- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- North Carolina Qualified Education Loan Payments Paid by Employer

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

North Carolina Qualified Education Loan Payments Paid by Employer

Hello,

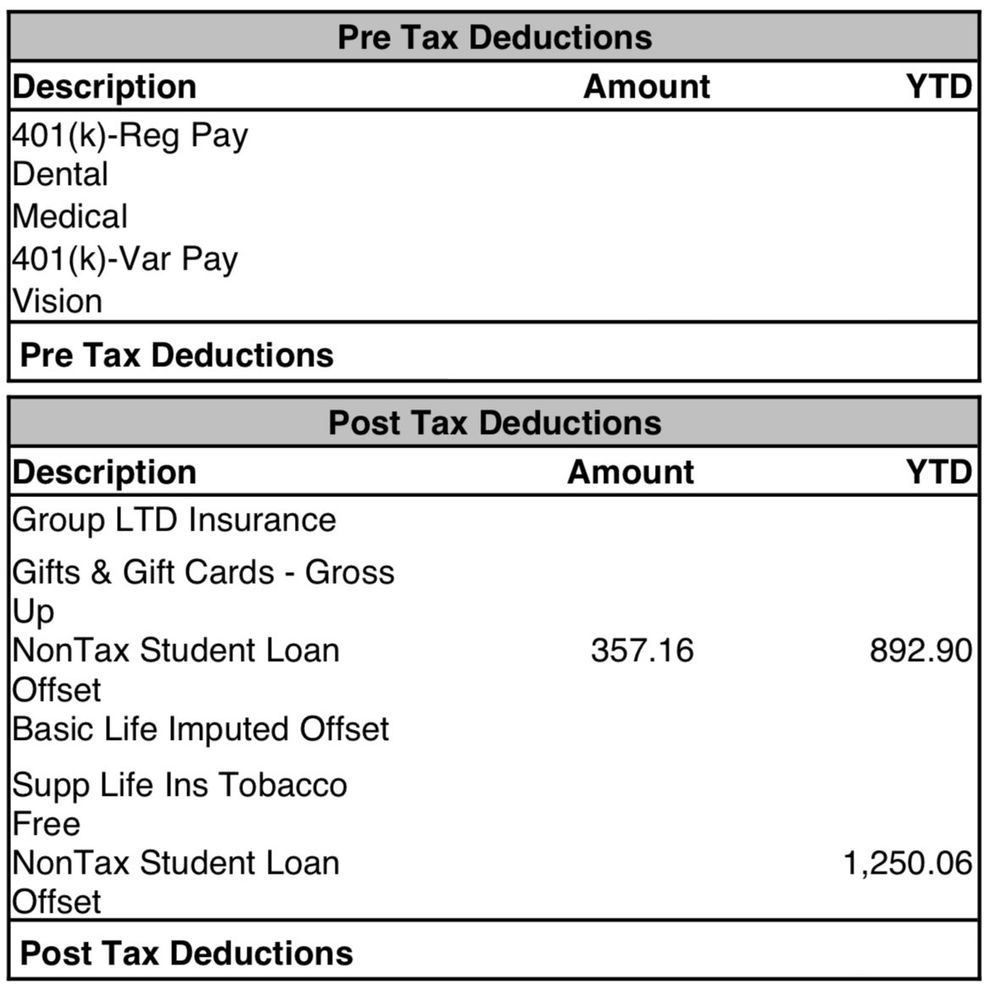

I am trying to file my North Carolina state taxes and getting confused on the section for “qualified education loan payments paid by employer”. My employer pays $178.58 towards my student loans each month. This amount wasn’t reported on my W-2 in box 14. When I pull up my individual paystubs, however, I can see post-tax deductions, one of which is “non-tax student loan offset”. Do I enter that YTD amount on my tax return?

Thanks in advance!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

North Carolina Qualified Education Loan Payments Paid by Employer

The student loan payments are marked post tax which would mean they came out after taxes. This implies all of your income is in the w2 but HR said student loans are not.

I wonder if there is a better way to ask the question or if payroll would have a better answer.

If the student loans really are part of the w2 wages, then the student loan was taxed and doesn't need to be added. Otherwise, yes, you should add the income.

If $45, tax on the income, is not worth the hassle of calling payroll and trying to make it reasonable, add it to your income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

North Carolina Qualified Education Loan Payments Paid by Employer

"Post-Tax" means "After Tax" .

I think you mean "Pre-Tax" if the amount of the loan payments are not included in Box 1 of your W-2.

Yes, you would add those payments as income for your North Carolina state return, HOWEVER check box 16 on your W-2 to see if your employer added the loan payments they made to your NC state income. If they added the amount there, you would not need to enter an addition.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

North Carolina Qualified Education Loan Payments Paid by Employer

@KrisD15, thank you for the reply! The “non-tax student loan offset” does show up under “post-tax deductions”. Here is a snip of my paystub:

I believe that there are two separate “non-tax student loan offset” amounts because I moved states in 2023. The $892.90 would be the amount paid while I’ve been in North Carolina.

In box 16 of my W-2, I see the total wages for North Carolina, but I don’t know how to determine if the amount includes the student loan payments made by my employer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

North Carolina Qualified Education Loan Payments Paid by Employer

Actually, I just called my HR department and they confirmed that the student loan payments are NOT included anywhere on my W-2, so I assume that I need to include the $892.90 amount (for North Carolina) on the state tax filing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

North Carolina Qualified Education Loan Payments Paid by Employer

The student loan payments are marked post tax which would mean they came out after taxes. This implies all of your income is in the w2 but HR said student loans are not.

I wonder if there is a better way to ask the question or if payroll would have a better answer.

If the student loans really are part of the w2 wages, then the student loan was taxed and doesn't need to be added. Otherwise, yes, you should add the income.

If $45, tax on the income, is not worth the hassle of calling payroll and trying to make it reasonable, add it to your income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

TomG6

New Member

ualdriver

Level 3

larockmanhere

Returning Member

AggieJen

Level 3

adrian_moore100

New Member