- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- financial aid as income

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

financial aid as income

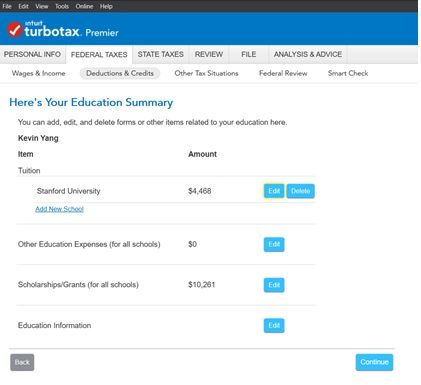

2019 was my son last year’s college. He took 0 class at last quarter since he finished all the requested credits. However, university still paid the financial aid for that quarter and I only paid room and board fee. I paid $5302.74. In 1098-T, table 1 shows $4468.26 and table 5 shows $10261.26.

I have two questions:

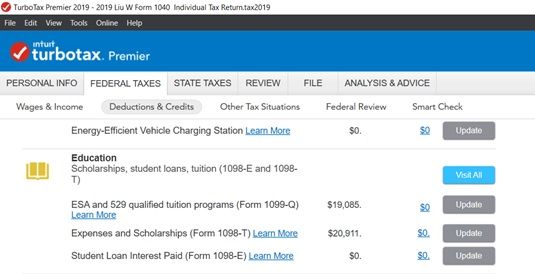

- Why I got $0 in item of Expenses and Scholarship (see below screen print) after I put the 1098-T into Turbo tax?

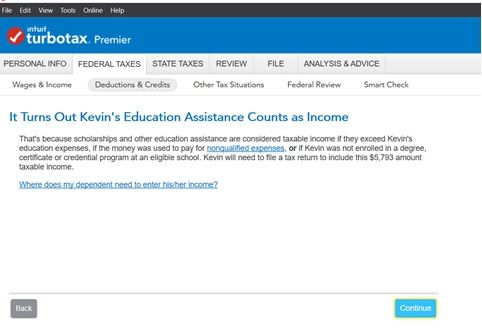

- I have used Turbo tax for several years and never paid income tax for financial aid. However this year, I got this information that my son has to include $5793 in his return as taxable income (see below screen print). This amount is just the financial aid from table 5 minus table 1 in 1098-T.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

financial aid as income

Simple answer: TurboTax (TT) has it correct, you son has (at least) $5793 of taxable scholarship income to report. Yes, the taxable amount is, usually, simply the box 5 amount (on the 1098-T) minus the box 1 amount.

You get 0 qualified expenses, for the tuition credit, because you paid 0 (room and board are not qualified expenses, except for a 529 plan distribution).

But, there is a tax “loophole” available. The student reports all his scholarship, up to the amount needed to claim the American opportunity credit, as income on his return. That way, the parents (or himself, if he is not a dependent) can claim the tuition credit on their return. They can do this because that much tuition was no longer paid by "tax free" scholarship. You cannot do this if the school’s billing statement specifically shows the scholarships being applied to tuition or if the conditions of the grant are that it be used to pay for qualified expenses.

Using an example: Student has $10,261 in box 5 of the 1098-T and $4468 in box 1. At first glance he/she has $5793 of taxable income and nobody can claim the American opportunity credit. But if he reports $9793 as income on his return, the parents can claim $4000 of qualified expenses on their return*.

You have another issue: "He took 0 class at last quarter since he finished all the requested credits". To qualify for the more generous American Opportunity Credit (AOC), you student must have been considered half time or more. You are good, on this point, if box 8 on the 1098-T is checked.

Another possible issue: you may have already claimed the AOC the maximum 4 times, and will be limited to the lesser credit or deduction. To claim the most Lifetime Learning Credit, you should increase his taxable scholarship by $4468, rather than $4000. The Tuition and Fees deduction has a $2000 or $4000 cap, depending on your AGI.

_____________________________________________________________________________

*You essentially have to use a work around in TurboTax (TT). Here's how I would do it. Enter the 1098-T, on your return, but only enter $4000 in box 1. No other numbers. You only enter the 1098-T to get TurboTax to check the proper box on form 8863. Lying to TurboTax to get it to do what you want does not constitute lying to the IRS.

Enter the 1098-T, exactly as received, on the student's return. In his interview, you should eventually reach a screen called "Amount used to calculate education deduction or credit" Be sure the amount in that box is $4000. That will put all his excess scholarship as income on his return.

Be advised some people are saying they're not getting the "Amount used to claim the tuition deduction or credit" screen on the dependent’s . The alternate workaround is to enter $4000 less than the actual box 1 amount, when you enter the 1098-T on the student's return or $4000 more in the box 5 amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

financial aid as income

Thank you Hal_Al so much for the detail explanation.

- I can’t do the “loophole” since the financial aid was paid for tuition only.

- The box 8 on the 1098-T is checked.

- We claimed AOC three times before, this is fourth time.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

hope3355

New Member

Jnessa

New Member

AUChE

Level 1

alu2008

Level 2

4dda030c7daf

New Member