- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Where do I enter a residential real estate depreciation schedule of 27.5 years on Schedule C? The income from my rentals is treated as "active" not "passive"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter a residential real estate depreciation schedule of 27.5 years on Schedule C? The income from my rentals is treated as "active" not "passive"

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter a residential real estate depreciation schedule of 27.5 years on Schedule C? The income from my rentals is treated as "active" not "passive"

Residential rental real estate is reported on Schedule C if you are a real estate dealer or provide "substantial services" to your renters. Otherwise, residential real estate is reported on Schedule E, whether passive or nonpassive ("active" is a lay term and doesn't exist otherwise, except for "active participation").

On Schedule C, you will find only nonresidential real estate in the Asset/Depreciation section of TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter a residential real estate depreciation schedule of 27.5 years on Schedule C? The income from my rentals is treated as "active" not "passive"

Typically, long term residential rental real estate is reported on SCH E. It would only be reported on SCH C if it met the requirements to qualify as an "active trade or business", which is not at all common for long term residential rental real estate. It's not impossible; but it's not common.

If it does qualify as an active trade or business (doubtful, but not impossible) and you report it on SCH C, then it gets depreciated over 39 years; not 27.5 years.

If this is the only rental property you own, I have doubts that it qualifies as your active trade or business.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter a residential real estate depreciation schedule of 27.5 years on Schedule C? The income from my rentals is treated as "active" not "passive"

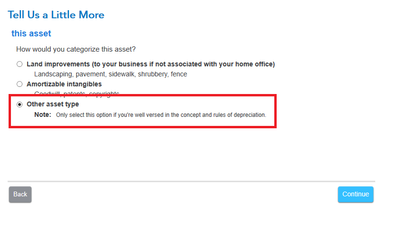

If you began entering your rental property information as Self-Employment Income in TurboTax, you will not see an option to describe your asset as Residential Real Estate. You will see, as you did, the property asset as Non-Residential Real Estate with a depreciation of 39 years.

Enter your residential rental property in Rentals, Royalties, and Farm section which is under Wages & Income. After you enter the basic information about your rental property, you will see the option to select Residential Rental Property, and in the Asset Summary screen, you will see the depreciation timetable as 27-1/2 years.

@dhuber24

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter a residential real estate depreciation schedule of 27.5 years on Schedule C? The income from my rentals is treated as "active" not "passive"

I do meet the test for material participation, and I have two rental properties, both of which have average rental days of less than 7 days. What I'm reading is that the IRS considers rental properties with average rental days less than 30 days, are no longer considered "dwelling" units, rather they are now classified as "transient" unit and need to be depreciated over 39 years as commercial property. This just doesn't make sense to me.. its not a commercial property.. but am I SOL and this is just the way it is?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter a residential real estate depreciation schedule of 27.5 years on Schedule C? The income from my rentals is treated as "active" not "passive"

I will page @AmeliesUncle as I believe he can explain this better than I.

Basically, however, the "rule" is for the purposes of Section 469 only and, in fact, a temporary regulation on this expired a long time ago.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter a residential real estate depreciation schedule of 27.5 years on Schedule C? The income from my rentals is treated as "active" not "passive"

Yes, a "transient" property would be depreciated over 39 years. That is dictated by Tax Code Section 168(e)(2).

However, are you providing "services", such as maid service or meals to the tenants? If not, it still belongs on Schedule E as a rental, and would not belong on Schedule C (but it would still be 39 years, even on Schedule E).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter a residential real estate depreciation schedule of 27.5 years on Schedule C? The income from my rentals is treated as "active" not "passive"

Substantial services include cleaning in-between rentals, changing linens, etc. According to the IRS, income filed on Schedule C.

Schedule C (Form 1040), Profit or Loss From Business Generally, Schedule C is used when you provide substantial services in conjunction with the property or the rental is part of a trade or business as a real estate dealer. Providing substantial services. If you provide substantial services that are primarily for your tenant's convenience, such as regular cleaning, changing linen, or maid service, you report your rental income and expenses on Schedule C.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter a residential real estate depreciation schedule of 27.5 years on Schedule C? The income from my rentals is treated as "active" not "passive"

You would need to use the desktop version of TurboTax to change your commerical property to residential. Using the Forms menu option, you can pull up the Asset Entry worksheet and on line 5 of that worksheet you can chose the code I Residential rental real estate option.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter a residential real estate depreciation schedule of 27.5 years on Schedule C? The income from my rentals is treated as "active" not "passive"

You would need to use the desktop version of TurboTax to change your commerical property to residential. Using the Forms menu option, you can pull up the Asset Entry worksheet and on line 5 of that worksheet you can chose the code I Residential rental real estate option.

If 2022 was not the fist year the property was placed in service, that will definitely screw up depreciation. Otherwise, you're fine.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter a residential real estate depreciation schedule of 27.5 years on Schedule C? The income from my rentals is treated as "active" not "passive"

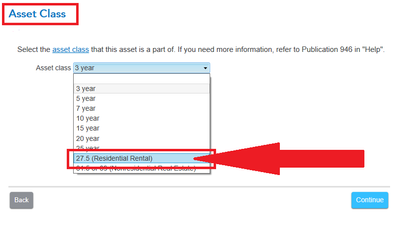

You can actually accomplish this (select 27.5 year) from within the interview (Step-by-Step) if you select Other asset type and then choose 27.5 (Residential Rental) from the dropdown, @dhuber24

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

jasonmark1993

New Member

user483784620

New Member

m-j-lapsley

New Member

ccacioppo

Level 1

Irasaco

Level 2