- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- American Opportunity Credit. TT claims my daughter not qualified because she already claimed for 4 years, but it is only her 3rd year of college. How do I resolve this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

American Opportunity Credit. TT claims my daughter not qualified because she already claimed for 4 years, but it is only her 3rd year of college. How do I resolve this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

American Opportunity Credit. TT claims my daughter not qualified because she already claimed for 4 years, but it is only her 3rd year of college. How do I resolve this?

"Hope Credit" refers to the credit that existed prior to the American Opportunity Tax Credit. Starting with tax year 2009, the Hope credit was supplanted by the more generous American Opportunity Tax Credit. If your student didn't receive the Hope Credit, then there should be no entry showing it was received for 2 years.

Check your prior year returns to confirm how many years the AOTC has been claimed. If you started claiming the credit for the year in which the student started in the fall, and there was any interruption in full-time study, it's possible for part of the third year of study to be in the fifth calendar year and for the credit to have been claimed in four prior years.

An eligible student for the AOTC is a student who:

- Was enrolled at least half-time in a program leading toward a degree, certificate or other recognized educational credential for at least one academic period during the tax year,

- Has not completed the first four years of post-secondary (education after high school) at the beginning of the tax year,

- Has not claimed (or someone else has not claimed) the AOTC for the student for more than four years, and

- Was not convicted of a federal or state felony drug offense at the end of the tax year.

If you received distributions from a 529 plan, see this thread for a discussion and explanation of how this could have affected your AOC.

For tax year 2022, the credit begins to phase out for:

- Single taxpayers who have adjusted gross income between $80,000 and $90,000.

- Joint tax filers when adjusted gross income is between $160,000 and $180,000.

- The credit is unavailable to taxpayers whose adjusted gross income exceeds the $90,000 and $180,000 thresholds.

You can also preview your return before filing to find out how your taxes were calculated. See here for details

See here and here for more information from the IRS on this topic.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

American Opportunity Credit. TT claims my daughter not qualified because she already claimed for 4 years, but it is only her 3rd year of college. How do I resolve this?

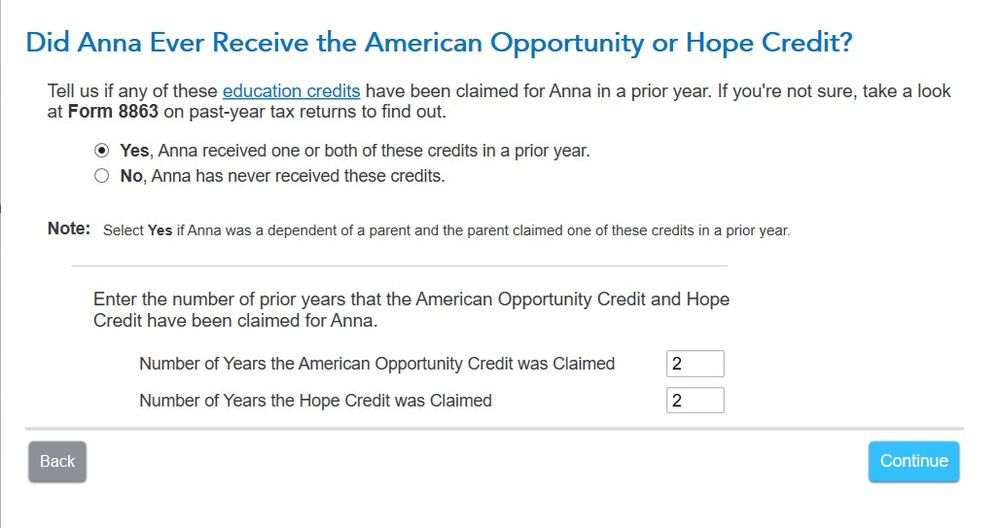

You may have mistakenly stated she claimed this for 4 years prior. Check this screen in the interview to see if you may have marked this a yes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

American Opportunity Credit. TT claims my daughter not qualified because she already claimed for 4 years, but it is only her 3rd year of college. How do I resolve this?

It was already "No". Only other possibility is this question, if it adds the two items together.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

American Opportunity Credit. TT claims my daughter not qualified because she already claimed for 4 years, but it is only her 3rd year of college. How do I resolve this?

This may be it, but this begs a new question. Does the question of receiving "Hope Credit" imply a tax credit, or Hope scholarship money towards tuition?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

American Opportunity Credit. TT claims my daughter not qualified because she already claimed for 4 years, but it is only her 3rd year of college. How do I resolve this?

"Hope Credit" refers to the credit that existed prior to the American Opportunity Tax Credit. Starting with tax year 2009, the Hope credit was supplanted by the more generous American Opportunity Tax Credit. If your student didn't receive the Hope Credit, then there should be no entry showing it was received for 2 years.

Check your prior year returns to confirm how many years the AOTC has been claimed. If you started claiming the credit for the year in which the student started in the fall, and there was any interruption in full-time study, it's possible for part of the third year of study to be in the fifth calendar year and for the credit to have been claimed in four prior years.

An eligible student for the AOTC is a student who:

- Was enrolled at least half-time in a program leading toward a degree, certificate or other recognized educational credential for at least one academic period during the tax year,

- Has not completed the first four years of post-secondary (education after high school) at the beginning of the tax year,

- Has not claimed (or someone else has not claimed) the AOTC for the student for more than four years, and

- Was not convicted of a federal or state felony drug offense at the end of the tax year.

If you received distributions from a 529 plan, see this thread for a discussion and explanation of how this could have affected your AOC.

For tax year 2022, the credit begins to phase out for:

- Single taxpayers who have adjusted gross income between $80,000 and $90,000.

- Joint tax filers when adjusted gross income is between $160,000 and $180,000.

- The credit is unavailable to taxpayers whose adjusted gross income exceeds the $90,000 and $180,000 thresholds.

You can also preview your return before filing to find out how your taxes were calculated. See here for details

See here and here for more information from the IRS on this topic.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

larockmanhere

Returning Member

siremonger

Level 1

jbatting

New Member

melissaproffitt

New Member

joshuaB

New Member