- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Vehicle expenses entered then computed by TurboTax not carrying to Schedule C?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Vehicle expenses entered then computed by TurboTax not carrying to Schedule C?

Hello-

I'm doing my son's tax return who is a DoorDash driver. I entered his 1099-NEC information into TurboTax no problem, which generates a Schedule C. I then went to the "Deductions & Credits" section, Employment Expenses section, Job Related Expenses of TurboTax to calculate his job related vehicle expenses, which TurboTax calculated as $815.

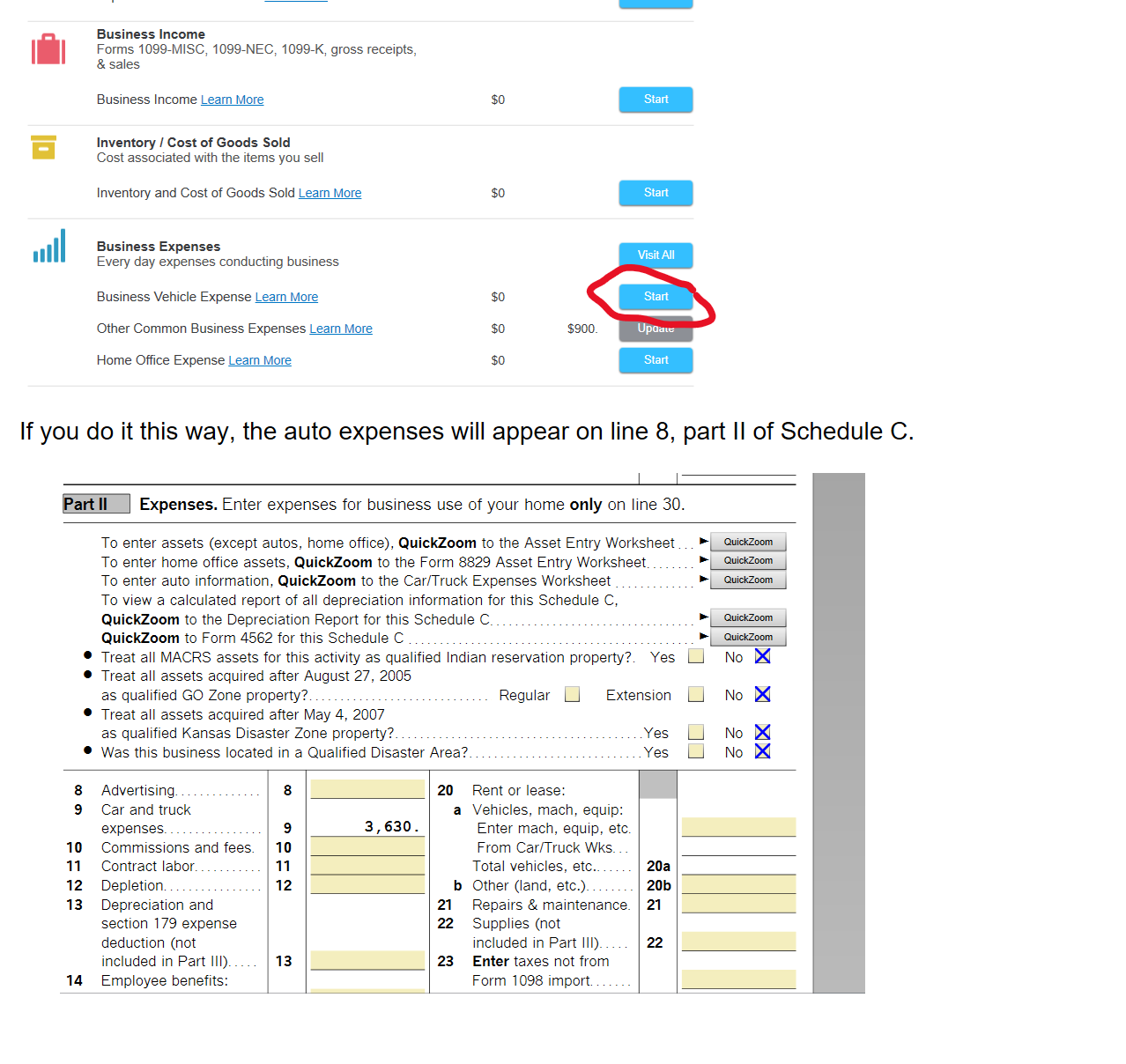

That $815 belongs on Part II, line 9 of schedule C as part of his expenses, however TurboTax is not putting this vehicle expense into that line. How do I get TurboTax to do that? Or am I supposed to go into View->Forms->Schedule C and enter the number manually?

Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Vehicle expenses entered then computed by TurboTax not carrying to Schedule C?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Vehicle expenses entered then computed by TurboTax not carrying to Schedule C?

I then went to the "Deductions & Credits"

You can't and don't claim SCH C business expenses there. Everything is reported in the SCH C section of the program. You need to delete everything you entered concerning vehicle expenses under the deductions and credits section.

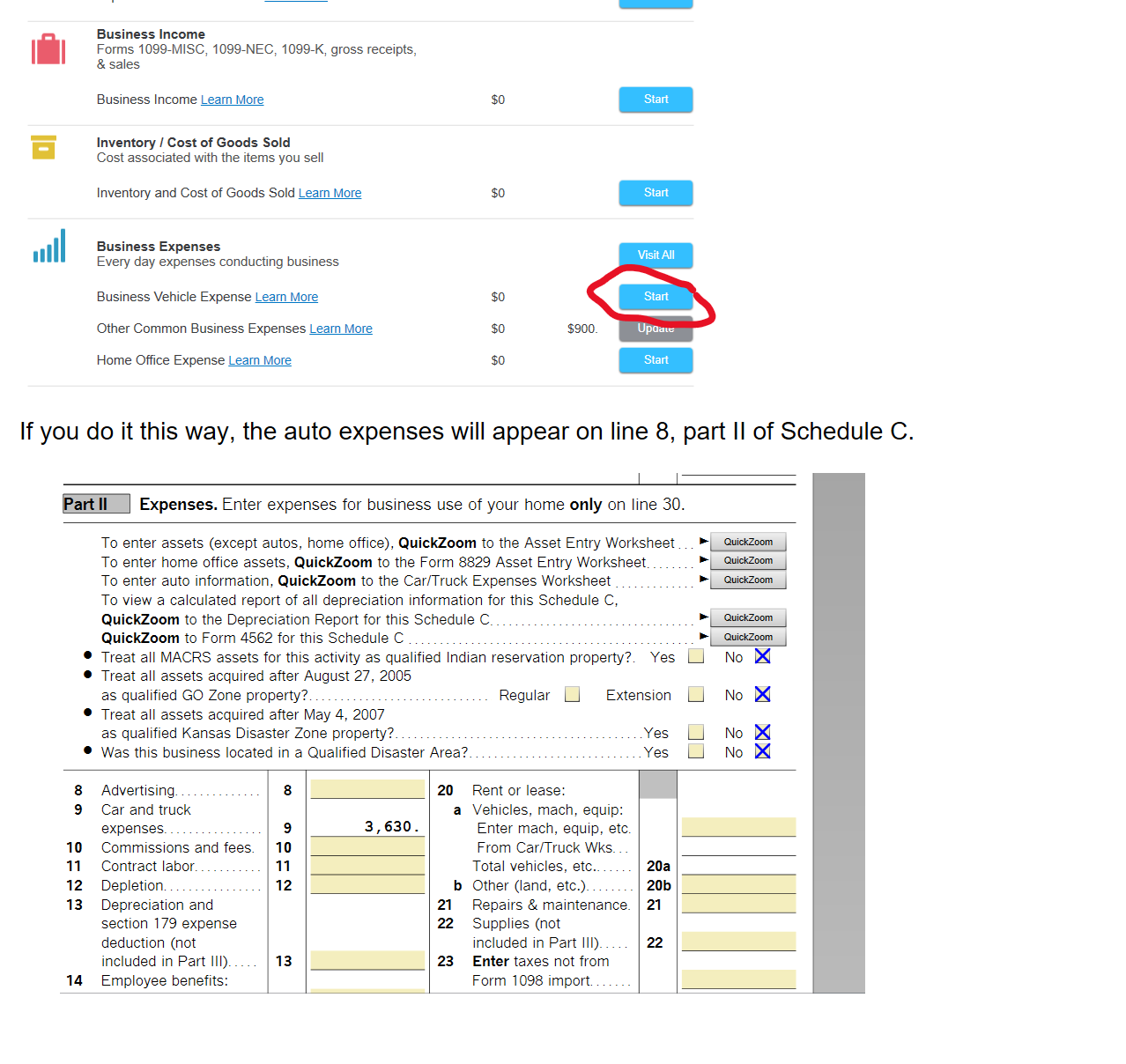

If you'll take a look, in the business expenses section there's a sub-section for business vehicle expenses.

Precisely how you get to that depends on what version of the program you're using, and if it's the CD you installed on your computer, or the online version of self-employed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Vehicle expenses entered then computed by TurboTax not carrying to Schedule C?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Vehicle expenses entered then computed by TurboTax not carrying to Schedule C?

Thanks Carl for correcting my error! Much appreciated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Vehicle expenses entered then computed by TurboTax not carrying to Schedule C?

ShirlynW

Thank you so much for taking the time to provide me with that detailed explanation. Now that I see it, I'm wondering what the heck I was thinking doing it the way I did and getting stuck!

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

latefiler5

Level 1

Melinda2538

New Member

Shannerzzzz

New Member

Flanda

Returning Member

jiillll

New Member