition than what shows on the 1098T.

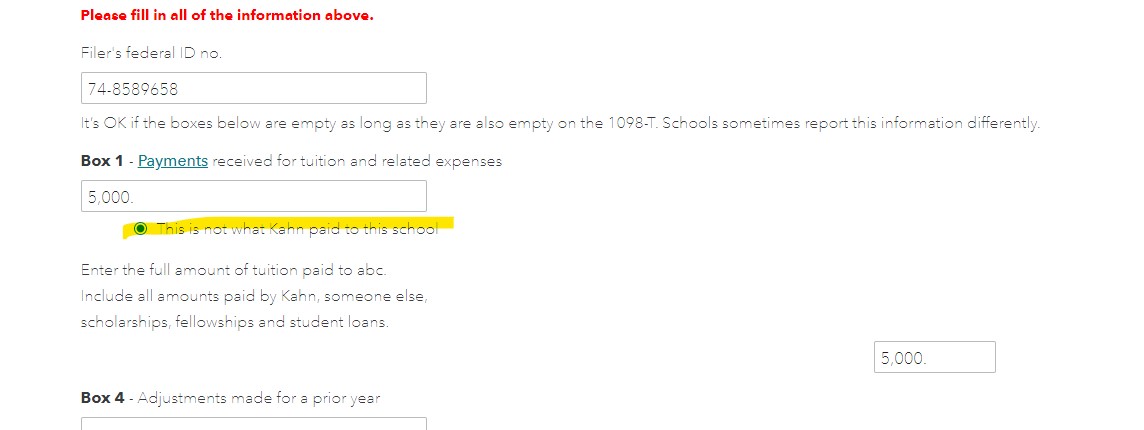

You school might have reported your information incorrectly on the Form 1098-T. You should report the actual amount of tuition you paid in 2020. In the program, you are allowed to make an adjustment in box 2. It is important to enter the actual amount of tuition expenses you paid. The program will base on this number to calculate your education tax break correctly on either a Form 8863 or Form 8917. Here are the steps to make adjustment on the Form 1098-T:

In TurboTax online,

- Sign in to your account, select Pick up where you left off

- At the right upper corner, in the search box, type in "1098t" and Enter

- Select Jump to 1098t

- Follow prompts

- On the screen, under box 1, check the box This is not what," Student' Name paid to school"

- Enter the actual amount you paid

- See image

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I paid way more in tuition than what shows on the 1098T.

Well I’m afraid I don’t have the right information from the school then. It changes my refund by 1200 if I use the higher amount. I don’t want to get stuck with having to pay back 1$1200 because I overstated it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I paid way more in tuition than what shows on the 1098T.

Thank you. I know how to change the amount in turbo. I’m just not positive about the number I am getting from a downloaded statement. It had a bunch of remarks next to each line item. I will try to attach it later.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I paid way more in tuition than what shows on the 1098T.

I am a little confused with the language used in this form and the IRS documentation.

The 1098-T I received from the institution shows $0.0 on Box 1 and $1500 on Box 5 for a scholarshipt. The total tuition for this course was 3200 from which I only paid $1700 (e.g. the tuition minus scholarship total)

So when checking the box This is not what," Student' Name paid to school"

what is the amount I should enter? $3200 or $1700.

The text below the box says to include the full amount paid to the institution and include all amounts paid by student, someone else, scholarships, fellowships or loans..

So it seems to me the amount should be $3200, but then I am not 100% sure. Does Turbo Tax take car of subtracting Box 5?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I paid way more in tuition than what shows on the 1098T.

Enter $3200. Turbo Tax takes care of subtracting Box 5.

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

MukeshJain

New Member

dsw_s

New Member

in Education

robinsonmd109

New Member

in Education

roccolom

New Member

in Education

Benjakowski

New Member

in Education