- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Trust 1041 form K-1 not listing Capital Gains

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trust 1041 form K-1 not listing Capital Gains

Hi,

I'm filing a form 1041 for a Supplemental Needs Trust, with a form K-1 for the beneficiary.

For Income, I have:

Interest $109

Dividends, $6,616

Long Term Capital Gains $2,106

All these are listed on the Income page of Turbotax Business.

I have made distributions to the beneficiary far exceeding the Total Income of $8,831

HOWEVER.........

When the distribution of income is carried forward to Schedule K-1, the Long Term Capital Gains of $2106 is Not Listed! It only shows Interest & Dividends of $6,725. NOT Capital Gains!

As a result, when this info is carried forward to the NY State Trust form IT-205, it wants to tax me on the Long Term Capital Gains of $2106 .

This is incorrect.

All my income should be listed on the K-1, AND carried forward to the IT-205, including the capital gains, and none of it should be taxed, neither State nor Federal.

This is urgent, I need to get the K-1 to the beneficiary ASAP.

Please help.

Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trust 1041 form K-1 not listing Capital Gains

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trust 1041 form K-1 not listing Capital Gains

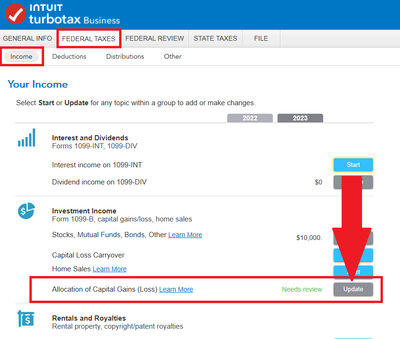

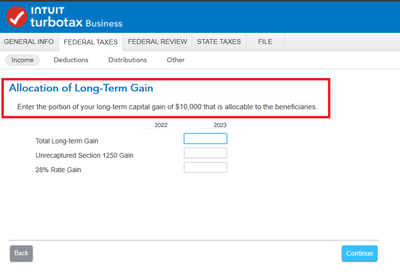

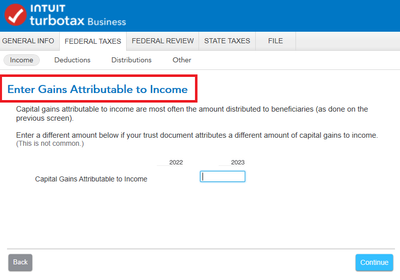

You missed a step with respect to capital gains; you need allocate the gains to income and also to the beneficiaries and then make the distribution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trust 1041 form K-1 not listing Capital Gains

"allocate the gains to income and also to the beneficiaries"

well I obviously missed that, so I went back to look and I'm still not seeing how to do this.

this is my first time at this, please point me in the right direction?

Searching help for "allocate capital gains" wanders off into irrelevancy. Business meal expenses? California scholarships? Whaaaaaa???

Screen shot would be most helpful. I'm not even sure where to find this.

Thanks in advance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trust 1041 form K-1 not listing Capital Gains

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Trust 1041 form K-1 not listing Capital Gains

Oh.

I was looking in the Stocks, Mutual Funds, Bonds, Other pages.

Silly me.

Guess I'm too bleary eyed from entering 1099-B transactions.

Y'know, the ones that SHOULD BE IMPORTED?!?! Yes, those. (hint, hint)

Thanks.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

DCDC2

New Member

mbdowty

Level 1

maylh

Level 1

brian94709

Returning Member

taxdoofus

New Member